Crescat Capital’s commentary for the month ended August 2021, discussing the tech bubble then and now.

Q2 2021 hedge fund letters, conferences and more

Dear Investors:

The Tech Bubble Then and Now

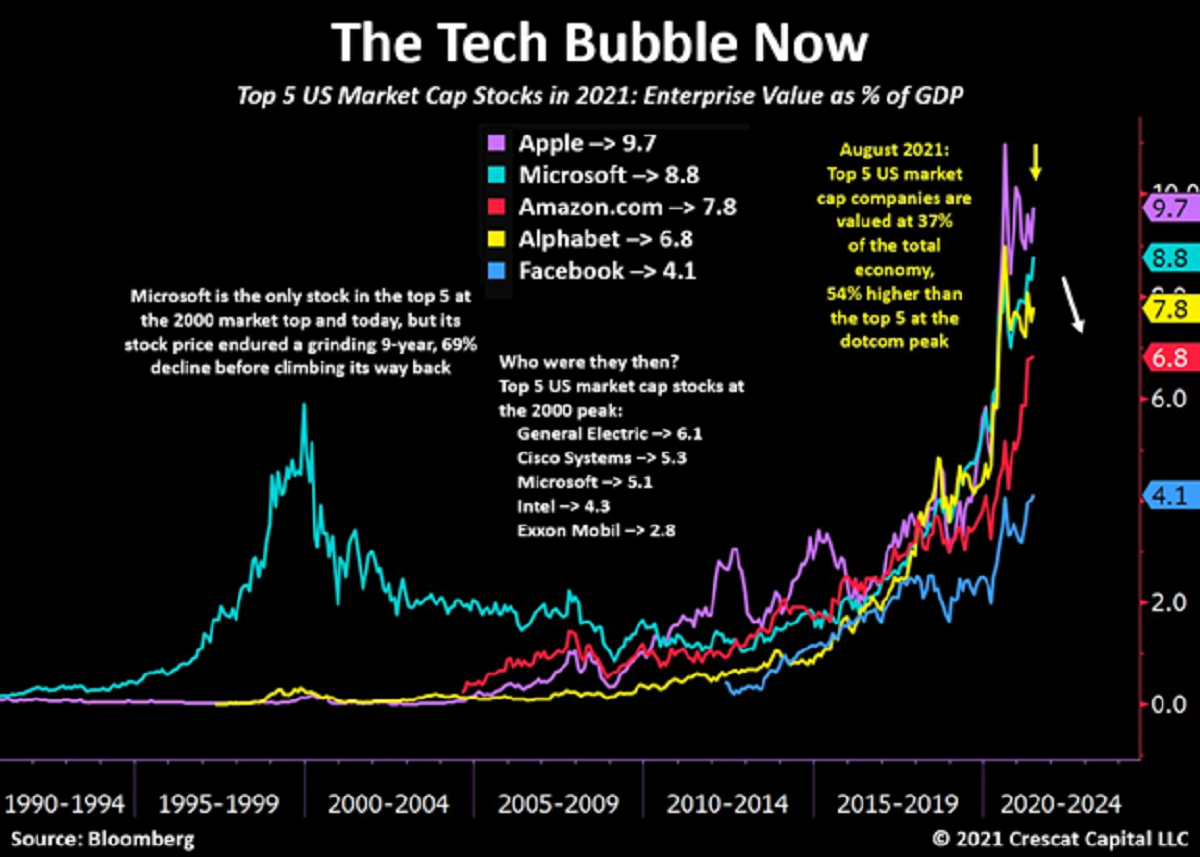

In our analysis, the US stock market today is historically overextended and poses substantial risks. To understand, we need to start by comparing it with the tech bubble in 2000. When Bill Gates retired as CEO of Microsoft that year, he was the richest person in the world. His timing was impeccable. A mad rush of corporate spending to fend off the Y2K software problem had just led to record earnings growth and profitability for his company and many other technology firms in 1999. It would mark the peak of the economic cycle, including a major stock market top that would lead to recession. By March 2000, the leading five US market cap companies combined were valued at a then-record 24% of the economy based on enterprise value to GDP as we show in the chart below. Only three of these were tech stocks: Cisco Systems, Microsoft, and Intel. General Electric and Exxon Mobil rounded out the top five. The internet would indeed blossom in the years to follow, but not without a major shakeup first. Microsoft’s stock price would plunge 65% over the next year and take 16 years to get back above its December 1999 high. Over the two and a half years of the tech bust in 2000-02, the S&P 500 Index declined 49% and the NASDAQ Composite crashed 78%.

