Crescat Capital’s commentary for the month of November 2021, discussing the catalyst for the great rotation.

Q3 2021 hedge fund letters, conferences and more

The Catalyst for The Great Rotation

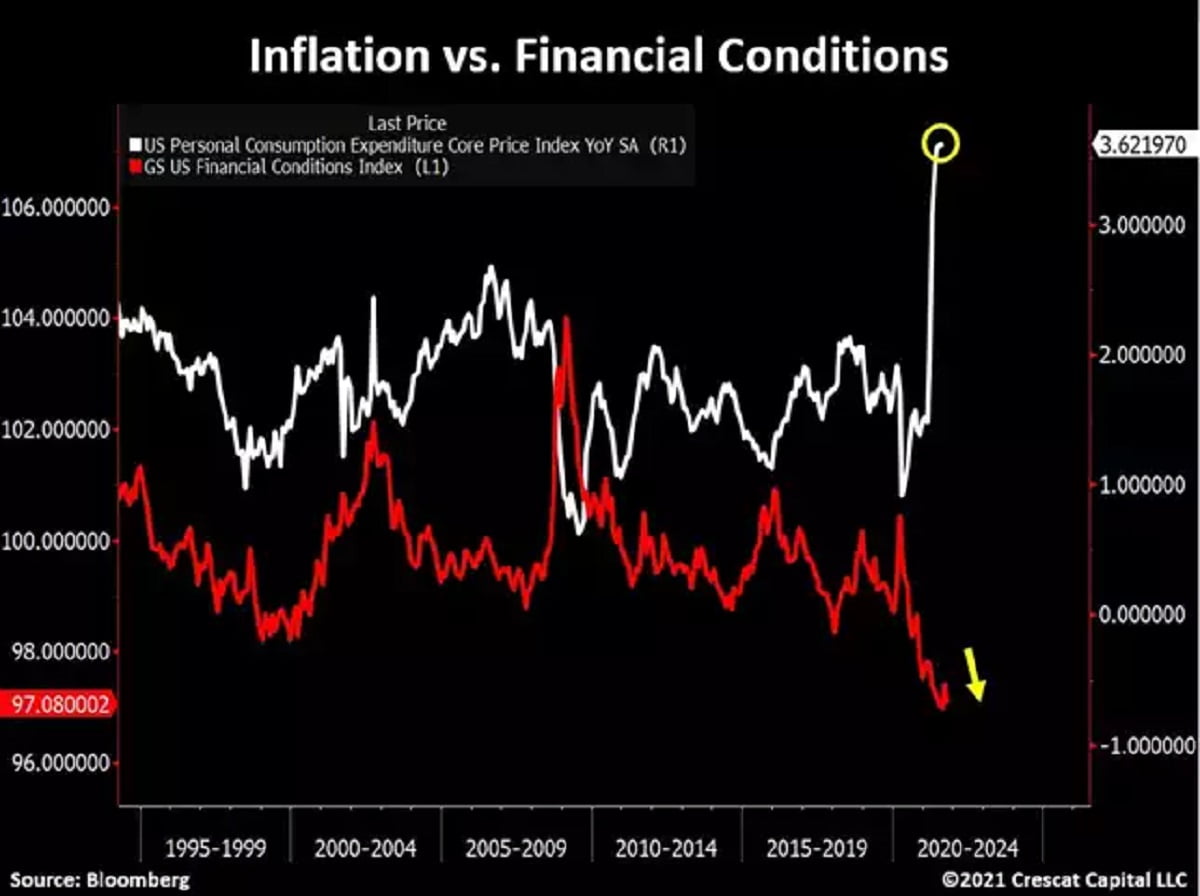

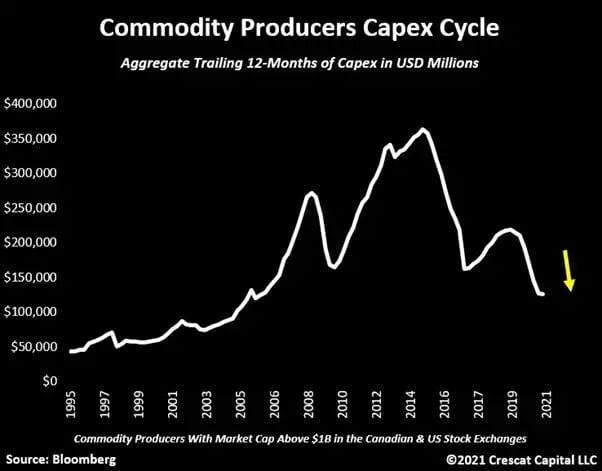

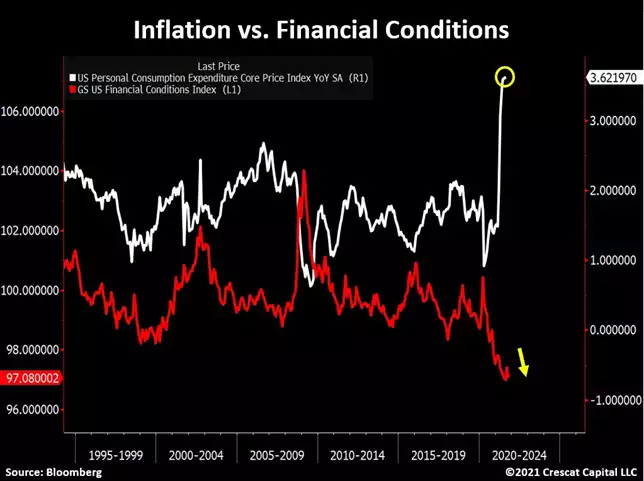

Based on the firm’s current equity and macro models, and our investment team’s analysis, we believe we are in the explosive first wave of an inflationary cycle in the US and globally that will elevate consumer prices at a much higher annualized rate and for significantly longer than priced into financial markets today. The factors driving our view include structural shortages in primary resource industries due to chronic underinvestment, incipient wage-price spirals, and unsustainably high government debt-to-GDP imbalances which make a new inflationary trend the policy path of least resistance.

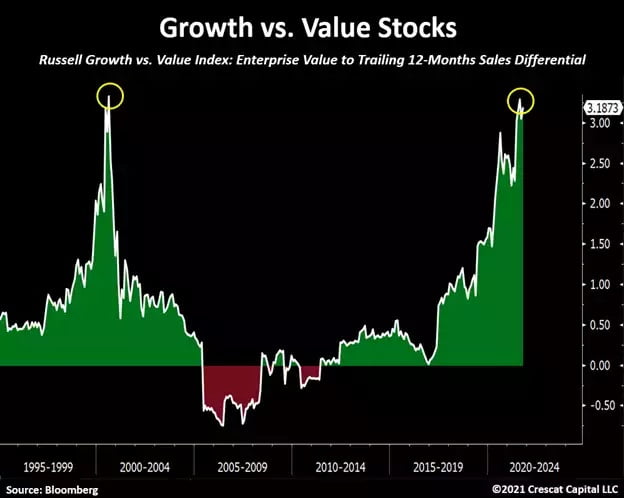

As an overarching macro investment theme at Crescat today, we are calling for what we have dubbed the Great Rotation. This theme is a highly probable and pending shift, in our view, out of crowded, hyper-overvalued, long-duration financial assets, including mega-cap tech and negative-real-yielding fixed income securities, and into the less populated and more undervalued segment of the market that is focused on the tangible assets at the core of the global economy. In our analysis, the companies involved in these industries are driven by both intrinsic and calculable fundamental value and offer some of the best value and appreciation potential in the market.

Rising inflation expectations and the Fed attempting to tighten financial conditions are the catalyst for this critical inflection point.

Policy makers are far from doing what is necessary to halt what is already the most inflationary environment since the 1970s when they are instead:

- Running twin deficits at double digit percentages of GDP.

- Holding the Fed funds rate at 0% for another seven months.

- Planning to add $400 billion more in QE before beginning to raise rates.

- Restricting commodity companies from exploring, developing, and producing natural resources.

