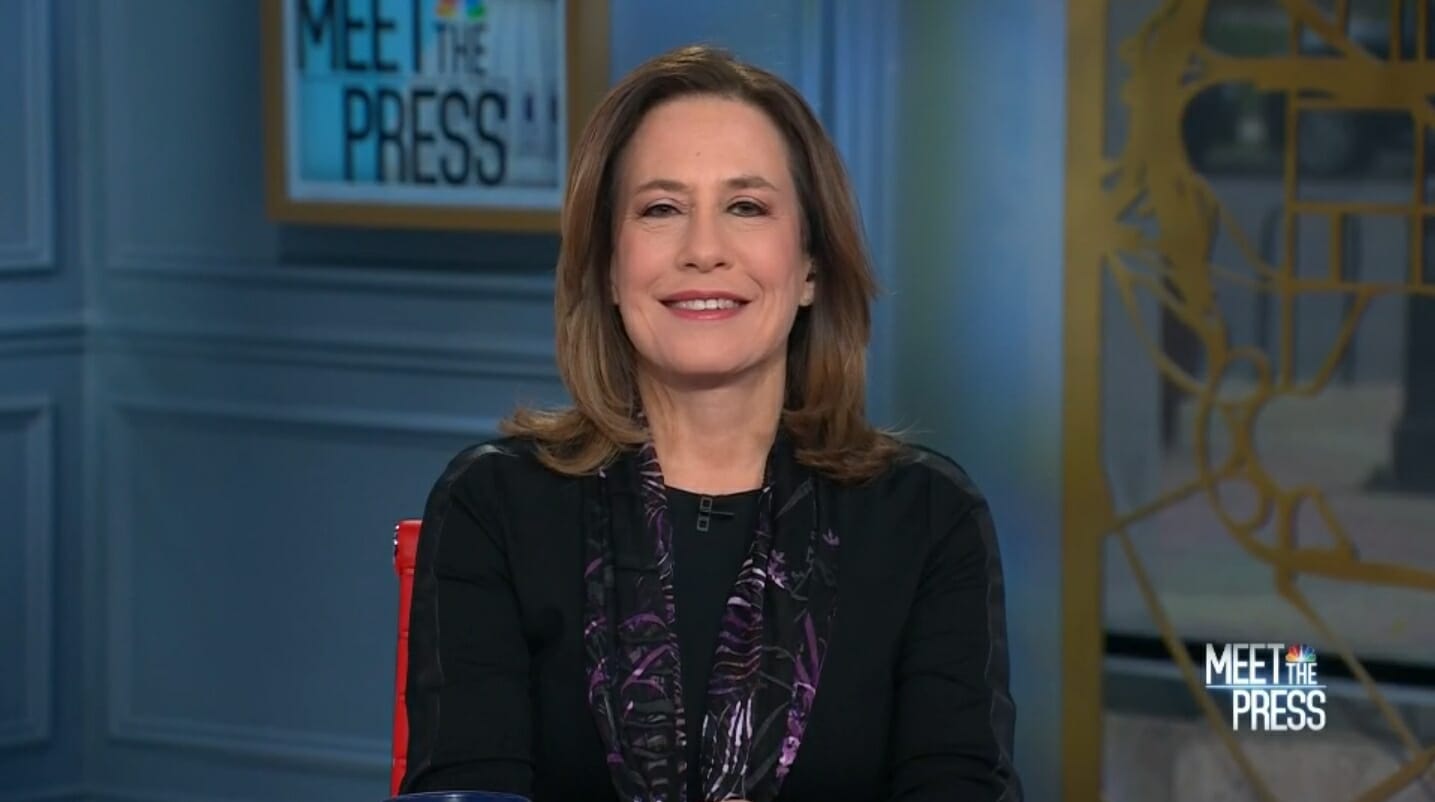

Former FDIC Chair Sheila Bair and CNBC Senior Economics Reporter Steve Liesman joined moderator Chuck Todd for a joint interview on Meet the Press this morning.

Former FDIC Chair: Silicon Valley Bank ‘Didn’t Have Time To Prepare’ To Sell

Highlights

On expected developments this week following Silicon Valley Bank (NASDAQ:SIVB) collapse: “You can expect what the advance dividend will be on the uninsured”

Q4 2022 hedge fund letters, conferences and more

CHUCK TODD: All right. Sheila Bair, you ran the FDIC. What can we expect from them tomorrow morning?

SHEILA BAIR: So I think you can expect what the advance dividend will be on the uninsured. And I want to emphasize, that might not be the total recovery on uninsured. That'll be a number that they feel confident they'll be able to recover based on the (UNINTEL)—

CHUCK TODD: Will they do it as a percentage?