Fast forward to today. Of the leading five US market cap companies, only one of them was in the top five in 2000. Coincidentally, it’s Microsoft after a resurgence over the last five years. One of them, Facebook was not even formed until after the tech bust in 2004. Another, Google, aka Alphabet, was still a private company in 2000 and just beginning to earn advertising revenues from its search engine. The point is that the largest, most profitable, and highest market cap companies in any business cycle will have trouble sustaining those high growth rates, at least without a major hiccup along the way, to be among the top companies in the next. To do so means that such companies would be on a path to engulf the entire economy, nearly an impossible feat, even for firms not being sued by their own government for being a monopoly, like Microsoft was at the time. For a similar reason, the CFA program and most business schools correctly teach that when valuing an enterprise using a discounted cash flow model, the terminal growth rate should never exceed long-term GDP growth of the economy. Alas, it appears that too many managers and individual investors alike are disregarding such fundamental principles again just like they did in 2000. As we show in the chart below, the top five US market cap stocks today are Apple, Microsoft, Amazon, Google, and Facebook or FAAMG. All of them are essentially tech stocks. The combined enterprise value of the widely held top five is 37% of GDP, 54% higher than it was for the top five at the 2000 peak.

Like almost all inevitable market tops, too many are keen to chase recent earnings growth and price momentum, extrapolating those trends too far into the future in their valuation assessment. Today, it is popular to invest in what is popular regardless of valuation. Psychologists say that people seek conformity in order to be liked and comforted. It seems that investors perceive safety in crowds. Such an investment strategy is fraught with downside risk at high valuations after non-repeatable economic growth inflection points.

Jeff Bezos, the wealthiest person in the world today, just retired as CEO of Amazon last month. Like Bill Gates, his timing should prove prescient. The fundamentals for the FAAMG companies have been fantastic. If anyone has any doubt, just consult the cover of Barron’s last week: “The Unstoppable Rise of Big Tech”. Our analysis of future growth rates differs to be sure. Just like the spending ahead of Y2K, the recent fundamentals for the FAAMGs have been way too good in our analysis. Because of the Covid-19 pandemic, in the last year and a half, businesses and individuals were forced to pull forward technology spending and accelerate their move to the cloud to accommodate remote work. The record fiscal and monetary stimulus as a percentage of GDP gave them unprecedented ammo to do so. Naturally, this has unsustainably boosted the revenues, earnings, and free cash flow growth, as well as the profitability, for all five of these already gigantic firms. That is the fundamental problem. The fact that four of these companies are also in the crosshairs of six antitrust bills initiated this year in Congress is yet another eerie parallel to the 2000 era.

According to Goldman Sachs, both hedge funds and mutual funds are heavily invested in stocks today while short interest for the S&P 500 and all sectors sit near record low levels. Goldman notes that hedge funds have near-record net and gross leverage while mutual funds have their lowest cash ratios ever. At the individual stock level, the FAAMG stocks are part of Goldman’s “Hedge Fund Very Important Position Basket”, a basket of stocks that has been underperforming the S&P 500 year to date by the way. Retail investor sentiment is also elevated according to measures at TD Ameritrade, Charles Schwab, and Bank of America (Merrill Lynch).

The whole US equity market is insanely overvalued with the total stock market capitalization relative to GDP far into record territory as we show below. Many other broad market valuation measures are also at historic levels. Index investing is also highly popular today offering apparently low volatility and high returns by hopping on the momentum train, but it is high risk and large downside return ahead in our analysis.

