The Broad Market Index was up 6.45% last week and 39% of stocks out-performed the index.

The last reporting update from the 1st quarter 2022 SEC financial statements is now complete. Financial statements for the upcoming 2nd quarter period will provide more evidence of the direction of corporate growth. But for now, this is the trend and outlook.

With last week’s strong rebound in stock prices, the broad market indexes continue to outperform long treasury bonds. That makes the stock market very vulnerable to a decline in growth. Falling growth and rising interest rates creates a difficult investing environment.

Q1 2022 hedge fund letters, conferences and more

USA Corporate Growth

The last time USA corporate growth peaked at near the current level was in 2000 when sales growth was 20% and the gross profit margin was the highest ever having risen in the prior decade largely due to the labor cost benefit of globalization.

2000 To 2002 Experience

Growth was at an all-time high and falling more frequently in the 3rd quarter of 2000. Stock indexes were unusually extended relative to bonds and index average price to sales was near 3X. Shares fell from 2000 to 2002 and were down over 50% before the growth decline ended in 2002.

In the most recent annual period, US corporate sales growth is 23% and the frequency of improvement is down for the second time. Average sales growth is lower and steeply lower at retailers. Stock indexes trade at an all-time high relative to bonds and index average price to sales is 3.7X

Potential 50% Drop

This illustrates the magnitude of what is to come. Major stock indexes will be half their current value before worst is passed. In the 2000 to 2002 experience, we could defend ourselves with bonds. Long treasury bond yields were 5.5 % and remained unchanged while stocks indexes dropped in half.

Inflation was measured at 3% and fell with stocks until 2002 which produced a stable premium return from bonds. They did their job as defensive investments.

The FED responded to the stock market decline with lower interest rates. The 90day treasury bill yield was 5% in 2000 the fed reduced that to 0.9% by the summer of 2002. Currently, Tbills are yielding 1% while inflation rages at 8%.

Today's FED Stimulus

There is simply no way for the fed to provide stimulus as corporate growth falls. Quite the opposite. Interest rates must rise steeply to counter higher inflation expectations. Companies are already announcing price increases many of which are anticipating higher costs, not really responding to higher costs.

Interest & Inflation

Interest rates are still too low relative to inflation to act as a defense against falling growth. Inflation is very sticky and will not drop until short term interest rates are higher than inflation and the yield curve is inverted. That means that the long treasury bond yield will double to 6% from the current 3%.

The value of long-term bonds portfolios will drop in half and stock indexes will perform worse than that. Cash will not protect us from the decline because interest rates are so low that they guarantee a loss of 7% per year.

The only way to navigate through these very challenging circumstances is with stocks of rising growth companies. In the 2000-2002 experience, rising growth companies outperformed the broad indexes by over 100%.

Finding Rising Growth

The only way to defend against rising interest rates is with rising growth. Make sure that all your portfolio companies have acceleration attributes. A Tall green MoneyTree in a golden Pot. (high/rising sales growth and better profit margins).

As we collect 2nd quarter financial statements in coming weeks, make sure that all your portfolio companies maintain a sales growth rate of 8%+ (higher than inflation) and rising profit margins. Sell any squat brown Moneytree in a red pot.

It is a question of how steeply the growth of US companies will fall. Currently sales growth is over 20% and falling on average and more frequently. We are on the downside of the virus wave now and that will press sales growth down for most companies.

