In his Daily Market Notes report to investors, while commenting on tech stocks, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

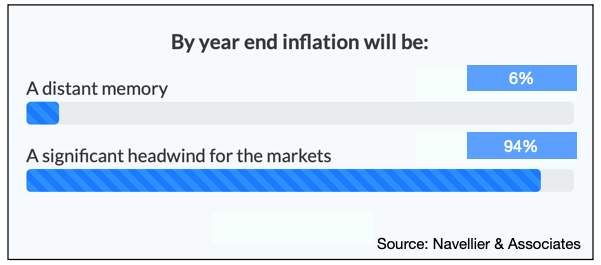

Our survey this week showed that a majority of investors believe inflation will be a significant headwind for the markets by year-end.

This is a notable difference from our survey in August where 24% of investors thought inflation was "transitory." Janet Yellen’s most recent comments on the matter did a little to allay fears. Inflation may be the only thing standing in the way of a year-end rally.

Growth stocks, as well as dividend growth stocks, are historically your best defense against rising inflation. Interest rates are also falling despite all the taper concerns.

Tech Stocks Save The Day

The US 30 year fell below 2% today, dropping over 9 basis points. The 10-year yield dropped 5 basis points. The US Treasury had a very strong 5-year auction today as well. What can explain this move in the face of apparent inflation trends and near term expectation of the beginning of tapering of open market purchases by the Fed? The outstanding performance of tech stocks in general and FANG stocks in particular this earnings season. Tech innovation succeeds in a big way by cutting costs from existing methodologies, along with adding new sources of revenues and profits.

The unprecedented rise of technology in the current decade has resulted in very subdued inflation numbers. The massive government support payments and even bigger quantitative easing by the Fed in response to the Covid pandemic has brought concerns of the inflation risk of pumping so much liquidity into the economy. The spike in energy prices from reopening demand, logistics snafus in particular computer chips shortages, a spike in home prices from work at home demand, and labor dislocations were all feeding inflation expectations. These, however, are mostly short term reactions to the pandemic adjustments and recovery.

Investors have been reminded of the long term deflationary trends brought by technology changes by the remarkable continued strong growth of even the trillion dollar sized tech giants. Without a gap up in interest rates in the cards, equity valuations become even more reasonable, particularly growth stocks. There may be a bump in the road when the tapering actually begins, but long term trends win in the end and those appear to be on track for further gains in equities.

The Commerce Department on Wednesday reported that durable goods orders declined 0.4% in September, which was substantially better than economists’ expectations of a 1% decline. This was the first monthly decline in durable goods orders since last April and was largely caused by supply chain glitches and port bottlenecks. Durable goods orders for August were also revised lower to a 1.3% gain. Durable goods orders have risen for 15 of the past 17 months. So far this year, overall new orders for durable goods numbers are up 23.4%, but shipments are up only 13.6%, due to order backlogs from the supply chain glitches.

Heard & Notable

German city Frankfurt was found to have the highest risk of a housing bubble developing in a recent survey released by investment bank UBS. Other cities at high risk were Toronto, Hong Kong, Munich, Zurich, and Vancouver. New York City ranked 18th while San Francisco ranked 14th. Source: Statista