In his podcast addressing the markets today, Louis Navellier offered the following commentary.

If you wish to listen to this commentary, please click here.

There is not a lot of economic news this week, except Wednesday’s CPI report, so the second-quarter announcements should dominate the news. This week will predominately be earnings results for financial stocks. As an ex-banking analyst, I do not own financial stocks, because I know too much. Furthermore, a relatively flat yield curve is not ideal for most financial stocks. The guidance from financial firms on consumer default rates is expected to be the biggest news. The Fed recently reported that the consumer savings rate recently rose to 5.4%, so I suspect that consumer default rates will remain low.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

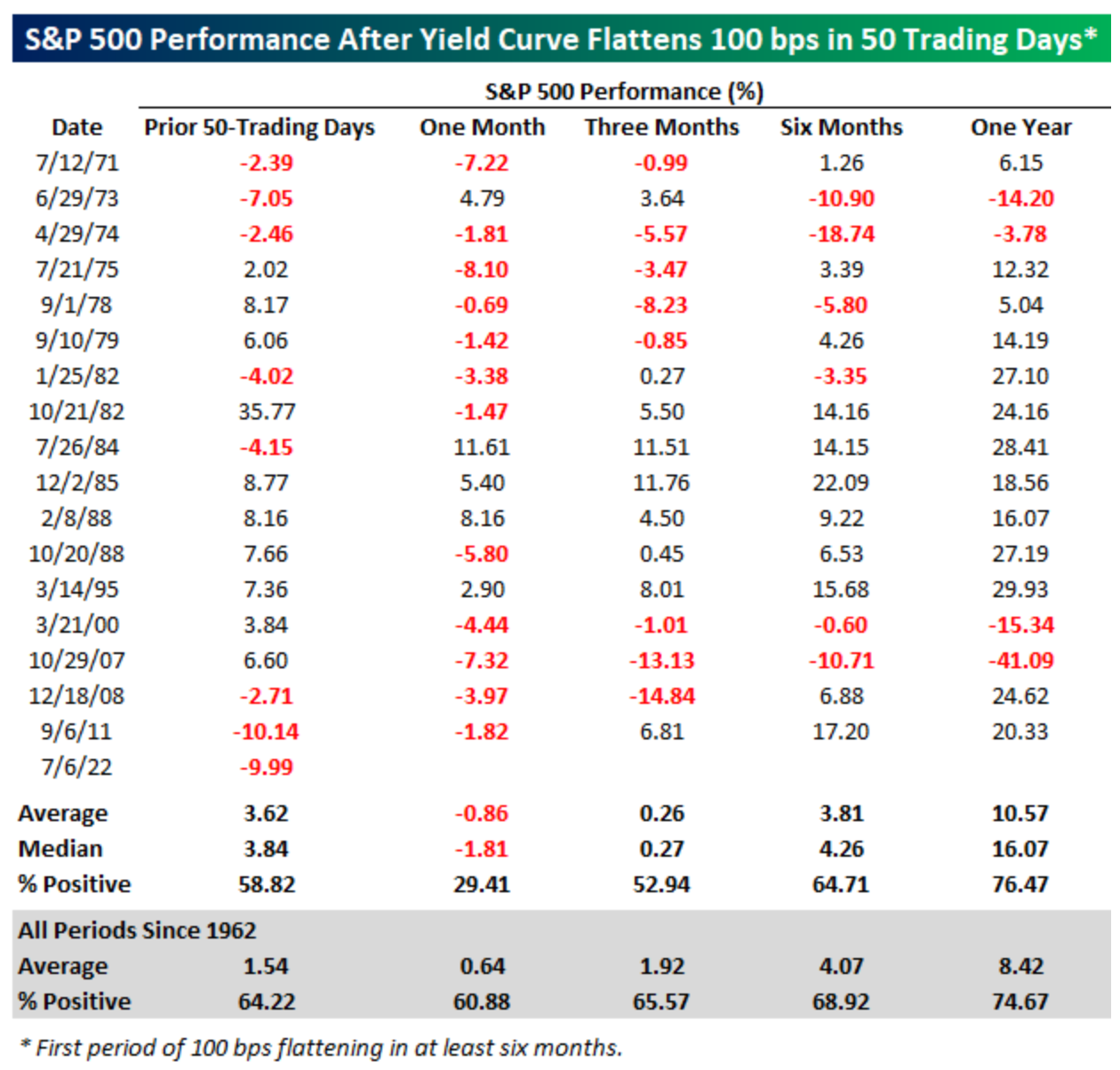

Speaking of the flatting yield curve, our Bespoke Investment Group recently issued a fascinating report that illustrates that in the previous 17 times the 3-month to 10-year yield curve flattened by 100 basis points in 50 trading days since 1971, the S&P 500 over the next three months, six months and year improved by a median 0.27%, 4.26%, and 16.07%, respectively.

