In his Weekend Reading Notes to investors, while commenting on the long-overdue stock market correction, Louis Navellier wrote:

Q2 2021 hedge fund letters, conferences and more

The Long-Overdue Stock Market Correction

The missing, but long-overdue correction in stocks is probably a factor of the relentless pumping of electronic dollars into the financial system at a rate of $120 billion per month, causing the Federal Reserve balance sheet to rise to $8.349 trillion at last count. The pump rate will likely throttle down by the end of the year – Powell told us so! – so the trillion-dollar question is: By how much?

My guess is that the reduction will be small – anywhere between $10 billion to $20 billion per month.

QE is not really “printing money,” since the excess reserves that it creates is for financial institutions only, and only those that are under the supervision of the Federal Reserve. If they can’t lend the money, as there is low demand for credit right now, they plow the funds back into the bond market. Buying bonds is a form of lending, but if the supply of bonds is not increasing commensurately, the prices of bonds will rise as their yields fall. That’s how the Fed suppresses bond yields and credit spreads as well as bond market volatility. That’s how it distorts market signals that were quite reliable before the days of QE.

Suppressing bond market volatility also means suppressing stock market volatility. That’s why when the Fed finally tapers – we don’t know exactly when – both the bond and stock markets will shake, the same way they shook in the fourth quarter of 2018 when the Fed was draining $50 billion per month in excess reserves from the financial system. Since any QE intervention would now be more extreme compared to anything Ben Bernanke did, I suspect both stocks and bonds will be more sensitive to any tapering.

The Bond Market Is at a Critical Juncture

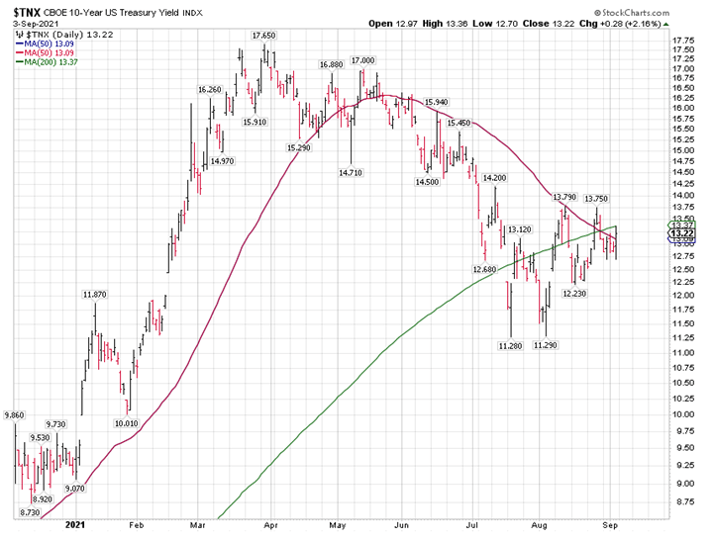

We have seen the first couple of daily closes above a falling 50-day moving average on the 10-year Treasury yield, which puts the bond market at a critical juncture. With Fed tapering amid a recovering economy, Treasury yields should rise. If they fall from here, that means something is wrong.

We have tended to see weak financials, energy and materials sectors on days when yields are falling and out-performance of technology and the reverse when yields are rising. I suspect we’ll see more of the same in the coming months. A sharp rise in Treasury yields from here means NASDAQ is ready for a sharp correction, similar to the one we saw in September last year. A sharp fall in yields may take the whole market down, although I suspect tech would do better than the rest of the value space in a rate downturn.

To be honest, I am not sure which way the bond market will go. Bonds rallied and yields fell on Powell’s Jackson Hole speech. Bonds sold off and yields rose on the much weaker August jobs report a week later. It seems to me bond market investors can’t make up their minds – the bond bulls and bears have drawn a line in the sand at the vicinity of the falling 50-day moving average of the 10-year Treasury yield.

There is another issue though. While I do not consider myself a chartist, I have to tell you that I have not met one futures trader who does not know how to read a chart, and a humongous determinant of where Treasury yields go is the Treasury futures market. In that market, we just saw the ominous “death cross,” where a falling 50-day moving average pierced a rising 200-day moving average to the downside.

That type of chart formation would normally indicate further falling yields, if it were not for the extreme intervention in the bond market by the Federal Reserve. But if the Fed pulls back from QE more aggressively, in theory they could override this ominous technical signal and send yields surging.

The downside of having extreme Fed intervention is that market-driven signals like spreads or death and golden crosses (when it comes to moving averages) are less relevant as the Fed can override them.

The Fed’s job is literally manipulating interest rates trends in order to promote maximum employment and price stability. I think the price stability problem we have now is more due to reopening bottlenecks and less about the Fed, as lending growth is weak, as is the case after any sharp recession. There are limits to the Fed’s power. I wonder where they are, as crossing the point of no return might break the system.