Crescat’s Global Macro and Long/Short Equity strategies are hedge funds with significant short positions in the overvalued areas that we believe the investor masses will be rotating out of, as well as long positions in the undervalued areas, where we believe the smart money will be rotating into, in this likely-to-be epic regime change. At Crescat, these two strategies are the most comprehensive ways to play the Great Rotation. Large Cap and the Precious Metals strategies, on the other hand, are ways to play the long side of the Great Rotation without the short component.

Note how the relative fundamental valuation, using enterprise value relative to sales, between the Russell Growth vs. Value indices is re-testing the peak tech bubble levels that we saw in 2000.

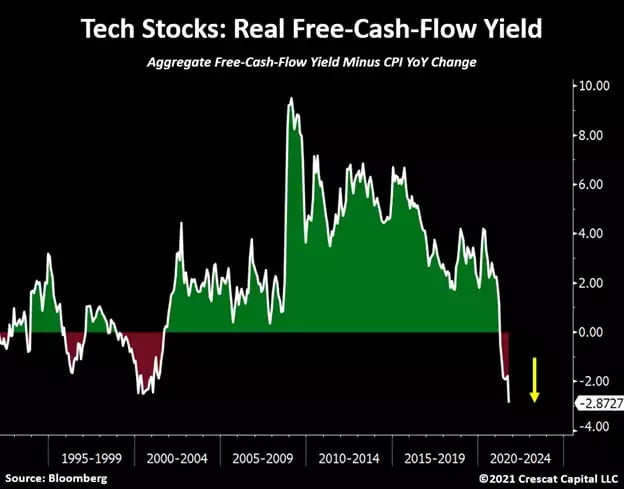

Tech Looks Ready to Roll Over

Technology stocks have retained the limelight in the press and investor consciousness year to date as well as price momentum but are now facing an outlook of significantly deteriorating growth and profitability. Meanwhile, primary resource stocks in the energy, materials, and industrial sectors have had equally strong momentum since the March 2020 Covid crash but possess eminently better intermediate-term growth, value, and appreciation potential as the world continues to emerge from the pandemic.

The real aggregate free-cash-flow yield among tech companies in the S&P 500 is now even lower than it was at the peak of the Tech Bubble.

With three of the big-five mega cap tech stocks (FB, AMZN, AAPL) missing Q3 revenue and/or earnings expectations and warning of a weak Q4, this is a fundamental signal of a major US market top in the making. Add to that Elon Musk boldly cashing in on $6.9 billion worth of his Tesla shares this week, the largest sale ever by a CEO. This at the same time as one of the best performing and most persistent hedge fund short sellers of the last decade was forced to throw in the towel due to client redemptions. Those clients are fools. Russell Clark is a legend and so is his performance on this much needed and now almost vacant side of the market. Hat tip to him.

Our research shows that, across a composite of valuation metrics, the stock market is more overvalued than it was in 2000, as well as any other time in history, including 1929. However, our models also show that we are headed towards an inflationary bubble burst, like that of 1973-74, when popular large cap growth stocks were decimated at the same time as commodity prices and resource stocks exploded to the upside. This is a unique type of bear market and economy that we envision, because it is much different than the deflationary-style meltdowns of 1929-32 or 2008-09. The 2000-02 tech bust and 1973-74 stagflationary shock are much better case studies for the type of macro environment we envision and want to be positioned for over the next one-to-three years. These were abrupt regime shifts in macro environments where bubbles burst in overpopulated segments while new secular bull markets began in others. There was much money to be made on both the long and short side of the market by being in the right industries on each side. There was also much pain for those who ignored valuation, changing fundamentals, and macro indicators in their approach and just kept hanging on, or worse if they bought the dip of the prior popular trend instead.

Crypto

Software based crypto assets, in the CIO’s opinion, are in a broad speculative mania along with the entire software industry akin to the Dotcom bubble on steroids. No doubt, distributed ledger technologies and tokenization are brilliant innovations that have value and will have endurance, just like the Internet did at its investment craze peak in early 2000. Crescat is not short crypto assets though the idea has been tempting due to the excessive level of speculation, along with their abundance and questionable intrinsic value. They are not securities with underlying fundamentals that can be valued based on a discounted-free-cash-flow model or with macro data that makes any sense to us today. For now, we see too much risk to being short crypto assets due to their crazy popularity and dogmatic following, including as a form of inflation protection. We couldn’t agree more with the need for inflation protection, but fervently believe there is a much more prudent way to get that when one’s nest egg is considered.

