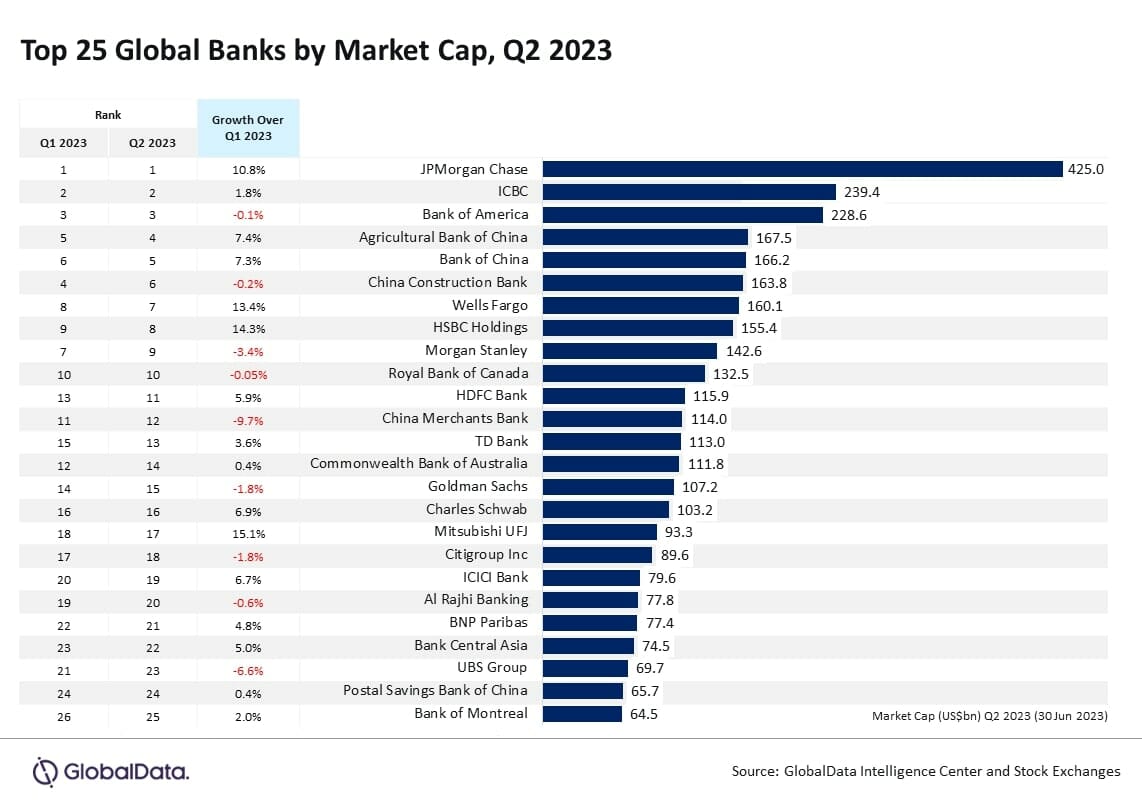

- Mitsubishi UFJ, HSBC Holdings, and Wells Fargo grew over 10%

- China Merchants Bank and UBS Group lost more than 5%

- JPMorgan Chase consistently topped the table for the last five quarters

The aggregate market capitalization (MCap) of the top 25 global banks grew by 3.8% to $3.3 trillion quarter-on-quarter (QoQ) during the second quarter (Q2) ended on 30 June 2023. The growth indicates a potential recovery in the markets and inflation being brought under control, says GlobalData, a leading data analytics and research company.

Murthy Grandhi, Company Profiles Analyst at GlobalData, comments: “The Federal Reserve’s decision to pause the interest rate hike in June was seen by investors as a sign that the central bank is not as concerned about inflation as it was previously. This, along with signs of US inflation cooling, a brighter outlook for the Euro zone economy, and China’s stronger-than-expected economic recovery, boosted investor sentiment.”

Mitsubishi UFJ

Mitsubishi UFJ Financial Group experienced a significant increase in share price and MCap because of positive 2023 results, better earnings estimates, and a rating upgrade. The Japan-based bank holding and financial services company’s MCap surged by 15.1%, indicating that investors responded positively to Mitsubishi UFJ’s performance and outlook.

HSBC Holdings

Strong growth in revenues in Q1 2023, supported by the performance of all divisions and the ongoing cost discipline initiatives, coupled with a reshaped portfolio including exits from US mass market retail, the planned sale of France retail, Canada banking business, and Russia and Greece operations, contributed to a 14.3% increase in the British universal bank and financial services group’s Mcap to $155.4 billion.

Wells Fargo

Positive Q1 2023 results pushed up the share prices of the American multinational financial services company, leading to a 13.4% rise in MCap. Well Fargo‘s revenue in Q1 2023 increased by 17% to reach $20.7 billion. This growth was primarily driven by higher net interest income and increased net gains from trading activities. However, there were some mitigating factors, including lower net gains from equity securities and decreased income from mortgage banking.

Grandhi continues: “China Merchants Bank MCap witnessed a notable decline of 9.7%, primarily due to a 1.5% decrease in operating income during the first quarter of 2023 compared to the same period in 2022. The decline in operating income can be attributed to net-interest-margin pressure, likely stemming from the availability of cheaper mortgage loans made during that period after the Chinese regulators decision to cut mortgage rates to bolster the struggling real estate market in the country. UBS Group faced a MCap decline of 6.6% due to weak Q1 2023 results and the acquisition of Credit Suisse Group.”

JPMorgan Chase

The bank’s strong performance as the leading table leader in Q1 2023, despite the turmoil in the banking industry, exceeded analysts’ predictions and bolstered the bank’s stock price. During this period, the bank’s net revenue surged by 25% to reach $38.3 billion, primarily due to increased interest rates and revenue from principal transactions in the Markets segment.

China Big Four banks

ICBC, Bank of China, and Agricultural Bank of China gained between 2-8% in MCap and China Construction Bank fell by 0.2% in MCap. All these four banks reported positive Q1 2023 results coupled with recovery in Chinese economy during the first quarter of 2023.

Grandhi concludes: “In the upcoming quarters, there is a potential for a modest recovery in the global banking sector. Contributing factors include a potential pause in interest rate hikes by policymakers and a smaller-than-expected expansion of net interest margins. Additionally, lower volumes of lending and credit transactions are anticipated due to tighter credit conditions.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.