A Rude Awakening

For the first time since the 1970s the sense of fiat currency erosion relative to financial assets and consumer prices due to misguided policies has penetrated the mindset of investors in a significant way. Global monetary debasement is now setting the stage for a rude awakening. The inflation genie is out of the bottle and policy makers are unable to sustainably ease off the liquidity pedal. Financial repression has become essential to secure the health of the economy at the current levels of overall debt. Nonetheless, easy and cheap access to capital has also been one of the key reasons for the historical disconnection between asset prices and fundamentals. In fact, the sheer amount of financial assets today that trade at near record multiples is truly concerning. Preventing a collapse in risky assets has become a true policy constraint for monetary authorities. Different than other times in history, the Fed’s ability to allow the cost capital to substantially rise is incredibly limited. Ultimately, policy makers have their hands tied and will be forced to counter deflationary pressures in financial assets with further liquidity. Igniting an inflationary environment is the path of least resistance.

To use the US stock market as an example, the 5-year cyclically adjusted earnings yield is now near all-time lows. In other words, investors are undeservedly paying excessive prices relative to bottom-line fundamentals. Going back over a century of historical data, such depressed earnings’ yields have always led to very significant market meltdowns: the Great Depression, the 1937-8 Recession, and the 2000 Tech Bubble. For every one of these periods, the market unexpectedly reversed from very bullish multi-year trends with an average subsequent 3-year performance of -53%.

In the five years leading up to the Great Depression, markets were up about 30% in annualized terms. After the crash started, markets suffered for three years straight with an annualized decline of about 54%. In 1932, stocks finally bottomed, and we saw a five-year streak of 36% annualized return. By March of 1937, the equity market reached historically overvalued price levels relative to depressed corporate fundamentals and the macro environment made a 180-degree shift again. From 1937 to 1942, stocks suffered a 60% drawdown. The 2000 bubble was no different. In a similar manner, the US equity market was performing exceptionally well leading right up until the bust.

As we have shown, today’s stock market is more overvalued than those other three times by a variety of metrics. In this context, it is hard to believe that the Fed will be able to sustainably reduce its monetary stimulus without triggering potential market meltdown issues.

Naturally, as different opportunities present themselves over time, market positioning and capital allocation tend to change drastically every five years or so causing major reversal trends. We strongly believe investors are poised to experience another one of these significant market rotations where capital allocation moves away from historically expensive equities to then find its way into cheap tangible assets, i.e. commodities.

The Elephant in the Room: Low Interest Rates

Now let’s address the elephant in room. You would think that a low interest rate environment would be positive for stocks, but that is far from the truth. The problem is that inflation is running much higher than interest rates. When we look at valuations of equities versus 10-year real yields in the last 120 years, equity fundamental multiples significantly compressed when real yields were negative for a long period of time. To be fair, however, this is the first time we have seen negative 10-year real rates with valuations at historic levels. An incredibly important takeaway, commodities performed exceptionally well during the three highlighted times below.

The Potential for a Systemic Selloff

Among the important exogenous risks to be aware of, it would be China. The recent crackdown by the Chinese Communist Party on domestic companies could easily spill over significant economic deceleration in the rest of the global economy. Asian stocks and the MSCI World index have had a very strong correlation over the years. It amazes us to see the number of folks choosing to ignore these market risks as being independent cases led by the Chinese government. However, what most forget is that the Chinese economy is far from being isolated from the rest of the world. In our view, this major decline in Asian stocks suggests a systemic selloff in global equities ahead. We also showed in our prior letter that this decline in Chinese ADRs could indicate a significant deceleration in US PMI in the near future. In fact, the rate of change in US manufacturing data tends to follow the delta in Chinese stocks very closely in the last 12 years. We just had one of the strongest economic environments in history in the last six months and growth seems to be mean reverting.

From the Government to the People

On the other hand, we believe inflation will continue to surprise to the upside in the following years. One major reason for that is the chart below. The combination of Fed stimulus to finance historical amounts of government spending has led to one of the largest wealth transfers in history. Interestingly, since the Global Financial Crisis, the increase in government debt has been directly linked to the increase in net worth of the US population. One important difference from prior years, however, is that fiscal policies are increasingly becoming more focused on the bottom 50%.