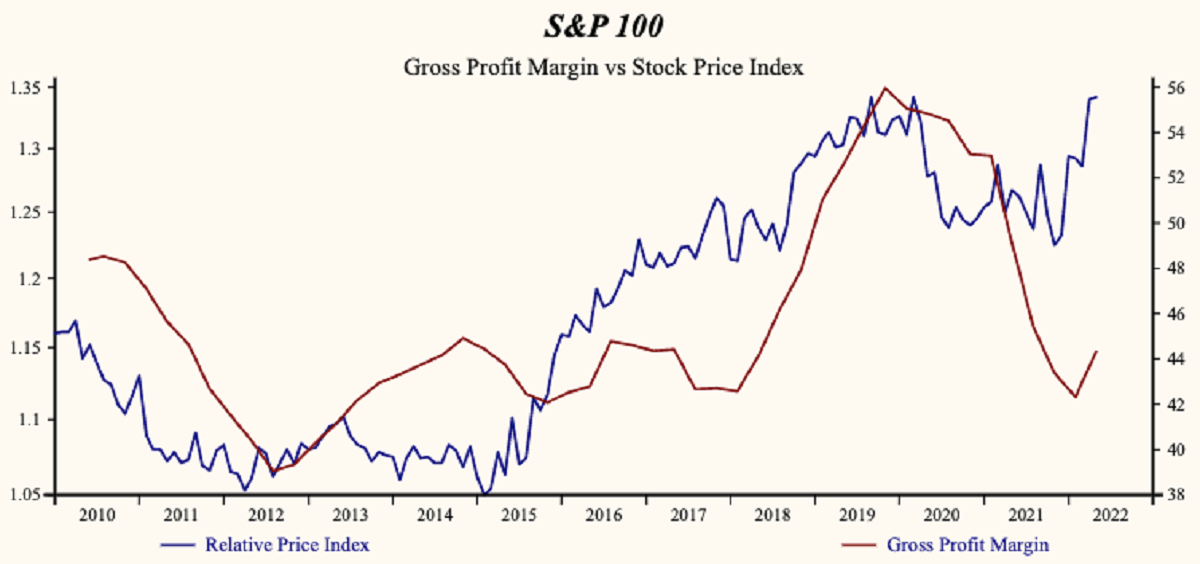

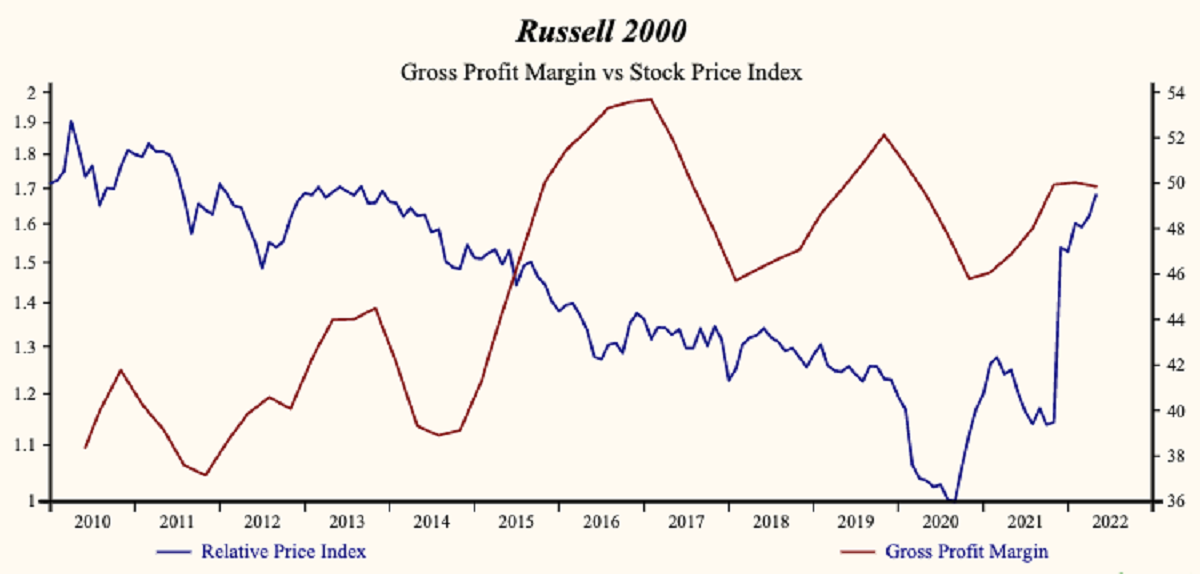

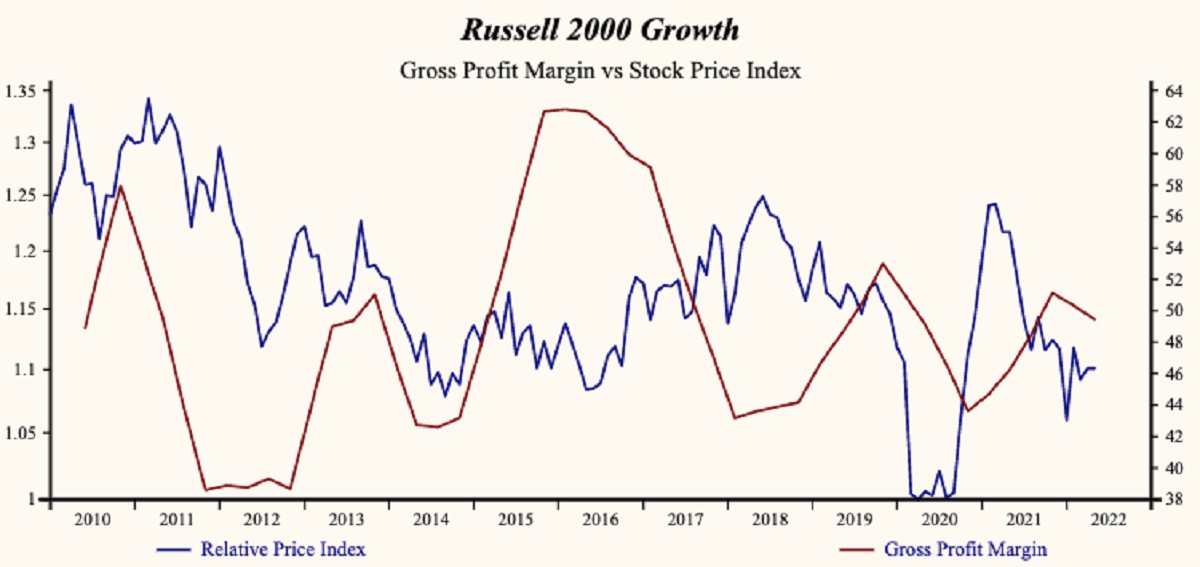

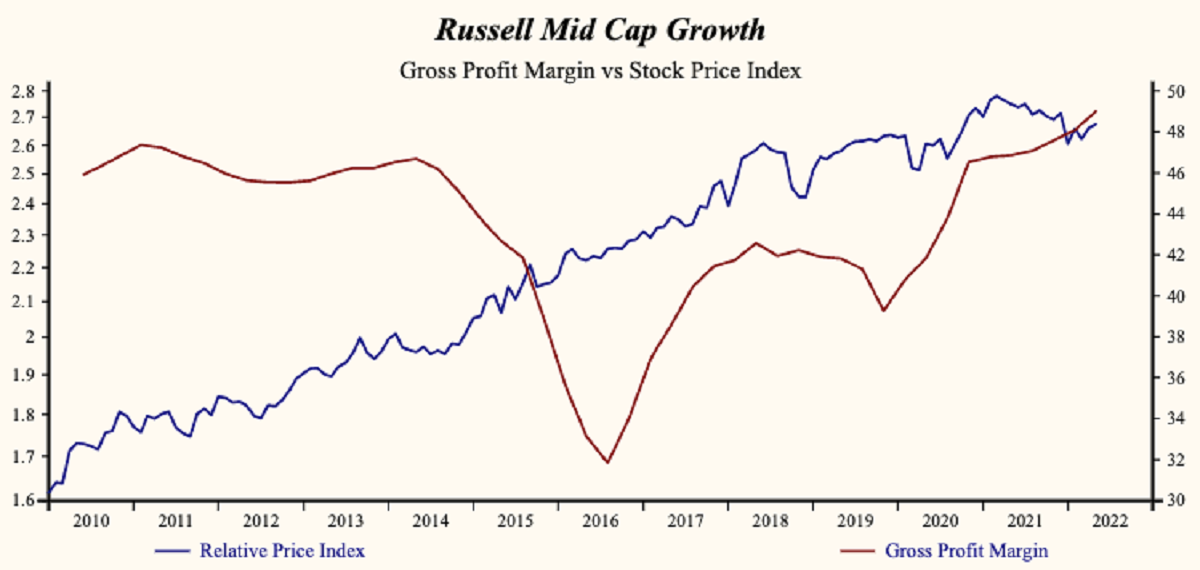

Gross Margin Direction Is Key

Make sure all your portfolio companies are achieving a rising gross profit margin. In a period of rising inflation, companies that have pricing power and can pass on rising costs to their customers will perform well. In the most recent period, 43% of companies (accounting for 52% of market capital) reported a rising gross profit margin.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.