SHEILA BAIR: They do it as a percentage, right. (UNINTEL)—

CHUCK TODD: Oh. Just what he was saying?

SHEILA BAIR: Yes, exactly. So IndyMac Bank, which is the closest parallel of a failure during the Great Financial Crisis, we announced a 50% dividend. IndyMac Bank was in a lot worse shape than this thing, so I can only assume it's going to be significantly higher.

Says regulators are “playing catch-up” to find SVB a healthy buyer: “That’s the best outcome”

CHUCK TODD: The fact that they haven't found a buyer yet, is that what your successor is doing right now?

SHEILA BAIR: Yeah. Well, I think so. I hope so. I mean, that's the smoothest way to handle these. And almost all of our bank failures during the Great Financial Crisis, we had about 100 of them. We did purchase an assumption. We sold a failed bank to a healthy bank.

And usually, the healthy acquirer would also cover the uninsured, because they wanted the franchise value of those large depositors so optimally, that's the best outcome. The problem is, this was a liquidity failure, it was a bank run, so they didn't have time to prepare to market the bank. So they're having to do that now, and playing catch-up.

On whether FDIC can assist depositors beyond insured amounts for employers with payroll concerns: “If there’s a systemic risk exception which would suggest there’s something very wrong, then as an extraordinary procedure, they arguably could … I think it’s going to be hard to say that this is systemic in any way.”

CHUCK TODD: I want to, Sheila, put up here a number of companies that people might be familiar with who had deposits in here, who all need to make some basic payroll runs here. The FDIC, can they sort of help ease the payroll issue on their own? Or are they going to need, like, an act of Congress or something?

SHEILA BAIR: Well, no. They only insure deposits, that's what they do. They charge premiums for the insured, under $250,000. They don't insure uninsured. If there's a systemic risk exception which would suggest there's something very wrong, then as an extraordinary procedure, they arguably could.

But again, this is a $200 billion bank, a $23 trillion banking industry. $200 billion bank, I think it's going to be hard to say that this is systemic in any way. For the payroll, I think the advance dividend will help these companies make that. I know some of the names you put up there, that's not necessarily payroll. I know Circle, those are reserves behind Stablecoin. That's not their money, they can't use it for payroll. So I think you need to differentiate.

Full Rush Transcript

CHUCK TODD: Well, joining me now is Sheila Bair, the former chair of the FDIC which had to take control of Silicon Valley Bank on Friday, and Steve Liesman is CNBC's senior economics reporter. Welcome to both of you. Steve, let me just start with you. What's going to happen tomorrow morning?

STEVE LIESMAN: Well, we're waiting to hear what regulators say, what the Federal Reserve says. Do they do anything to try to calm market, either through a statement or any kind of programs? We don't know if that's the case at this point. It's a big, big question tomorrow morning, Chuck.

Two things: One is, does the FDIC amount how much uninsured depositors will get? And that number could be fairly critical, Chuck, as to the kind of confidence that would permeate through the market. If the number is something like $0.80 or $0.90 on the dollar there might be some calm that would pervade the markets.

If it's $0.50 on the dollar, then I think uninsured depositors at other banks are going to be concerned. That's one. The second thing is, does the Federal Reserve work with other agencies to provide anything regarding insurance or some kind of assistance to those who are sitting on uninsured deposits at other banks.

CHUCK TODD: All right. Sheila Bair, you ran the FDIC. What can we expect from them tomorrow morning?

SHEILA BAIR: So I think you can expect what the advance dividend will be on the uninsured. And I want to emphasize, that might not be the total recovery on uninsured. That'll be a number that they feel confident they'll be able to recover based on the (UNINTEL)--

CHUCK TODD: Will they do it as a percentage?

SHEILA BAIR: They do it as a percentage, right. (UNINTEL)--

CHUCK TODD: Oh. Just what he was saying?

SHEILA BAIR: Yes, exactly. So IndyMac Bank, which is the closest parallel of a failure during the Great Financial Crisis, we announced a 50% dividend. IndyMac Bank was in a lot worse shape than this thing, so I can only assume it's going to be significantly higher.

CHUCK TODD: The fact that they haven't found a buyer yet, is that what your successor is doing right now?

SHEILA BAIR: Yeah. Well, I think so. I hope so. I mean, that's the smoothest way to handle these. And almost all of our bank failures during the Great Financial Crisis, we had about 100 of them. We did purchase an assumption. We sold a failed bank to a healthy bank.

