S&P 500 not only refused to rally, but crashed on high volume driven by banking sector (news and regional banks). Even some tech names ripe for a downswing joined – not only that 3,958 was broken, but so was the next 3,910 key support.

Seeing the overnight action made me a bit cautious, but from a swing trading point of view, it had been worth waiting for the probably hot NFPs figure (regardless of the Challenger ones showing progressing weakness) – even if the initial reaction to a strong figure had gone in the opposite direction, I expect the sellers to come and battle it out today still.

Q4 2022 hedge fund letters, conferences and more

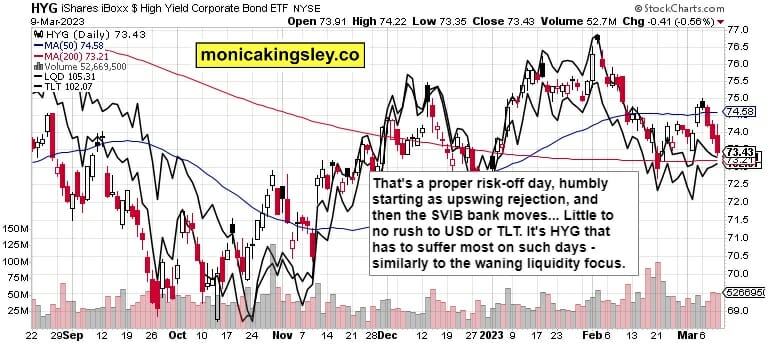

Worse risk – especially given the bearish factor of ever shrinking liquidity (M2 money supply) – is what happens regarding any SVIB bailout rumor mill. Medium-term, the table is set, and Powell has been clear on inflation fight, and such a guessing game as we‘re witnessing today, really needn‘t have played out this much.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

3,915 is the "point of control" switching the daily outlook back towards the bears as regards momentum. The 3,945 – 3,958 zone must hold, and the latest moves are highly encouraging for the bears today already.

Credit Markets

The risk-off turn in credit markets should continue, and that‘s most essential for stock market bears even as TLT is predictably treading water for now.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.