Quotes from Neil Barbour, associate research analyst at S&P Global Market Intelligence:

“The renewed video game M&A deal activity came as a bit of a surprise as it arrived amid a legal battle between regulators and Microsoft Corp (NASDAQ:MSFT) over claims that its $79.60 billion offer for Activision Blizzard Inc (NASDAQ:ATVI) was anti-competitive.

“However, the deals in the recent quarter did not involve the large US-based tech companies that draw the highest levels of scrutiny. Instead, dealmaking was largely centered on companies outside the US, acquiring assets in the mobile gaming space.”

Key highlights for the analysis include:

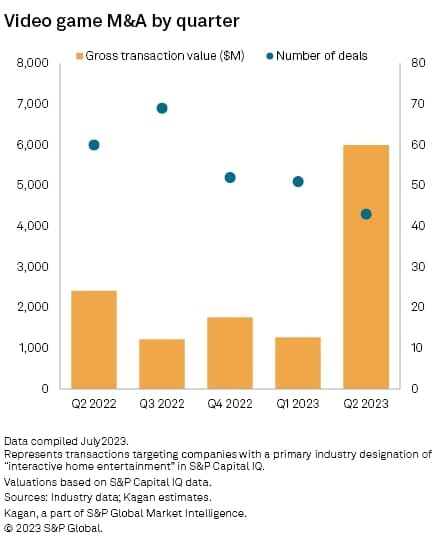

- Billion-dollar dealmaking returned to the video game segment in the second quarter of 2023. The total gross transaction value for announced interactive home entertainment M&A deals hit $5.99 billion in the quarter, according to S&P Global Market Intelligence. It is the highest level since the first quarter of 2022, when Microsoft Corp.’s proposed acquisition of Activision Blizzard Inc. was announced.

- Savvy Games Group’s acquisition of Scopely Inc. was completed on July 12 and, at $4.90 billion, is the sixth-largest deal on record for the interactive home entertainment segment.

- Tokyo-based Sega Sammy Holdings stepped in to acquire Rovio Entertainment after the Angry Birds publisher spurned a similarly-sized offer from Playtika Holding Corp. The deal of $781.8 million is expected to close in the third quarter.

- The only other deal valued at more than $100 million in the second quarter was Light & Wonder Inc.’s $112.3 million proposal to buy the remaining stake it does not already own in SciPlay Corp., which develops social casino-themed games.

- The US federal ruling made on July 11 that allowed Microsoft’s acquisition of Activision Blizzard may clear the way for more, and potentially larger, dealmaking activity in the coming months. Perhaps reflecting this dynamic, a number of console-focused publishers have grown substantially in terms of enterprise value over the past quarter. They are also benefiting from a rising installed base of new-generation consoles now that supply chain issues have subsided.

Editor’s Note: The Video Game M&A Tracker compiles activity around companies designated by S&P Global Capital IQ Pro as operating primarily in interactive home entertainment. The sector is mostly composed of publishers and developers of video game products. It also includes a minority of education, fitness and gambling software produced for home consumption.