Stocks have recovered off the intraday lows yesterday, in what is one of the less severe battles of the unfolding taper tantrum – commodities such as copper and oil bear the brunt thereof, which is perfectly understandable given the slowdown in economic expansion. My yesterday‘s analysis coupled with Monday‘s one has all the details of the fundamental backdrop and Fed positioning (little changed with yesterday‘s Powell virtual townhall meeting).

Q2 2021 hedge fund letters, conferences and more

Markets are simply being nervous here, and it‘s my view that the economic recovery hasn‘t yet peaked, for when I look at various yield spreads, we haven‘t reached levels consistent with the peak (e.g. in the 10-year over 2-year Treasury, by far not). I continue to think we‘re approximately midway into the expansion, and only yield curve inversion would herald an approaching recession to me.

Again, today’s report will be a little shorter than usual, and focus on select charts so as to drive position details of all the five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

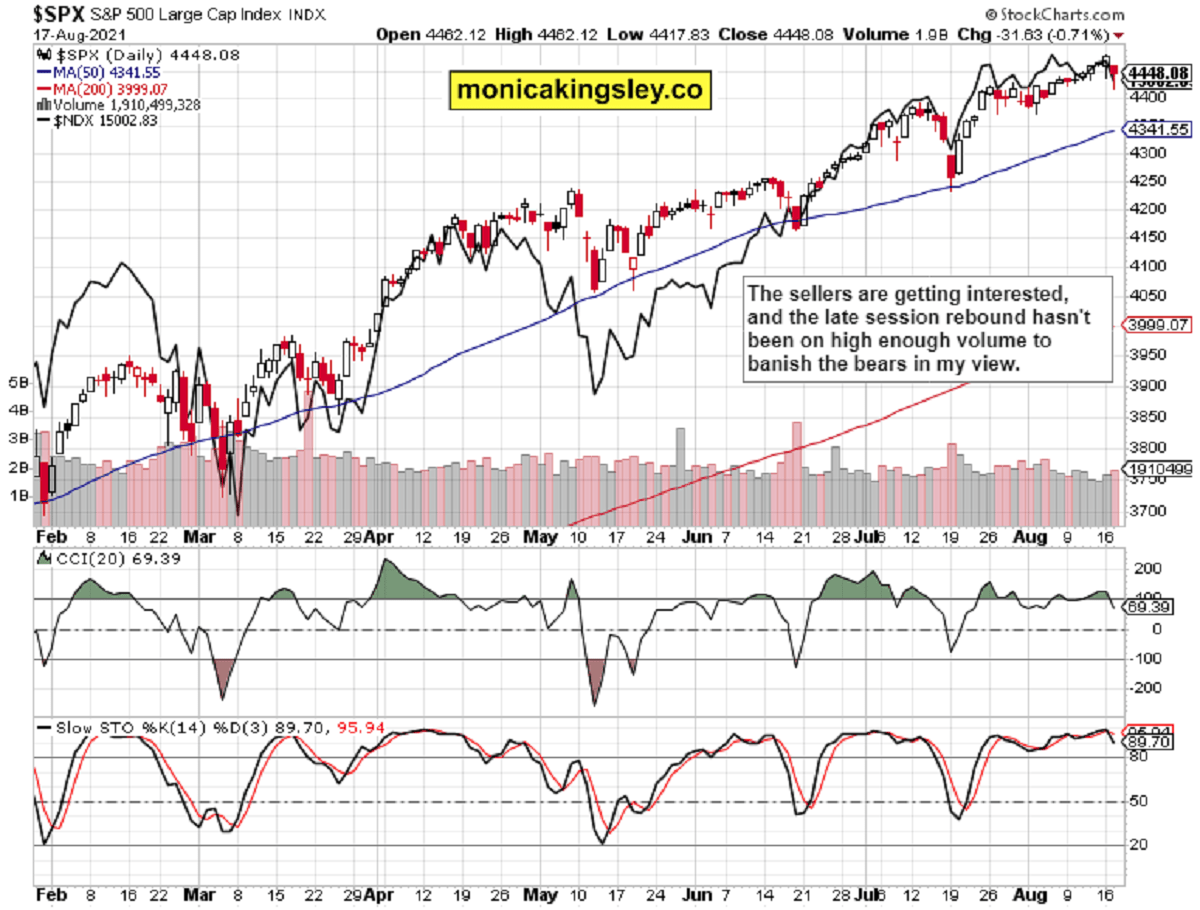

S&P 500 and Nasdaq Outlook

The bears made their appearance, finally – and the increasing volume tells that they‘re probably not done yet. Sideways trading is the best the bulls can hope for, and looking at the credit markets, I‘m not looking for a swift bullish resolution before a thorough test first. Yes, the odds of a serious correction in the S&P 500 have increased again.

