The Broad Market Index was down 0.59% last week and 36% of stocks out-performed the index.

Q2 2021 hedge fund letters, conferences and more

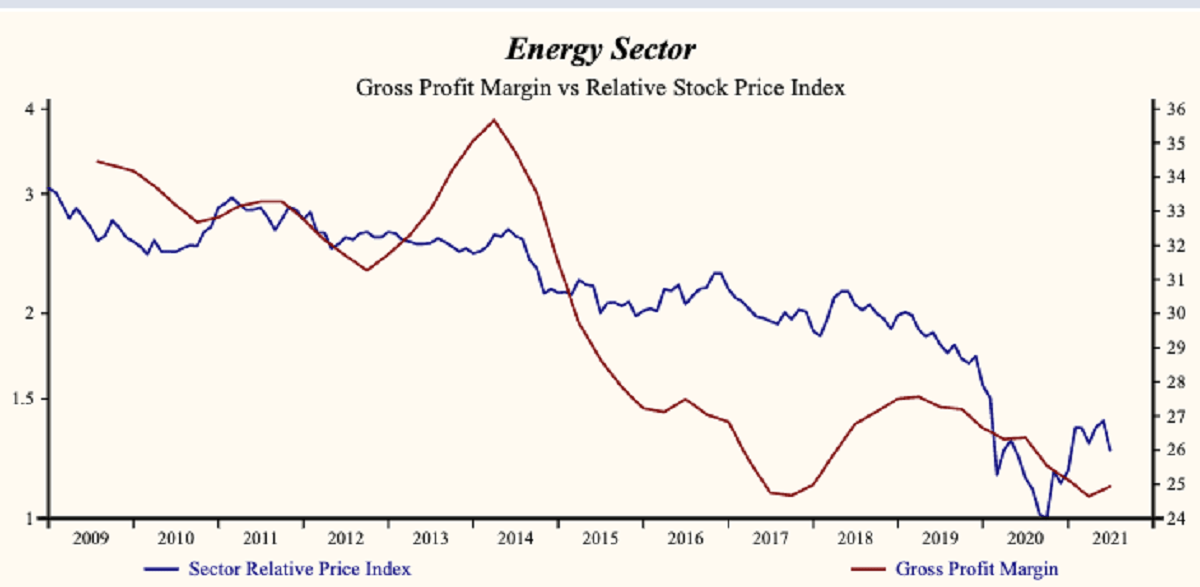

It all hangs on the cost of oil & gas. As an input cost for most companies, the price of oil has been an important contributor to low measured inflation since the energy industry peak in 2014. At the time, US policy was concerned with energy self-sufficiency and very large investments were made in new drilling and enhanced production using fracking. Investors were given tax incentives to support that policy and provide capital to oil companies.

Oil Per Barrel Is Down

The effect was to glut the oil market and press down oil prices. That was clear in the oil company corporate accounting data in 2014 when higher capital expenditures combined with a high and falling gross profit margin. The average gross profit margin fell from 35% to 24%. Sector wide, share prices fell more than 50% relative to the market average and lower energy costs were an important to the advance in the gross profit margin of non-energy companies.

The Bell Is Ringing

Last quarter for the first time in 2 years the average gross profit margin increased in the energy sector and 54% of companies achieved an improvement. Capital expenditures are down relative to sales for the first time since 2018. Capital expenditures have been reduced dramatically through the virus but sales growth was so steeply negative that, relative to sales, the indicator continued to advance. Now on a lower base of capital expenditures and with sales growth positive and higher.

Oil Production Pressure

In recent weeks, with concerns about the delta variant and aggressive pressure by the US government on foreign oil producers to increase production, oil prices have dropped from $75/barrel in July to $61 down 10% just last week. This is important to the lower inflation forecast from the US federal reserve that is critical cover for the current ultra-loose money policy and ultra-low interest rates at an unprecedented discount to measured inflation.

Energy Prices To Rise

Meanwhile we are measuring the most powerful industrial recovery in the US data record. Historically, we have not seen an advance in autos and housing that was not accompanied by higher energy prices. Recently, with energy sector capital expenditures lower, and now lower relative to sales, we are likely to see slower supply growth and higher energy prices as the industrial advance continues.

Commodity Prices To Rise

This is the catalyst for the inevitable money crisis that we face. Higher commodity prices are the reliable result of higher demand for autos and housing. Historically it has been higher interest rates and more restricted access to capital that cools demand for these big-ticket consumer goods and slows the commodity price/inflation effect. Instead, global central banks are willing to delay and pretend that the recent jump in measured inflation is temporary.

That is dangerous! It will take a much larger contraction in money policy to reduce inflation once it becomes embedded in expectations.

Buy Commodities Now

It is important to buy energy and commodity companies now. The recent drop in share prices is inconsistent with the strong and unconstrained recovery in autos and housing that is underway now. Investors with a concern for the environment and committed to end fossil fuels should consider that the transition away from fossil fuels cannot be achieved without the participation of oil companies. We should also consider that the most powerful incentive to switch to sustainable fuel alternatives is higher oil prices.

Energy Industries To Watch

Industries showing growing strength in fundamentals compared to this time last quarter are Oils Integrated and Oil & Gas Exploration & Production. The industries in this sector showing growing deterioration in fundamentals compared to this time last quarter are Oils Domestic Refining and Oilfield Services & Equipment.

Look for MoneyTrees with longer trunks, greener globes and trimmer, golden pots.

Investors do not wait. Act now!