Comus Investment commentary for the first quarter ended June 30, 2021.

Q2 2021 hedge fund letters, conferences and more

Dear Partners,

Comus Investment Performance Update

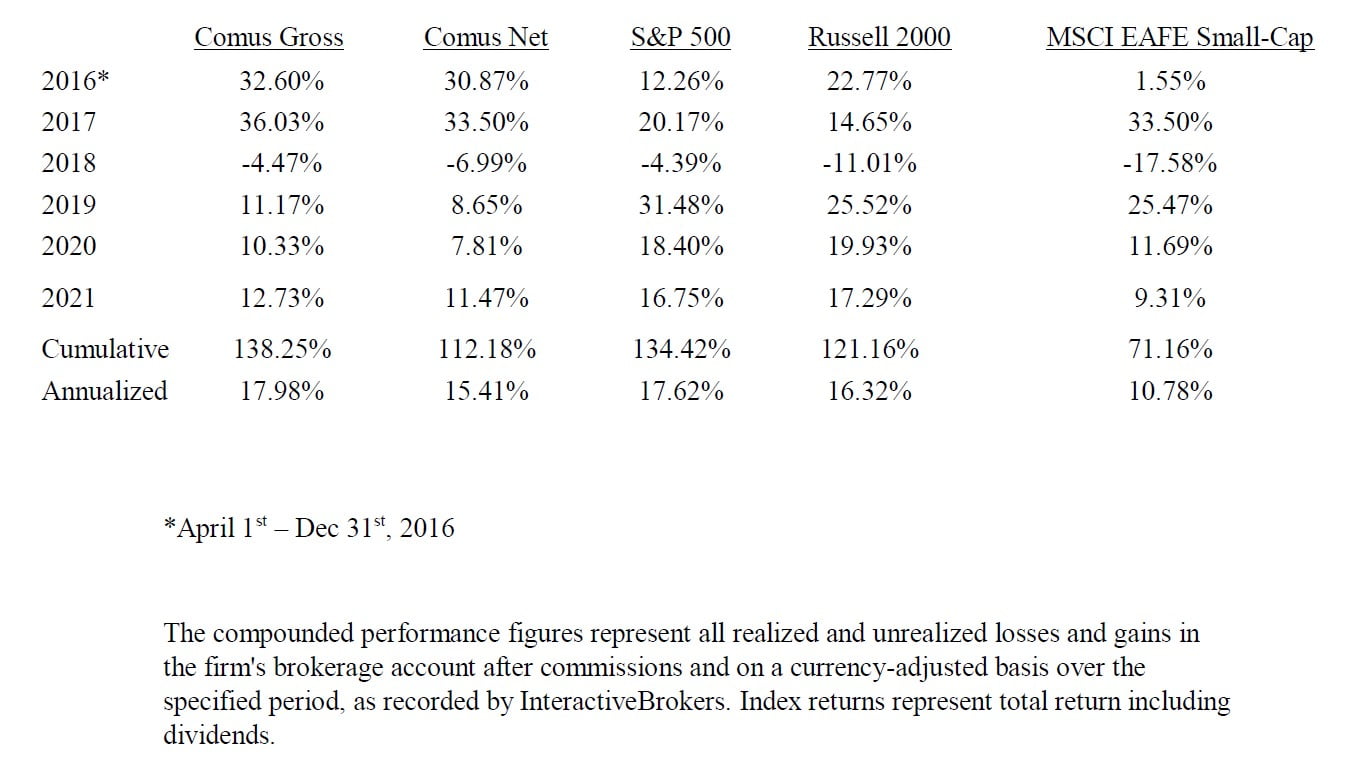

In the second quarter of 2021, our investments experienced a total return of 3.39% before fees and 2.76% after fees, versus 10.79% for the S&P 500 index. At this point, you will have received reports with the details on your balance, fees, holdings, and performance from InteractiveBrokers for the past quarter.

Primarily due to weak returns to international and value-type stocks, our returns since inception have been poor and only suitable as a substitute for international equity index exposure- this will soon change. Starting from unsavory valuations, this has been one of the best 5 year runs in U.S. stock history, and with the 2018 trade war and foreign stock collapse, followed by the pandemic and the ensuing weak returns to Asian markets year-to-date, our net returns haven’t been able to match U.S. large-cap indices. From March 1990 to 2000, the Nasdaq index returned 1,000% total for a 26% annual return and was a primary contributor to U.S. stock returns for the period. Similarly, the Nasdaq has returned 325% since 2017, for a 30% annual return- if this could continue indefinitely, I would suggest we all buy U.S. tech indices. U.S. stocks have continued upwards year-to-date as the Nasdaq held its 49% covid gains in 2020, while the rest of the market has recovered.

U.S. investors are currently paying 200% of the country’s GDP to own the stock market, the highest in recorded history and up from 141% at the 2000 peak. Index earnings multiples are also high, though partly due to temporary covid issues affecting earnings. These market earnings multiples are also obfuscated by the record high percentage of loss-making companies and recent IPOs.

Public Favorites Are Perennial Losers

As stated before, I continue to believe that public favorites are perennial losers in most markets which properly incorporate demand into pricing, and this period for U.S. stocks shouldn’t be different. As an example, imagine if we bet on the best sports team in a particular league, one that is also the most popular team to bet on. Every time they win we take a 10% profit, and since they win the vast majority of the time, we feel that we are winning gamblers- at least until they eventually lose, in which case that one loss wipes out 10 games of profit. On the other hand, we have those underdogs which are unlikely to beat top teams, but when they do (and they will, though it is often unpredictable), we receive multiples of our original bet. Most of the time we will lose, however, if they win some reasonable percentage, we will likely be inordinately rewarded for the uncertainty we bear since there is little demand to bet on such teams. In the first case, we win most of the time, but are losers; in the second, we lose most of the time, but are winners.

Since inception, I have primarily relied on academic studies, textbook information, and the knowledge of old masters to guide my decision-making. For various reasons, in this field there is a dearth of observation and scientific-prowess, and a lean towards qualitative analysis, which I have increasingly begun to eschew. Until this past month, I haven’t had access to the data necessary to provide support or falsification for various ideas, but, thanks to my largest partner, we have come across a handful of unintuitive findings which I find significant and unnoticed in past deep-value research and equity research in general. These will substantially affect our portfolio in the coming years.

As always, feel free to contact me at any time with questions, comments or concerns.

Best,

Aaron J. Saunders

Owner & Manager, Comus Investment, LLC.