The dollar is so strong to hit the euro for the first time in 20 years, but gold shows no weakness. How to profit from gold being so bullish?

And so, after taking profits from our short positions in them, we’re long juniors once again. We saw some bullish signals yesterday, and we also see them today. In fact, we have a few extra.

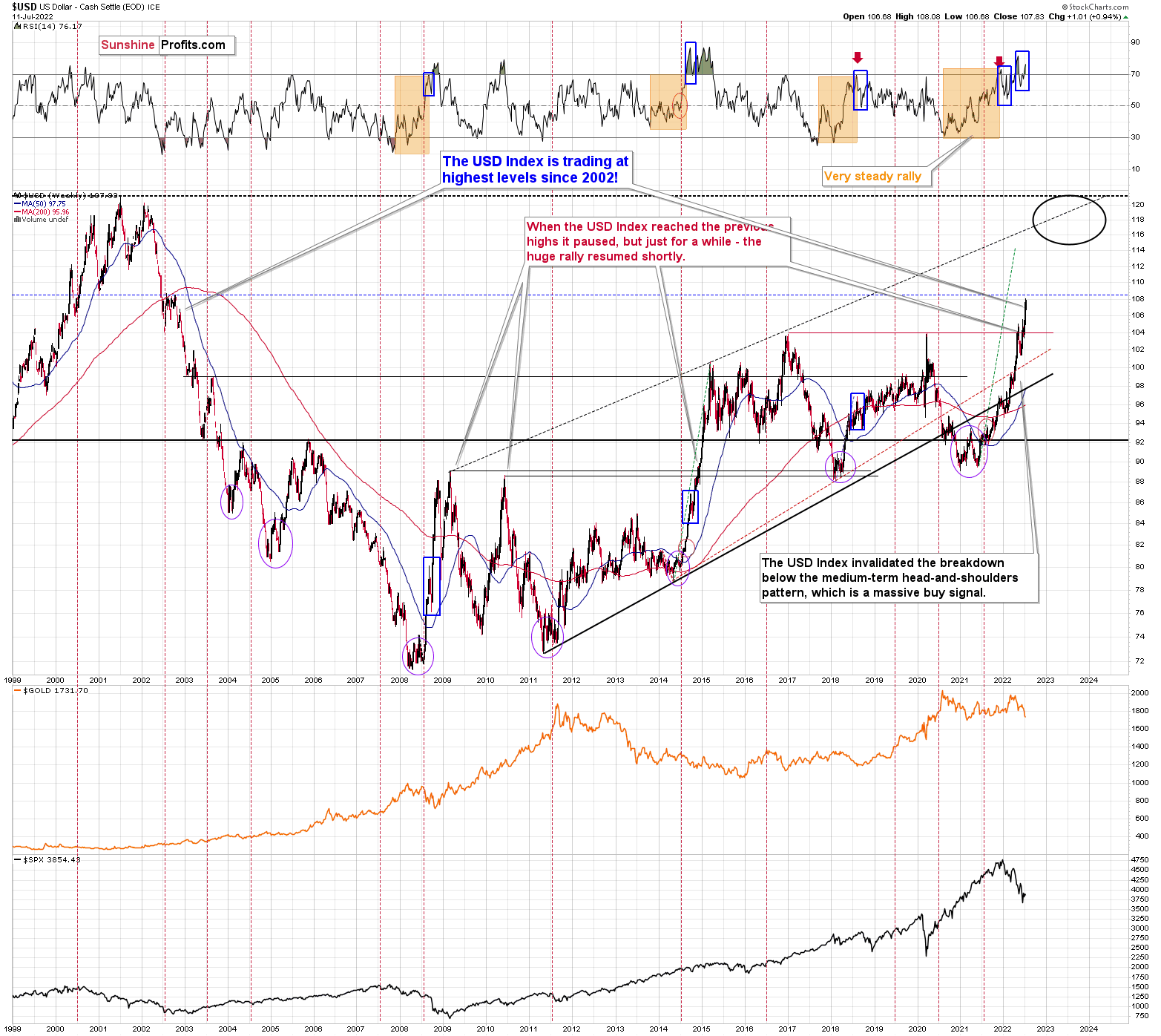

The most important reason behind the long position – on top of what I wrote yesterday – is the strength that gold currently shows relative to what’s happening in the USD Index.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The latter is soaring.

Yesterday’s intraday high was 108.08 and at the moment of writing these words, the USD Index futures are trading at 108.37. That’s very close to the long-term resistance level, which – especially given very overbought RSI – is likely to trigger at least a short-term pullback.

Let’s look under the hood.

The USD Index is a weighted average of individual currency exchanges, and the EUR/USD has the biggest weight (over 50%). Here is what it’s doing right now.

The euro futures (visible in the above chart) are plunging, and they are about to reach a very strong support level.

As you can see, the lower border of the declining trend channel is about to be reached, but there’s also something very special about the level at which it’s likely to be reached.

It’s the most important round number of them all: 1.

This means that if the trend continues, any hour now, the U.S. dollar is about to be as valuable as the euro!

This is a headline shocker in the words, and it’s very likely that it will trigger fresh buyers. “Enough is enough” they might say, not wanting to believe that the euro can be cheaper than the buck. Of course it can, but it’s unlikely that this level (and buyers) will allow that without a fight.

This fight is likely to trigger at least a brief reversal and a rally.

This, in turn, is likely to trigger a decline in the USD Index, which would be in perfect tune with what’s likely based on the USD’s long-term chart.

And since in today’s pre-market trading the USD Index is rallying and the euro is declining, gold is surely declining as well, right?

Wrong.

Gold declined initially, but then it reversed at its previous support level (that already worked several times), and it then moved back up despite the bearish forces coming from the forex market.

Instead of declining, gold showed strength and formed a reversal. This is a very bullish combination of factors. And the fact that it’s happening at the previous lows is notable also in light of the analogy to 2013 that I described yesterday.

Moreover, please note that gold’s Friday’s bottom formed right at gold’s triangle-vertex-based reversal. It moved slightly below Friday’s low today, but since it rallied back up, the breakdown was already invalidated. Overall, it seems that the bottom is either in or at hand.

So, we have a situation in which it seems that the USD Index is about to reach its top, but gold is not willing to react to the USD’s rallies. This is a very bullish combination for the short term. And there are ways to profit on this bullishness.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.