And usually, the healthy acquirer would also cover the uninsured, because they wanted the franchise value of those large depositors so optimally, that's the best outcome. The problem is, this was a liquidity failure, it was a bank run, so they didn't have time to prepare to market the bank. So they're having to do that now, and playing catch-up.

CHUCK TODD: The fact that it was a bank run, Steve, and in fact it was venture capitalists, Peter Thiel's name, who had became sort of famous in political circles for getting heavily involved in the 2022 elections, it seemed like he pulled his money out and said, "Hey guys, something doesn't look good here," and it started a run. Does that tell you that maybe this is something that can be isolated, or could this happen at other banks?

STEVE LIESMAN: Chuck, you're asking the question that Wall Street has, I think, 24/7 been debating since this happened. Let's put the context here. This is probably the first bank run in the digital age. I don't know if Sheila would confirm that. So that means a tweet can cause a bank run.

I don't know that we've had a tweet cause a bank run before, but it's worth remarking that comments by people like Peter Thiel and others cause a massive withdrawal of deposits. So there's four things that are thought to make this bank unique.

It had a particular risk in its balance sheet when it came to interest rates. It did not seem to move to hedge that risk. Second, it was highly concentrated in the industry so that most of its depositors and borrowers, by the way, were from the same place.

Third, it had a lot of losses on its books, which by the way, a bunch of banks do, but they're unrealized. And the fourth thing was these uninsured deposits; 87%, we're told, of its deposits were uninsured compared to other banks its size, that were around 40%. So it's isolated, Chuck. But the key thing for tomorrow morning is, what do regulators do to give people comfort that, indeed, it was isolated and will remain isolated.

CHUCK TODD: I want to, Sheila, put up here a number of companies that people might be familiar with who had deposits in here, who all need to make some basic payroll runs here. The FDIC, can they sort of help ease the payroll issue on their own? Or are they going to need, like, an act of Congress or something?

SHEILA BAIR: Well, no. They only insure deposits, that's what they do. They charge premiums for the insured, under $250,000. They don't insure uninsured. If there's a systemic risk exception which would suggest there's something very wrong, then as an extraordinary procedure, they arguably could.

But again, this is a $200 billion bank, a $23 trillion banking industry. $200 billion bank, I think it's going to be hard to say that this is systemic in any way. For the payroll, I think the advance dividend will help these companies make that. I know some of the names you put up there, that's not necessarily payroll. I know Circle, those are reserves behind Stablecoin. That's not their money, they can't use it for payroll. So I think you need to differentiate.

CHUCK TODD: No doubt. But these were all the companies that have some--

SHEILA BAIR: These were companies that had substantial uninsured deposits, that's exactly right.

CHUCK TODD: Steve, you spend a lot of time watching Jay Powell at the Fed. Who should be watching out for these banks as they try to deal with the interest rate hikes here? Is it the Fed's responsibility to warn banks that they need to be smarter about managing the interest rate hikes? Or is this on the banks, and was this on Silicon Valley Bank, who was just sort of perhaps not realizing that, hey, these interest rate hikes might be here to stay?

STEVE LIESMAN: So again, a question that a lot of folks are going to be asking tomorrow morning, Chuck. Let me just walk through a little bit of that. Yes, this bank was regulated by the Federal Reserve. Were there enough red flags out there? Certainly some of the post-mortems that I'm reading suggest that regulators should have seen this probably in this bank.

On the other hand, Chuck, this is still a free market system despite massive bank regulation that's out there. Banks are free to fail. When you have a change of interest rates, like we had over the past several months, the most aggressive rate hike cycle in two generations, some banks, business models, are not going to work anymore.

Whether or not this bank should've taken steps, I think it should've. It was up to the bank in the first instance, but it's also up to the regulators in the second instance. And that post-mortem's going to look at whether or not the regulators should have seen this coming. And the next thing you're going to ask about is whether or not the Fed ought to be cutting interest rates. Certainly the market thinks that the Fed will be less aggressive now in (UNINTEL PHRASE)--

CHUCK TODD: I was just going to say, maybe not cut, but--

STEVE LIESMAN: --because of possible fallout.

CHUCK TODD: Yes, slow down the rate of increase, give banks more time to handle it? Yeah.

STEVE LIESMAN: That's what people are thinking, that certainly the market dramatically repriced on Thursday and Friday, Chuck.

CHUCK TODD: Assuming that. All right. Sheila Bair, Steve Liesman. Thank you both. Shelia, I think a lot of people are going to be tapping into your expertise this week, unfortunately, I guess. But thank you for coming on.

SHEILA BAIR: Thank you for having me.

CHUCK TODD: It's great to see you.