The Broad Market Index was up 3.26% last week and 58% of stocks out-performed the index.

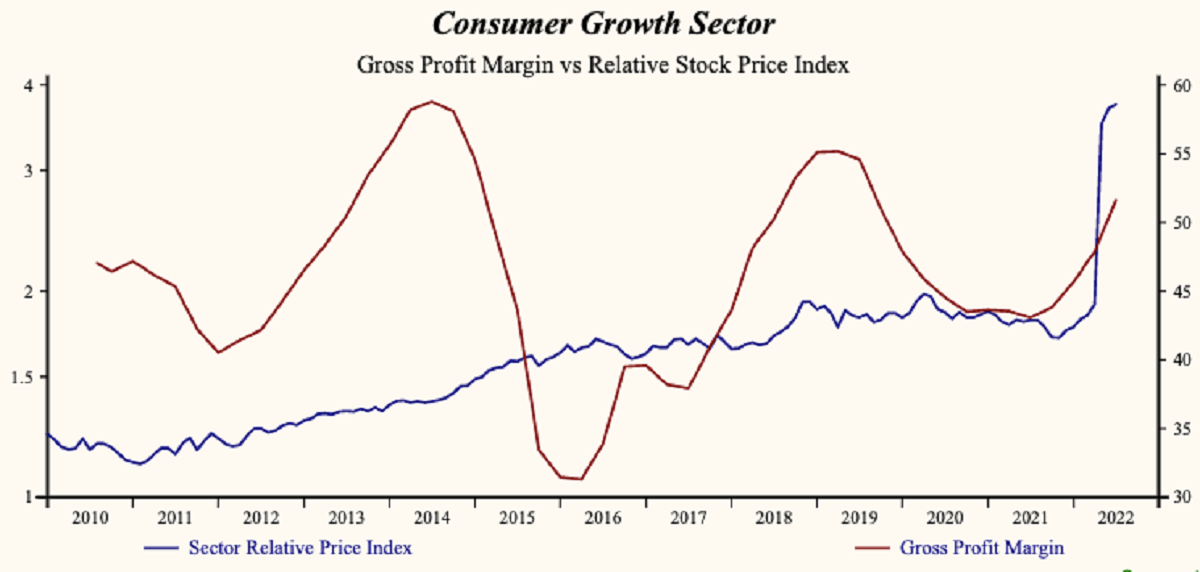

Growth of US companies remains very high after falling more broadly for the 3rd consecutive quarter. Sales growth remains near 20% and with profit margins rising, companies are still coining it like never before.

With cash flow growth at companies over 20%, the rates of return on alternative investments are so puny. Stocks remain the only choice.

Q2 2022 hedge fund letters, conferences and more

Inflation & Interest Rates

The gap between measured inflation and interest rates remains very wide and must close. The drop last month in measured inflation from 9.1% to 8.5% was nearly matched by a decline in long term treasury bond yields to 2.9% from 3.4% over the same period.

Bond yields are on the rise again and the fed has boosted short term rates from near zero to 2.56%. This is totally inadequate for influencing behavior around an 8.5% inflation rate.

