It’s never fun when tax season creeps up. Doesn’t matter if that means filing as an individual or operating within some sort of business, the process is taxing. Literally. There’s a lot to consider in the process of filing, but one thing that isn’t complicated is deadlines. So in preparation of tax season, here are some of the most important deadlines to remember.

Tax Filing Made Simple

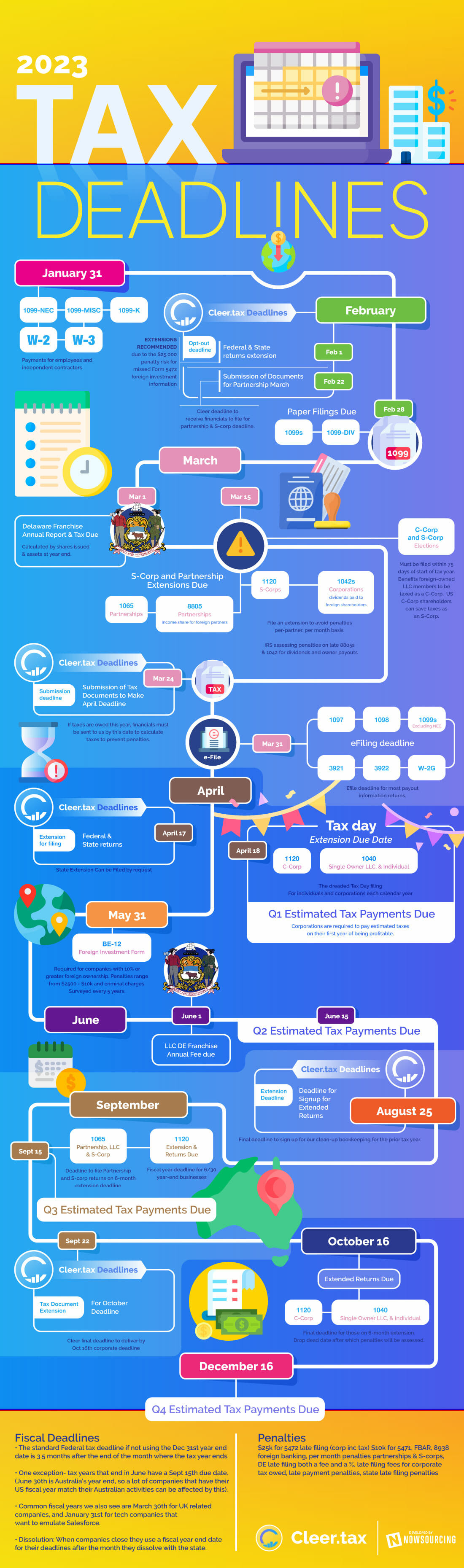

For individuals, the process has mostly already been completed. The end of January is when independent contractors and employees could start sending their tax returns in. It was recent, February 28th, that refunds were more widely available. This was also the date that paper filing for specific documents, most specifically 1099 and its variants, were due.

Q4 2022 hedge fund letters, conferences and more

Looking into March, the 15th is when corporations start to meet due dates. This is when S-corp and Partnership extensions are due. These are both businesses consisting of multiple people. This is important for filing because that means multiple people can be hit with penalties. For small businesses this can be lethal to early development.

This same date, March 15th, is also the election date for S-corp and C-corps. S-corps are LLC’s that flow their income, expenses, and deductions through its shareholders. These can only exist with an election submitted. Without this election, the business will not be considered a taxable S-corp for 2023. The same idea applies to C-corps.

March 31st, the final relevant date in March, is when eFiling is due. This is for a wide range of documents, but most relevantly 1097, 1098, and 1099s. It is also important to note that this is the due date for IRS direct filing. If there is any other organization or corporation involved in the process they may have their own due date.

A great example of a tax filing business is Cleer.tax, who has created a helpful visual on tax deadlines. This business has completely different due dates to the federal government. For example Tax Day itself is April 18th this year, a fairly average date. Cleer.tax wants tax documents submitted by March 24th, to allow for the business itself to file. Businesses vary greatly in their timeframe, what’s important is knowing that it varies from the federal timeframe.

It's worth mentioning, yet again, that Tax Day is April 18th. Filing was possible anytime before then but this is when filing or at least an extension is expected. It is also when quarter one estimated tax payments are due. Q2 are due June 15th, Q3 September 15th, these are distant dates but important ones to note down.

There are other prominent dates even after Tax Day. May 31st is when the BE-12 foreign investment form is due. September 15th is when the extended deadline for filing as a partnership or S-corp is due. And October 16th is when Tax Day extensions are due. These won’t be as relevant for most, but specifically for those requesting extensions they are vital to know.

Tax season is never fun, but it doesn’t have to be impossible to deal with. Knowing and keeping ahead of the due dates is an easy way to keep the headache away. Plus, at least for most individuals, there’s a nice tax return awaiting. Just have to file to receive it.

Infographic source: Cleer.Tax