Tax Cuts and Jobs Act Fuels Corporate Buybacks Creating Potential for Record, $1 Trillion Year

Since the Senate passed sweeping tax overhaul in December, stories about how the average American will benefit have dominated the headlines. According to CNBC, more than $2.5 billion in bonuses (“Trump Bonus”) have been announced in response to the new tax law. However, during the same period, U.S. companies have announced their intentions to repurchase more than $161 billion worth of their own stock. With the “Trump Buyback” outpacing the “Trump Bonus” by almost 65:1, corporate executives have made it clear what they intend to do with their tax windfall and repatriated cash.

Buybacks Jump To Record Offsetting Selling By Retail Investors

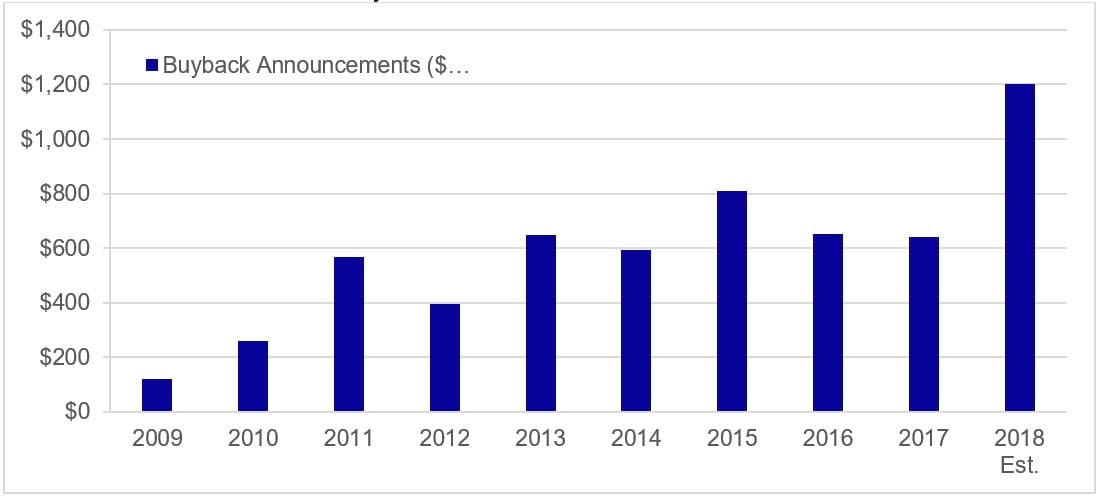

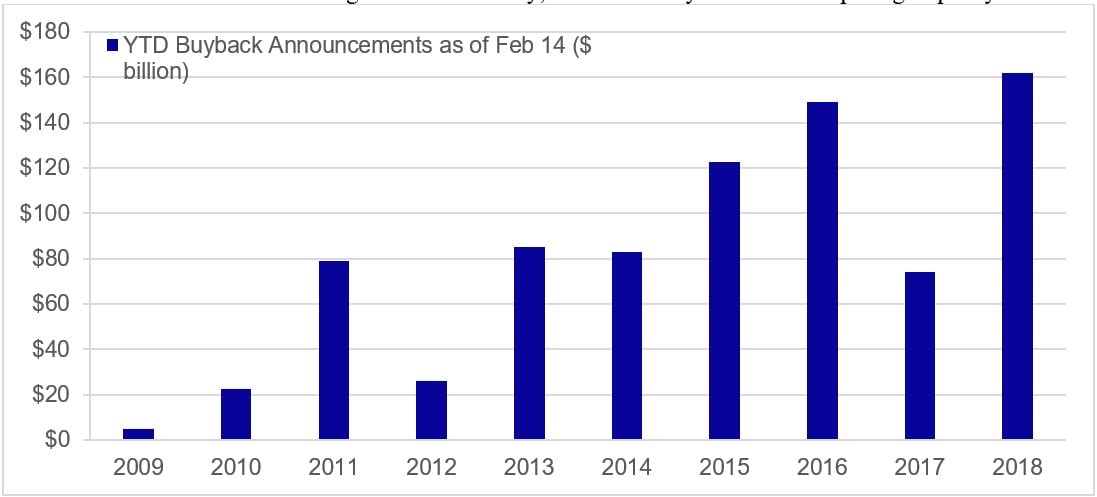

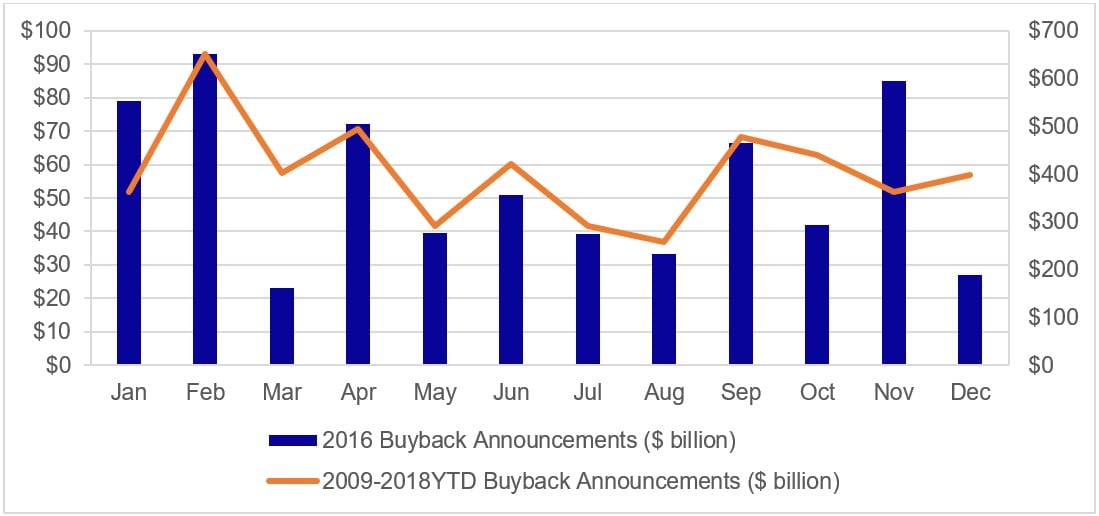

In fact, 2018 is in a strong position to be the first year where companies announce more than $1 trillion in corporate buybacks (Exhibit 1). This estimate is based on historical buyback trends and the strong start for 2018, as of February 14 (Exhibit 2). 2018 is off to the strongest start in history. Only 2016 experienced a similarly strong start, but announcements faded because of political and economic uncertainty. For example, during 2016, buyback announcements dropped off in relation to their historical trends because of concerns surrounding the potential Brexit and the U.S. presidential election (Exhibit 3). 2018, on the other hand, is positioned to be a year with a strong economy, lower taxes and the potential for a meaningful portion of the $2.6 trillion in American corporate profits sitting in overseas bank accounts to come back to the U.S.

Buybacks Are A Clear And Present Danger