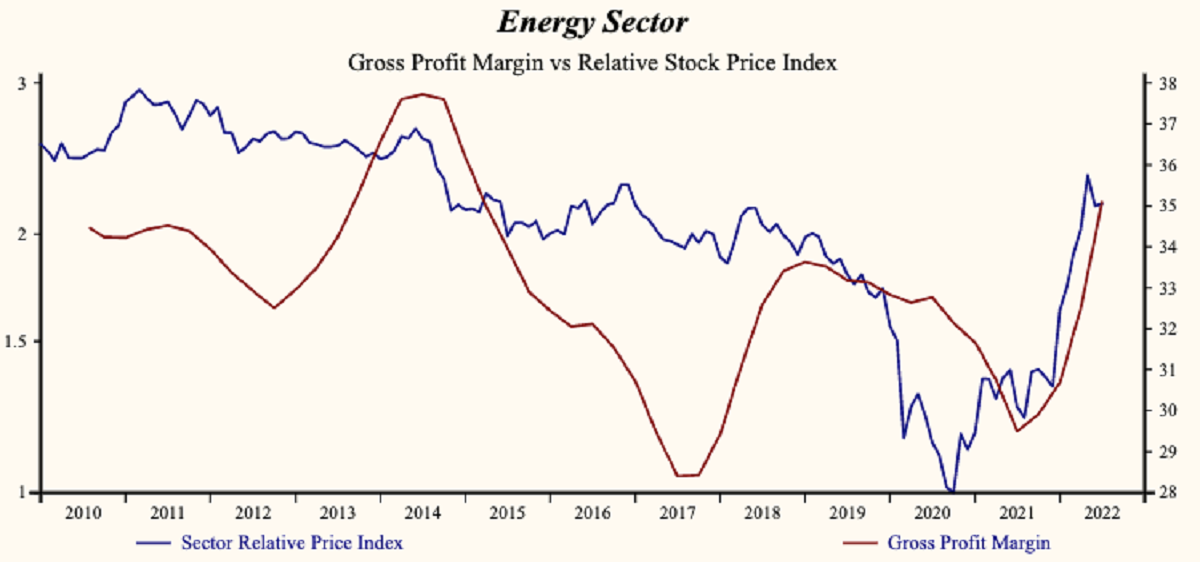

Oil Prices Again

Again, it all comes back to energy. The only reason measured inflation was down in the recent period was energy cost inflation fell from 60% to 30%. This is the virus wave and the very depressed level associated with the deepest trough is fading into history.

The feds have pulled out every stop. Making friends with the Saudis. Contributing the US strategic reserve to global energy markets and waving the excess profits tax flag. Oil prices have fallen since June.

Inflation & US Elections

Nobody wants to be talking about rising inflation in the election cycle. Meanwhile energy companies are underinvesting in new capacity. At a time when huge cash acceleration is available to finance new projects, companies are paying bigger dividends, repurchasing their own stock and paying down debt.

For the environment that is good news but for global energy prices and inflation and for the value of assets it is very bad news.

People need to adjust their behavior, spending and attitude towards wealth in this period of transition to a lower carbon lifestyle. There is little evidence that is happening.

Capital Investing

Lower capital investing in energy supply growth clashes with the stark energy necessity that is revealed by the supply crisis in Europe. Several decades of heavy capital expenditure in infrastructure will be required to support peoples transition to the new low carbon lifestyle.

Meanwhile global demand growth for energy continues and will expand further once the downside of the virus wave is exhausted. Only the rising price of fossil fuel will cause people to consume less. Simple supply and demand.

No doubt there are a lot of manipulators in the global energy markets. The US recently the loudest and richest.

The virus wave, that is now in decent in most industries, reaches the trough in the 4th quarter of this year and must get much worse if there is to be any decline in inflation.

Great Opportunities

The recent rally in growth stocks is providing another great opportunity to sell falling growth companies. In any reasonable future scenario, the huge advantages of globalization and ultra-low interest rates enjoyed by high growth companies (mostly technology) are now gone.

Sales growth is down at 90% of companies in the technology sector but remains very high at 18% down from 36% at the peak last year. At the peak last year 89% of technology companies achieved a profit margin improvement. In this period just reported 39% reported improvement.

That produces a steeply falling growth rate. We suggest placing sell orders well above the current market prices for companies with deceleration (Money Tree with red truck, brown globe and red pot.)

This is the opposite of last quarter when usually depressed prices created opportunities to buy. The timing of these trades is the challenge, and it seems reasonable that after investing so much, the feds will continue to manipulate the markets until the election.

Market Outlook

It is still too early in the update cycle to reach a conclusion about the breadth and magnitude of the growth decline. Following weeks will make it clearer. Only sell at premium prices at least until the end of September when the third quarter financial statement update begins.

For income investors, we are using the recent decline in relative performance of high yield stocks to add accelerating companies at attractive prices. Now that most companies have reported, we will be placing those trades this week.

Maintain portfolio companies with high sales growth and rising profit margins (tall green MoneyTree in a golden pot).

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.