Primary Resources Industries

According to our macro and fundamental models, the most desirable assets to own in today’s changing investing climate, are the hard and soft commodities that are the core building blocks of the global economy. In our analysis, some of the best prospective risk-adjusted performance in the financial markets over the next three years (our target investment horizon) should accrue to the companies that own and produce these resources. These firms offer some of the highest relative revenue, earnings, and free cash flow growth for the foreseeable future along with low stock price multiples today, a powerful setup. These companies are spread throughout the energy, materials, industrial, and agricultural sectors of the economy. Based on a discounted free cash flow valuation approach, they predominate the list of highest appreciation potential stocks in Crescat’s fundamental equity model.

We expect the leadership in primary resource industries of the economy to continue over the next several quarters and years due to acute raw material shortages at the root of the supply chain, as well as increased demand due to fiscal and monetary policies, including the resource intensive push to a cleaner and greener economy. Heightened environmental and social pressure have only made the supply and demand imbalances more extreme.

Strong fiscally driven tailwinds including the new $1.1 trillion Infrastructure Investment and Jobs Act just passed by Congress, and about to be signed by the president, add fuel to this fire. Supply-side constraints to producing the materials needed to run the new as well as the existing economy are not easily reversed due to long lead times and the multiple years of declining capital investment trends.

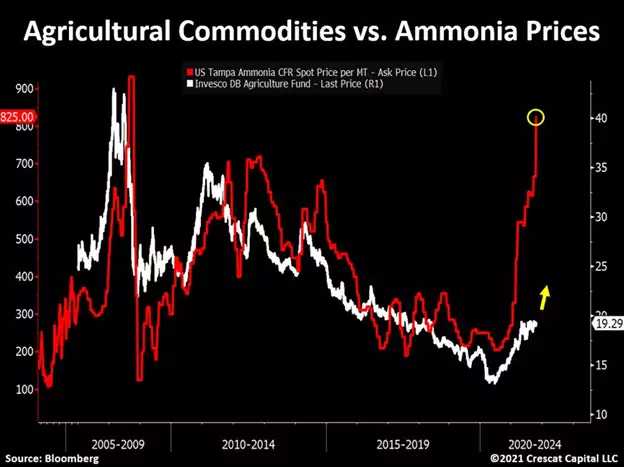

We are already experiencing a domino effect among natural resources. It started with spikes in lumber prices, then oil and gas, lead, zinc, and coal. If we look at ammonia prices, a key ingredient in fertilizer, agricultural commodities are a whole new set of commodities likely to be spiking next, potentially creating food shortages.

Crescat’s Large Cap, Global Macro, and Long/Short strategies own many positions in the broad resource sectors identified by our models. Among our favorites is precious metals.

The Fundamental Opportunity in Precious Metals

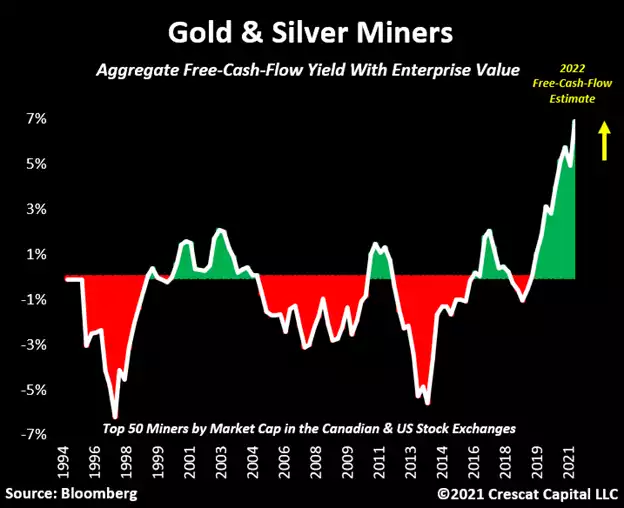

Gold and silver producers are trading at historically low free-cash-flow multiples and strong near-term growth prospects. We love them. But even more, we are enamored with high-quality gold, silver, and select copper and base metal explorers with high-grade targets who are aggressively growing new resource ounces in top mining jurisdictions globally. The companies with competent management and technical teams in this segment offer unbelievable value and appreciation potential according to our DCF model. Owning gold in the ground in a carefully constructed portfolio of these firms is one of the most asymmetric reward-to-risk opportunities we have ever seen.