The Four Main Fronts of the US Fiscal Agenda

The US fiscal deficit problem has somewhat improved since March of this year, which was the worst level in 70-years. Relative to nominal GDP, the fiscal deficit now stands at -12%, which is about 6 percentage points better than its prior lows at -18.5%. The issue is that this number still is 2 percentage points lower than the worst levels reached during the Global Financial Crisis. The US government is determined to pursue a fiscal agenda that has four main fronts:

- The Green Revolution: the financial efforts to attempt curbing the effects of climate change have become a major priority of the current political leadership. We are seeing big steps towards regulating carbon dioxide emissions and reducing fossil energy production and exploration. Meanwhile, the government remains focused on incentivizing renewable energy technologies and electrification as part of a transition to a modern and sustainable energy.

- An Infrastructure Revamp: bipartisan policy makers believe the economy necessitates major improvements in roads, bridges, airports, ports, electrical grids, green initiatives, etc.

- Peak Inequality: policies targeted towards narrowing the wealth spread between the lower classes and the richer parts of the society appear to be at the forefront of the Biden administration’s policy stance. Some examples would be their efforts towards cancelation of student loans, the increase of minimum wages, hiking corporate taxes, etc. As part of this, we have recently seen a 27% increase in food stamps, the largest one in history. This process of wealth transfer from the rich and the government to the bottom 50% of the population is only getting started.

- A Fiscal Arms Race with China: Biden and his team have kept a very hawkish stance against China. The prior administration approached their concerns by imposing tariffs on Chinese imported products. This administration wants to tackle this differently by subsidizing domestic companies in strategic industries to be able to compete with Chinese businesses.

It is hard to believe that with such an ambitious agenda government spending will not remain aggressive going forward. We think fiscal deficits will continue to run at double-digits for the next years. The issue, however, is that in addition to the extreme levels of government stimulus, the US trade balance is already turning significantly lower and likely to continue to deteriorate.

Structural Inflationary Pressure Building Up

For the last four decades, cyclical increases in inflationary forces have been short lived. Aside from a steady downward trend in money velocity, one of the key reasons why inflation has not yet grown more sustainably is due to a secular decline in wage and salary growth since the late 1970s. However, among one of our highest conviction ideas, we believe we are experiencing the beginning of a structural shift in the growth of workers’ remuneration. Most investors have been paying close attention to the wage growth tracker by the Atlanta Fed which continues to show very muted changes since the pandemic started. The issue with this index is that it applies a sample of only 60,000 households or less than 0.04% of the total amount of employed Americans. We think the most accurate calculation is to look at the wages and salaries aggregate number divided by the number of employed persons. Our own measurement is now growing by 14% on a 24-month basis. Similar to what Americans experienced in the early 60s to the late 70s, we think we are at the very beginning of an upward inflection in wages and salaries.

In line with our view about the potential growth in salaries and wages, here is an important metric that came out last week from the Richmond Manufacturing Survey. The average wage index just reached record levels.

The Macro Opportunity on the Long Side of the Market

What we view as particularly exciting in the current macro environment is the commodities market. In our analysis, the natural resource industries have turned into remarkably profitable businesses in the last several quarters. Aside from the coal industry, we view the entire segment as an attractive investable opportunity. The aggregate free-cash-flow now generated by commodity producers is growing at a pace we have not seen in the last 30 years. In the table below, we provided six different fundamental metrics for commodity producers with a market capitalization above $1 billion in the Canadian and US stock exchanges by breaking them down into five industries. Precious metals’ companies were clearly the most attractive on a growth, balance sheet strength, valuation, and quality basis. Aside from the strong bottom-line growth and relatively high free-cash-yield, the margins for gold and silver companies are significantly better than the other commodity producers. Although natural resource companies are capital intensive businesses, precious metals’ producers have a much cleaner balance sheet profile than the others. Oil and gas companies, on the other hand, appear to be the cheapest on a free-cash-flow yield basis but are also significantly more levered. Base metals’ stocks performed well recently and therefore show better growth but worse value metrics. In our funds, we favor a larger exposure to gold and silver companies as we remain highly convicted that the underlying monetary metals will benefit the most from the current macro environment. We have a sizeable position in base metals and also hold energy and agricultural companies in our large cap strategy.