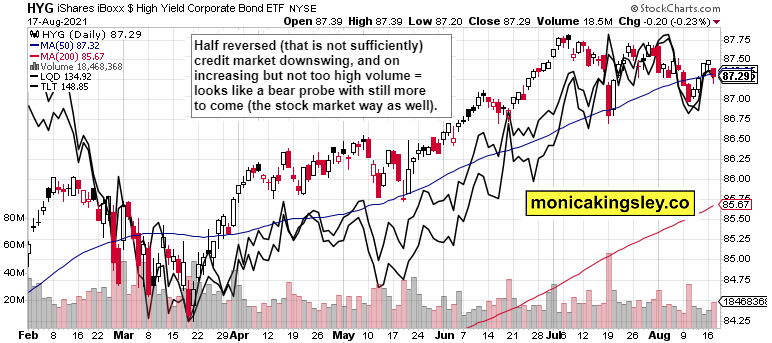

Credit Markets

Noticeable hiccup in the credit markets appeared yesterday, making the short-term outlook definitely not bullish. Sideways to down seems to be the most likely scenario.

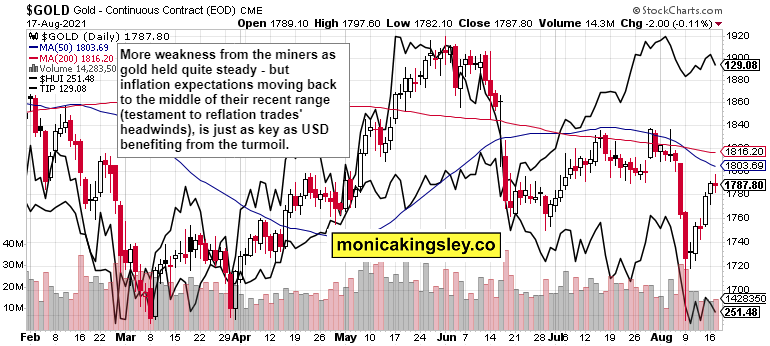

Gold, Silver and Miners

In spite of continued miners‘ underperformance, gold resilience is understandable in the current risk-off environment with safe haven assets such as Treasuries being sought in order to take cover from the reflation trades getting under fire (and that affects silver too, for it trades as both a precious metal and a commodity).

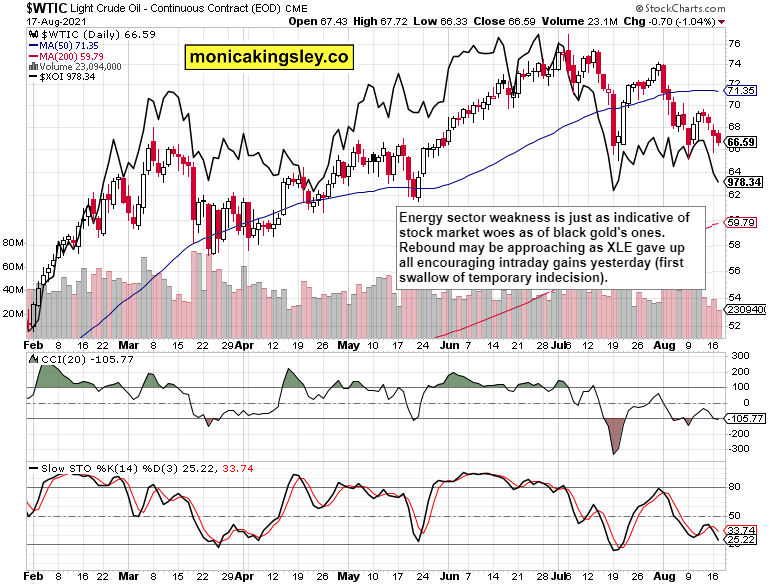

Crude Oil

Energy stocks paint a grim picture, and crude oil‘s downside doesn‘t appear to be over in spite of momentary and relative resilience.