Precious Metals, A Key Focus Today

With inflation continuing to surprise to the upside, precious metals mining stocks are ripe for a major breakout after taking the strong early lead among all S&P industry groups in the immediate four months after the March 2020 Covid crash. Until last month, gold and silver stocks had been consolidating, but with their underlying fundamentals only getting better, we believe they are poised for another major leg up. We are constructive regarding our potential to deliver a strong finish to 2021 based on the incredibly strong fundamental and macro set-up. That is our goal.

At Crescat, we recently became so excited about the deep-value opportunity for precious metals ahead of a likely new secular bull market, that we created two focused strategies based on it, the Precious Metals separately managed account strategy launched in June 2019 and the private Precious Metals Fund in August of 2020, both industry specific mandates.

Here is some quick math to illustrate the set up likely ahead of us. The monthly price of gold is now above its 2011 highs. If miners were to re-test the same levels, it would imply a 61% appreciation from here. More importantly, the fundamental story behind these companies today is unquestionably better than back then.

Precious Metals Fund Description

The Precious Metals Fund is an activist private fund. It is a macro and fundamental-driven industry specialist fund focused exclusively on the precious metals. This fund can short, in addition to going long, but chooses to be long-only today, given where we believe we are in the precious metals cycle, early in a new secular bull market. It also has an active futures account associated with it. The Precious Metals Fund participates in private as well as public transactions and holds a substantial equity warrant portfolio.

We have partnered with renowned exploration geologist, Quinton Hennigh, PhD to help us manage the precious metals portfolios across the firm. He has been advising Crescat for the past two years and has recently joined the team full-time as an equity owner/member of the firm and its geologic and technical advisor. We remain locked and loaded with an extensive portfolio of undervalued gold and silver in the ground. We have significant copper and other base metal exposure too where gold and silver are significant byproducts.

Our activist precious metals portfolio companies are focused on substantial organic growth in high-grade resource ounces through exploration and drilling. We expect industry M&A to heat up significantly over the next several quarters and our companies to be coveted. In a segment that has seen declining exploration spending for a decade,we have over 300 million target gold equivalent resource ounces in our portfolio which is thanks to Quinton’s expertise. Total global gold production in not even 100 million ounces.

Global Macro Fund Description

Crescat Global Macro remains the firm’s most comprehensive strategy and can trade any asset class globally, long and short, across currencies, commodities, fixed income, and equites. The Global Macro Fund was launched in 2006 to express investment themes via a broad set of instruments in addition to equities. The Global Macro Fund includes an active futures account and as well as equity account and several ISDA relationships with large bank counterparties to trade swaps that are not otherwise traded on an active exchange, such as our Chinese yuan and Hong Kong dollar put options that we own today.

Long/Short Fund Description

Long/Short is a classic equity hedge fund and is our second broadest mandate. It also exploits Crescat’s firmwide themes but is focused exclusively on equities. Long/Short is Crescat’s second longest running strategy. It was launched in 2000 and has persistently delivered strong alpha through multiple business cycles.

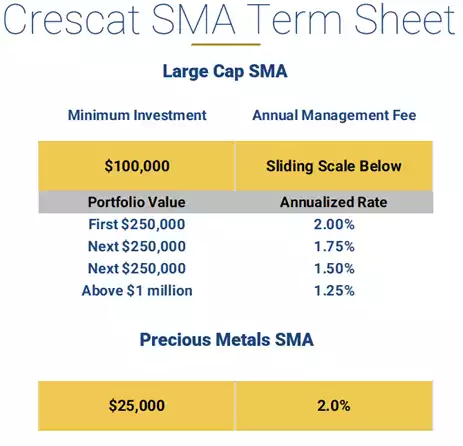

Large Cap SMA Description

Large Cap is a separately managed account strategy also focused on equities, but in the large and mid-cap realm. Think of it as a souped-up, blue-chip portfolio. Like all Crescat strategies, Large Cap is driven by our firmwide models and themes. It is focused on the best large and mid-cap long equity opportunities therein. It is diversified across select industries without being “diworsified” across all of them. Large Cap is Crescat’s longest running strategy. It was launched in 1999. It has been through the Tech Bubble, Tech Bust, Housing Bubble, Global Financial Crisis, and the longest bull market ever followed by both the Covid Crash and recovery.