Exhibit 1: When analyzing historical buyback trends, it appears 2018 is in a strong position to be the first year where U.S. companies announce more than $1 trillion in corporate buybacks.

Data Source: Catalyst Capital Advisors LLC and Bloomberg L.P.

Exhibit 2: 2018 is off to the strongest start in history, as of February 14 when comparing to past years since 2009.

Data Source: Catalyst Capital Advisors LLC and Bloomberg L.P.

Exhibit 3: While 2016 was off to a similarly strong start, the buyback trend was derailed by Brexit and the U.S. presidential election.

Data Source: Catalyst Capital Advisors LLC and Bloomberg L.P.

What is Fueling the Corporate Buybacks

Corporate executives have wasted no time announcing their buyback intentions in response to the Tax Cuts and Jobs Act, which ends U.S. taxes on foreign income and lowered the corporate tax rate from 35% to 21%. Companies that will benefit from reduced taxes, such as Wells Fargo (WFC) and Valero Energy (VLO), already announced their intentions to return some of the excess cash to shareholders, with a $22 billion and $2.5 billion buyback announcement, respectively.

Stock Buybacks Trending Lower, Except Among Financials

CNN Money reports that $2.6 trillion in American corporate profits are sitting in overseas bank accounts, with about half of that in cash. As companies repatriate this cash under the new tax law, it would not be surprising to see more buyback announcements due to a lack of immediate growth opportunities to put so much cash to work. Barron’s recently reported that the tax-reform legislation will likely lead to a spike in corporate buybacks because the tax reform will “encourage companies to repatriate much of the cash currently held outside the U.S., and much of that will likely find its way into stock repurchases.”