In other words, if history repeats, the S&P 500 may essentially tread water until early October and then stage a nice year-end rally that should continue in 2023. Intuitively, this makes sense, since the Fed will likely have its last 0.75% interest rate hike on September 21st and raise the federal funds rate to 3%. Also, crude oil prices should have fallen significantly by October as season demand wanes, which will help to boost both business and consumer confidence.

Euro Collapse

The biggest news this week was the euro hitting parity of 1.0002 with the U.S. dollar intraday on Tuesday.

The collapse of the euro has been fascinating and is largely due to the European Central Bank’s (ECB) negative interest rate policy, the failure of the ECB to fully unwind quantitative easing, and the realization that the European Union (EU) is the “new Japan” with too much cumulative government debt per capita, so it cannot effectively raise key interest rates. The ECB meets on July 21st, so their actions will be closely scrutinized. Furthermore, since Russia is cutting Germany off from natural gas, it threatens its vast chemical industry that relies on that cheap natural gas. Furthermore, as countries in Europe prepare for natural gas rationing, especially as the winter months approach, that is also undermining the euro.

The other big news this week is Wednesday’s CPI report. There is a lot of pessimism that the CPI may have reached an annual pace of 9% in June. However, the consensus estimate is for the CPI to rise 1.1% in June and 8.6% in the past 12 months. The core CPI, excluding food and energy, is expected to increase 0.5% in June and 5.8% in the past 12 months. In May, the core CPI was running at a 6% annual pace, down from a peak of 6.5% in March. As long as the core CPI continues to steadily decline, the Treasury bond rally that has been underway since mid-June should persist.

Appeasing Saudis

President Biden’s trip this week to Israel and Saudi Arabia will be interesting. Iran’s aggressive military maneuvers recently will likely dominate the talks with both Israel and Saudi Arabia. Since Saudi Arabia is an ally of the U.S., President Biden’s criticism of its new leadership will likely be tested. Naturally, President Biden is expected to push Saudi Arabia for increased crude oil production, but I suspect that any proposed increase will be minimal.

Although the U.S. is now energy independent again due to lower domestic demand and increased production, crude oil prices are not expected to decline significantly until September, when seasonal demand ebbs. Nonetheless, crude oil could have a significant reaction in the wake of any Saudi Arabia announcement.

Speaking of President Biden’s trip this week to Saudi Arabia, he must be trying to appease the Saudi leaders, since The Wall Street Journal announced early this week that the Justice Department is investigating whether the PGA Tour engaged in anticompetitive behavior as it bans players from the Saudi-backed LIV Golf tour. A spokesman for the PGA Tour said it was aware of the Justice Department investigation.

Interestingly, the PGA Tour ended its annual tournament at Trump National Doral in 2016 after a 45-year history and pulled its 2020 PGA Championship major tournament from Trump National Golf Club in Bedminister, New Jersey after the January 6th Capitol Hill protests. Ironically, the LIV Tour will have a tournament at the end of July at the Trump National Golf Club in Bedminister, plus its $50 million finale at Trump National Doral in October. The fact that the Biden Administration’s Justice Department is now indirectly helping Donald Trump is a big surprise, but apparently, President Biden really needs to please Saudi Arabia if he wants them to boost their crude oil output.

Exhausting Recession Talk

Since bond yields peaked in mid-June, some market pundits are now talking about how cheap stocks are relative to their price-to-earnings (PE) ratios. The strong corporate earnings that will be announced in the upcoming weeks are also expected to push PE ratios lower. Initially, PE ratios plunged on both recession and higher interest rate fears. However, since there is no “earnings recession” and Treasury bonds yields have moderated since mid-June, the collapse in PE ratios is increasingly being viewed as overdone.

Speaking of overdone, all the recession talk by Wall Street strategists has been exhausting. Interestingly, the Atlanta Fed revised its second-quarter GDP forecast to an annual decline of 1.2%, up from its previous estimate of a 1.9% decline. So whatever recession fears there are, they are not as acute as they have been. Since there is no earnings recession and the labor market remains healthy, if there is a recession, it is very shallow and a weird one.

Coffee Beans

India and China have both been spending more money on Russian oil in 2022 compared to 2021. India's spending on the commodity rose by 538% between March and May 2021 and the same time period this year, shelling out $3.5 billion. China, on the other hand, paid a lot more – $15.7 billion for the three-month period, a 78% increase over the same period last year. Source: Statista. See the full story here.