Precious Metals SMA Description

The Precious Metals separately managed account strategy is a long-only separately managed account strategy designed for investors who do not qualify for our private fund, but who still want exposure to our management and publicly listed holdings. The Precious Metals SMAs do not participate in private placements and pre-IPO investments, nor do they get the warrants frequently associated with those investments, but they can still participate in our favorite public gold and silver stocks in a managed portfolio.

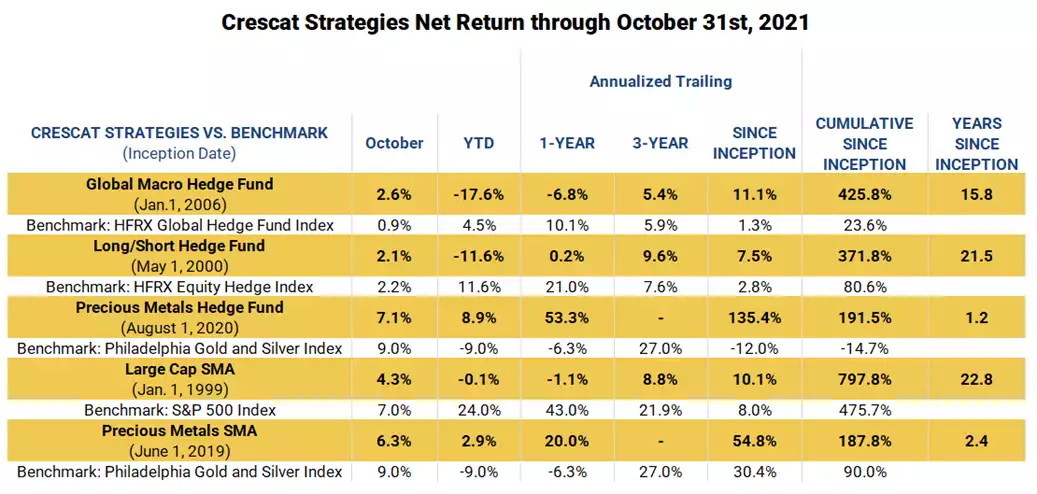

We are long a selective basket of miners in the precious metals industry across all five strategies at Crescat today due to rising actual and expected inflation worldwide and ultra-cheap valuations. However, it is important to understand that Crescat is more than a precious metals focused investment firm. We remain a comprehensive, value-driven investment firm guided by fundamental equity and macro models across five differentiated strategies. In addition to the two precious metals strategies, we manage a Large Cap long-only SMA, a Long/Short Equity hedge fund, and a Global Macro hedge fund. Each of these three strategies has an increasingly broader mandate in that order.