In fact, after careful review of companies with the most cash overseas, it appears many companies have authorized significant buybacks, positioning themselves to immediately put some of the repatriated money to work. For example, Apple (AAPL), which has about $250 billion in cash overseas according to Bloomberg, currently has about $33.9 billion remaining under its current authorization. Apple has consistently authorized additional purchases every April/May since April 2013. Based on Apple’s plans to be cash neutral, it seems reasonable that Apple will increase its authorization again this May, possibly authorizing even a larger buyback increase than in past years.

Similarly, Cisco Systems (CSCO), which plans to repatriate $67 billion under the new tax law, recently authorized a $25 billion buyback increase, bringing the total buyback potential to around $31 billion. Juniper Networks (JNPR), which authorized a $2 billion buyback at the end of January, stated that it intends to use the approximately $3 billion in repatriated cash resulting from the Tax Cuts and Jobs Act to invest in its business, support M&A and fund its return of capital to shareholders.

As the market reacted positively to Trump’s election and his pro-business platform, some companies may have revealed their confidence in tax reform and being able to repatriate cash with quick announcements following the election. Facebook (FB) authorized its first ever buyback on November 18, 2016. As of February 1, 2018, $3.9 billion of the $6.0 billion remains under the authorization. Of the $2.1 billion that has been repurchased, $630 million was reported on November 2, 2017 and an additional $1.0 billion was repurchased before the next report on February 1, 2018. As the tax reform has come into play, Facebook has ramped up its corporate buybacks. Facebook has approximately $33 billion in cash overseas.

Investors should expect the pace of buybacks to continue as companies better estimate the impact of the tax cuts and are able to start repatriating significant amounts of cash. This is the likely catalyst for 2018 being the first year where U.S. companies announce more than $1 trillion in share buyback authorizations.

BOA: Corporate Buybacks Fall 30% Year-On-Year

The Case for Stock Buybacks

While everyday wisdom may suggest that this buyback trend bad, an understanding of how corporate buybacks operate reveals that this is probably a positive sign. U.S. companies are responding well to the new tax environment.

Frequently, buybacks make headlines because executives are being accused of cutting investment to instead focus on short-term stock price manipulation, in many cases doing so to boost their own share-based compensation. In a recent article published by Harvard Business Review, author Alex Edmans, professor of finance at London Business School, counters “such a nefarious use of corporate funds makes for great headlines. But these claims are very rarely backed up by large-scale evidence, and often driven by a misunderstanding of how buybacks actually operate… Firms that buy back stock subsequently beat their peers by 12.1% over the next four years. Rather than eroding long-term firm value, corporate buybacks create value by ensuring surplus capital is not wasted.”

The influx of cash from tax reductions and repatriated cash will likely put many companies in a position where they do not have enough immediate growth opportunities to spend all the cash. Investors should celebrate the fact that executives are being responsible with the capital by announcing their intentions to return excess cash to the rightful owners of the company if better investment opportunities do not arise before that happens. Companies that make foolish investments or hoard cash put themselves in a position of increased risk, which is worse for many stakeholders.

Goldman: Trump's Policies Will Unleash A Wave Of Buybacks

Buybacks Demonstrate Strength of American Companies

The fact that companies are being responsible and not foolishly spending cash is a good sign. This includes both meaningful bonuses to their employees as well as authorizing large share repurchases that can be used in the event better growth opportunities do not arise. The corporate buybacks are issued for multiple years while the bonuses may simply be the first of many, leading to some distortion between the “Trump Bonus” and “Trump Buyback.”

We must remember that companies are not required to follow through on a buyback authorization. If the economy continues to ramp up and better investment return options are available, it would be in a company’s best interest to stop the buyback and invest in growth opportunities. However, if that does not play out soon, companies that hoard cash or make bad decisions put themselves and the average American at risk. A company that stumbles or fails because of bad decisions has an impact on more than just its employees and investors, it also impacts communities and ripples through the company’s supply chain, causing collateral damage elsewhere.

Article by Michael Schoonover

Michael Schoonover is COO at Catalyst Funds and serves as portfolio manager for the Catalyst Buyback Strategy Fund (BUYIX). The fund that Mike oversees holds JNPR, WFC and VLO