The housing boom has led to a lot of talk that we are in the middle of a housing bubble. Comparaisons have been made with the housing boom that preceded the financial crisis of 2008. Concerns have been raised that the boom is not sustainable and that demand will eventually hit a ceiling as prices prove to be too much for buyers. Yet, the evidence suggests that this boom is very different from the boom that fueled the subprime mortgage crisis. Indeed, it is possible to argue that critics are right that demand is not infinite and yet argue that elevated home prices will be a feature of the residential real estate market for some time to come.

Q4 2021 hedge fund letters, conferences and more

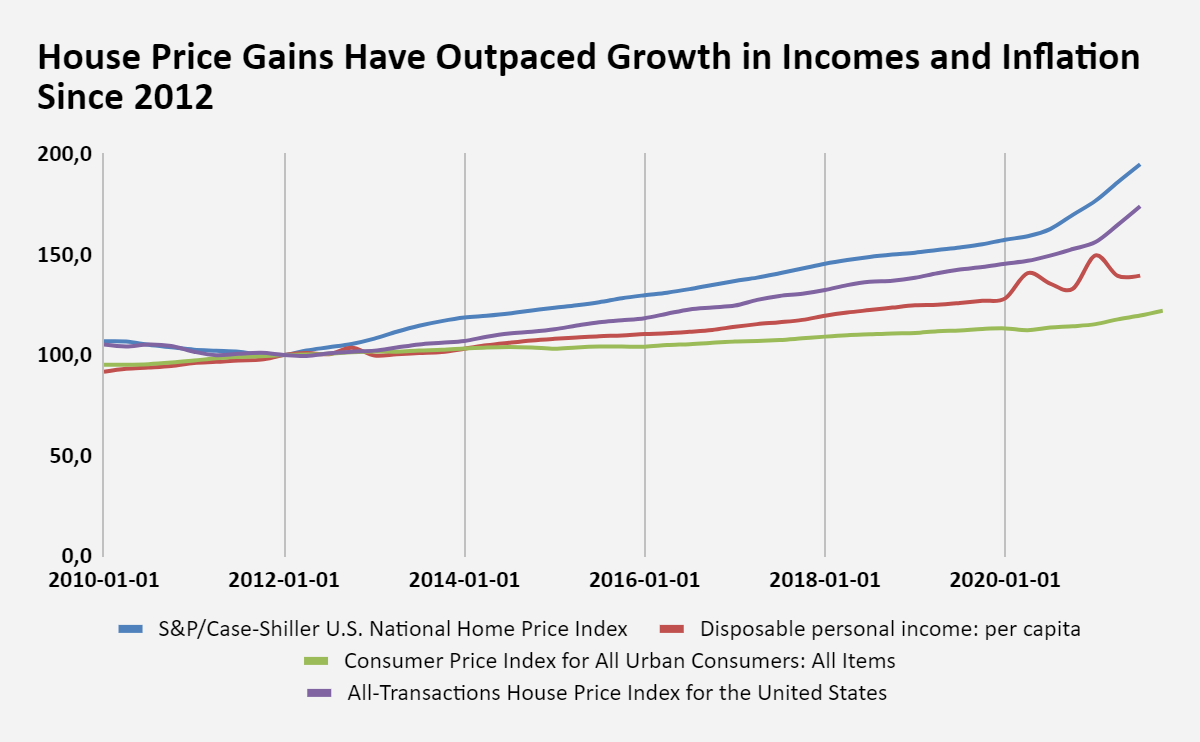

House prices fell to their lowest point ever in 2012, but since then, they have been on a tear, growing faster than both inflation and per capita income. According to the S&P Case-Shiller National Home Price Index, house prices are up an amazing 95% from their 2012 levels. Another commonly used measure of house prices, the FHFA’s All Transactions Price Index has seen similar gains and is up almost 74%. That represents a growth in price of between 5.7% and 6.9% compounded since 2012. Critics rightly point out that per capita incomes have, in that time, only grown 40%, which works out to 3.4% compounded across that period. Consumer prices have risen 22% in that time, compounding at 2% per year.