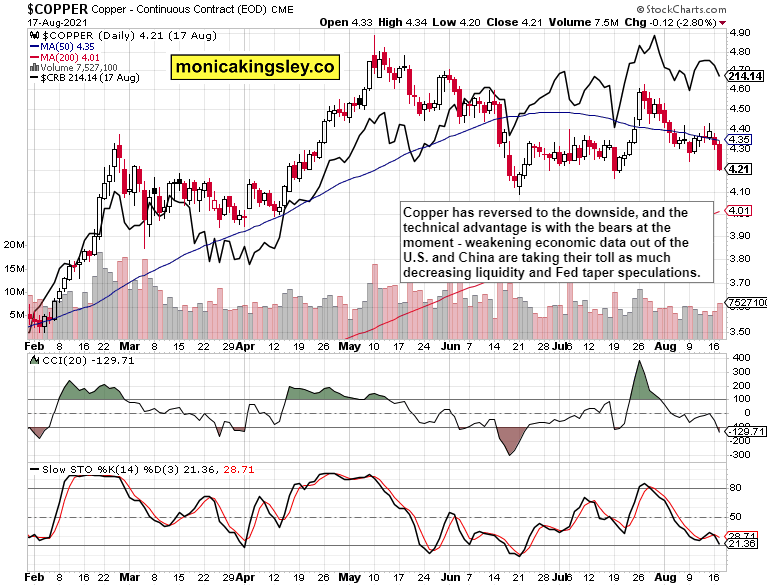

Copper

The local bottom has been indeed elusive, as yesterday‘s price action shows. No signs it‘s in either today – the volume is slowly rising, and the bulls haven‘t made their presence known much. When the taper bets get reversed though, look for a swift reversal to the upside – probably not as steep as in gold lately, but still clearly noticeable.

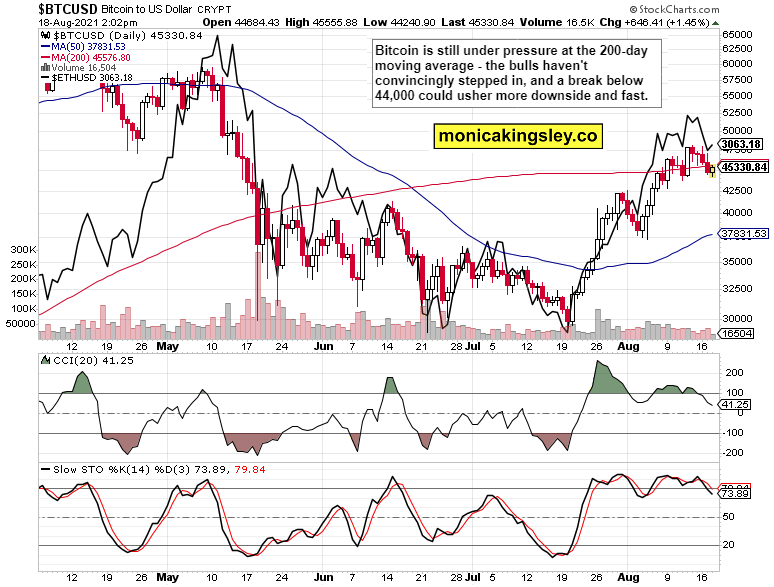

Bitcoin and Ethereum

Cryptos gave up solid intraday gains yesterday, and haven‘t quite come back today – the outlook is a bit unclear at the moment, with the decisive break of either $48,000 or $44,000 in Bitcoin serving as a litmus test of where next we‘re going.

Summary

While the risk of a correction in stocks grows, in many commodities it‘s already here – and getting more pronounced. The decelerating economy and margin debt retreat are taking their toll as much as taper fears, making the dollar rise in what can be described as a (mini) taper tantrum already here.

Does it change the reflation and economic expansion story? I don‘t think so as this has farther to go before rolling over, therefore I look for inflation trades to eventually return to strength, and for gold to take advantage of continued monetary accommodation.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.