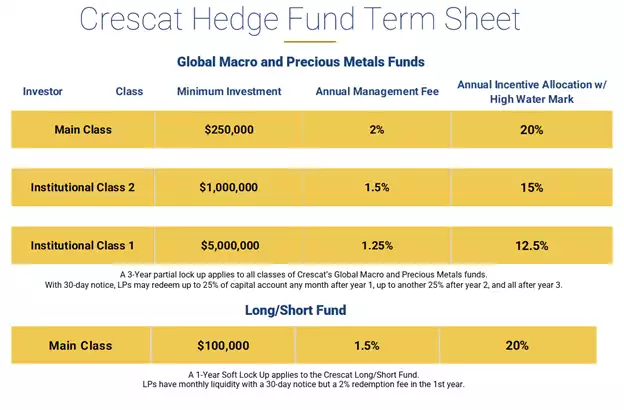

Crescat Hedge Fund Term Sheet

Crescat SMA Term Sheet

Fundamental Equity Quant Model

Both Crescat Large Cap and Long/Short have beaten their benchmarks since inception, net of fees, on an absolute and risk-adjusted basis over multiple business cycles. One constant behind these strategies has been Crescat’s fundamental equity quant model. The CIO originally began developing it in 1995. He, along with Crescat and its predecessor firms, have continuously refined and applied the equity model to managing client money since 1997. The equity model has always been an important tool in driving the firm’s stock picking in addition to helping define macro themes. Crescat has invested heavily in improving our equity model over the last year. We are more excited than ever about its current condition and potential to continue to help the firm deliver alpha.

Macro Models

Crescat also relies on macro models for developing its investment themes. Co-portfolio manager, Tavi Costa, helped take Crescat’s macro modeling to a new level after he joined the firm in 2014. Today, Crescat applies a variety of its own macro models in addition to our equity model to source and support its firmwide investment themes and positions.

Global Macro Positioning

Crescat Global Macro, being our most comprehensive strategy, maintains exposures to Crescat’s themes and most of the positions in our equity-oriented mandates, but it will also add exposures to currencies, commodities, and/or fixed income asset classes.

Today, Global Macro holds two substantial fixed income short positions in asymmetric reward-to-risk put options, because we are at the lowest level of real yields in post-World War II history without a bond bear market already having occurred. One is overdue, in our view, and most investors are not ready.

The first fixed income position is a junk bond short via the iShares iBoxx $ High Yield Corporate Bond ETF which long investors today are effectively paying, in the form of negative real yields at an historic level, for the dubious privilege of accepting default risk.

The second is a significant put option position in 10-year Treasury Note futures. With rising inflation in the form of both CPI and expectations, the Fed must do something credible to fight the steep rise in the price of consumer goods and services. It has already announced that it will be tapering its fixed income asset purchases. At the same time, the Treasury department is in extreme deficit spending mode relative to GDP while aggressively extending its maturities post a record Covid-T-Bill issuance. With the Fed out of the game, who is going to take-up the slack to digest the increased supply of long-duration Treasuries in a rising inflation environment? Shorting UST 10s from a starting nominal yield of 1.5% with CPI running at 6.2% simply makes a ton of sense to us here.

China is the Black Swan trade of the century that the market still just doesn’t get in our view. We remain committed to Plan A here in Global Macro, an asymmetric trade with minimal downside risk through low volatility option premium paid and large upside potential through long USD calls versus short CNH and HKD puts. We have been risking about 1 to 1.5% quarterly with notional upside to devaluation and de-peg that has ranged from 500 to 1000%. China has been melting down before the world’s eyes all year. We believe its currency is the ultimate shoe to drop. We are continuing with this strategy.

Summary

The Fed is trapped into moving forward with its plan to scale back its debt monetization. For now, this includes pressure from the yield curve to raise rates next year. The taper matters big time as the catalyst for financial asset bubbles to burst along with actual inflation. This reduction of monetary stimulus is a huge liquidity drain on the margin given the formerly outrageous QE levels and asset bubbles they have created. Whether it is now or within just several months from now, we believe we are very close to a major twin top in US equity and credit markets. We need to be ready and positioned for it now. Across the firm, we are doing everything we can on that front.

We are determined to make money on short side of the market in Global Macro and Long/Short when the Great Rotation burst gets going in earnest. The shorts have been holding those funds back YTD but we strongly believe that will not be the case forever. Many fund managers are precluded from shorting. We are not. The team here is working extremely hard and focused on delivering value across all our strategies.

October Performance

Crescat delivered robust performance in October across all strategies with precious metals long positions being the biggest driver. These holdings comprise our highest conviction forward-looking expected return vs. risk macro theme at Crescat. Thus, precious metals, and gold and silver mining equities, are widespread positions across all Crescat’s strategies.

November has started off extremely well MTD, with short positions adding value in Global Macro and Long Short on top of strong gains in precious metals.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

Cassie Fischer

Client Service Associate

Linda Carleu Smith, CPA

Member & COO

© 2021 Crescat Capital LLC

Article by Crescat Capital