Source: FRED

The Pandemic Changed Everything

Typically, housing booms end when recessions come, but the global pandemic differed. Rather than bursting the bubble, the housing boom had rocket fuel poured on it. An initial sharp decline in the price of new and existing single-family homes was followed by 21% increases in prices in June, from the month prior, followed by a 25% increase in July, as records for housing price inflation tumbled, taking costs higher than pre-pandemic levels.

The National Association of Realtors predicts that incoming fourth-quarter data for 2021 will show a 9.1% increase over the same period in 2020, resulting in 14.7% growth in 2021, followed by 2.8% growth in 2022. This is because single-family homes have been in incredibly high demand during the pandemic.

What changed is the nature of work. Remote work is the greatest reconfiguration of work since the Industrial Revolution. The Industrial Revolution took the center of production from home into offices and factories, and the pandemic shifted the center of production back to homes. With the connection between where a job is and where a person lives disrupted, people could move away from densely populated cities such as New York and San Francisco and into suburbs and rural areas. This spurred demand for single-family homes and made the housing boom even more widely spread out than before.

The Debtless Housing Boom

Those who base their arguments that this boom is similar to the housing bubble of the 2000sThis have to reckon with the fact that mortgage lending standards are tougher today than they were in the past. Whereas during the halcyon years of the subprime crisis, a person could buy a home without having the credit history to support a loan, or indeed the income, today, the bigger problem is that standards have become so high that many people do not have access to mortgages.

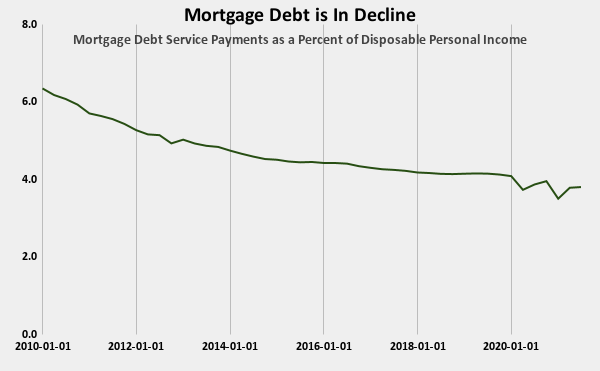

In fact, this period has been referred to as a “debtless housing boom” given the reduction in home mortgages in the post-2008 financial crisis period. Since the crisis, the share of disposable personal income going to mortgage debt service payments has fallen from 3.8% to 6.35.

Source: FRED

You have to go to the pandemic to find a meaningful increase in mortgage debts as a portion of personal disposable income.

Secular Trends Driving House Price Inflation

A number of long-term trends are pushing home prices up and these pre-date the pandemic and will be there after the pandemic has become nothing more than a bad memory.

Millennials are under-housed and are growing into their prime home-buyingyears. Like many Americans, they have been forced to save more to buy their homes.

Critically, the United States has a massive undersupply of homes, with new home construction unable to keep up with household demand. In addition, for various reasons, from expectations of future price increases to fears around relocating during a pandemic, homeowners have been hesitant to sell their homes, further tightening the supply of homes. As a result, homebuyers are competing for a limited supply of homes.

As opposed to the subprime mortgage crisis, homebuyers have been attracted to the market thanks to historically low-interest rates rather than lax mortgage lending standards. Despite the Federal Reserve’s announced policy of increasing interest rates in 2022, there are enough reasons to believe that broader trends will counteract the effect of those nominal interest rate hikes and keep real interest rates low. Further, interest rates have been so low that only an unprecedented hike in rates could return us to the pre-2008 era.

Further, with so much upward pressure on housing prices, homeowners will be able to sell their homes at a profit instead of facing foreclosure. Although financial firms package mortgages as securities, they are primarily government-backed.

A further source of upward pressure on homes is construction costs. According to the Federal Reserve, construction costs are a stronger driver of home prices than mortgage debt, especially in competitive markets. The relationship between the sale of new single-family homes and residential construction costs is so tight that the former grows by 0.98% per year compared to 0.91% for the latter. Indeed over the last decade and the last few decades, construction costs have trended upward and sharpened during the pandemic. Moreover, the supply chain crisis will keep construction rates high for at least the next few years. This does not mean that housing prices will continue to rise without check. However, it does mean that the floor on housing prices has been increased in the last decade thanks to solid fundamentals that are unlikely to go away soon.