Significant Balance Sheet Improvements Among Commodity Producers

Note how overall commodity producers just did their largest repayment of debt in the history of the data. Strong growth, impressive margins and clean balance sheets are exciting developments for this sector today.

A Range of Opportunities

Gold appreciated by 75% from August 2018 to August 2020, and after a breakout to new highs, it seems to be stuck in a trading range for the last several quarters. We saw something similar back in mid-2000s that preceded a major runup in price. We believe we are in a similar position today. Long-term consolidations tend to result in powerful moves to the upside.

Precious Metals Undervalued Compared to Other Commodities

Most commodities have rallied strongly since November 2020 leaving gold and silver behind. However, we not only have an interesting setup for precious metals relative to money supply, but also relative to other resource assets. Gold and silver are now at their cheapest levels relative to other commodities since 2009. This is a very interesting technical, fundamental, and macro setup. Keep in mind that the other two times this ratio reached such depressed levels marked incredible buying opportunities.

Early Innings in the Precious Metals Cycle

Among some of the important metrics to analyze how early we are in the precious metals cycle is the level of merger and acquisition activity in the industry. As shown in the chart below, the M&A cycle has not even started yet. Senior miners have become true free-cash-flow machines at these metal prices. We have not seen this level of net cash accumulation in a long time, setting up a flood gate of liquidity for the following years. In our view, it is just a matter of time before major producers look for high-quality exploration companies as acquisition candidates.

A Massive Long-Term Cup and Handle

After the strong smackdown in precious metals that we saw a few weeks ago, gold and silver stocks have firmly rebounded showing signs of technical strength. The long-term chart of silver continues to look better over time, and we believe it is poised to move much higher in the following months. Gold is also forming a very bullish monthly candle after a major reversal. We expect these moves in metal prices to continue to gain momentum with miners to lead the way.

Profound Inflationary Implications Ahead

While we continue to emphasize our optimism in precious metals, we also think other commodities will likely perform well in this economic setup. In fact, natural gas is having its best performance in 15 years. We are paying close attention to this as we believe an upward move in energy commodities will have profound inflationary implications in the economy. As part of our thesis, we believe this appreciation of natural gas will continue to gain momentum to the upside and might be an important transition fuel towards a greener economy.

See below the major breakout in natural gas prices from multi-year resistance. This price action looks to be incredibly bullish in our view. Natural gas may be a bridge to cleaner energy and a greener economy.

Ongoing Supply Issues

On a separate note, one would think that car inventories would be improving by now. Instead, the latest report for July just marked new lows. What pundits forget to mention is that this index was already at historic levels long before the pandemic. We think these supply issues are more troubling than most believe. We believe these problems will continue to feed into the inflationary narrative over time.

July Performance

Positioning for The Great Rotation

Gross domestic product is a nominal measure of the total economy and is taking off today because of inflation, not real GDP growth. The latter may soon be approaching negative territory leading to a stagflationary recession. Increases in the general price level of goods and services can squeeze profit margins, destroy savings, contract record P/E multiples, and trigger rising inflation expectations that escalate into a long-term wage-price spiral. The need to concentrate on the narrow group of value-oriented investments on the long side of the markets today in our opinion is more imperative than ever.

In our opinion, smart money should be taking advantage of the recent pullback in the precious metals and commodity markets on the likely unfounded concerns over the Fed’s taper. We think it is an opportunistic time to add to our precious metals and large cap strategies. Buying into a natural-resources focused portfolio that is early in the growth cycle with tremendous value opportunity ahead and that offers capital protection from monetary dilution seems wise to say the least. And for those looking to capitalize on the likelihood of a downturn in broad equity markets while still benefiting from long commodity exposure, we think our global macro and long/short funds are highly worthy additions today.

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

303-271-9997

Cassie Fischer

Client Service Associate

(303) 350-4000

Linda Carleu Smith, CPA

Member & COO

(303) 228-7371

© 2021 Crescat Capital LLC