January 2018 saw more companies publicly subjected to activist demands than any start to a year since at least 2013, according to data from Activist Insight Online.

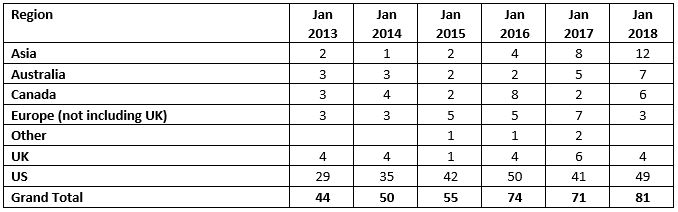

81 companies were targeted globally last month, up 13% year-on-year and 8% higher than the peak, in 2016. The data is thought to represent a new record for activism.

The total number of companies publicly targeted worldwide fell slightly in 2017 as a whole, according to The Activist Investing Annual Review 2018, which was published last week in association with Schulte Roth & Zabel - before the recent sell-off. The Annual Review predicted that 2018 would not set new records without a correction in stock valuations.

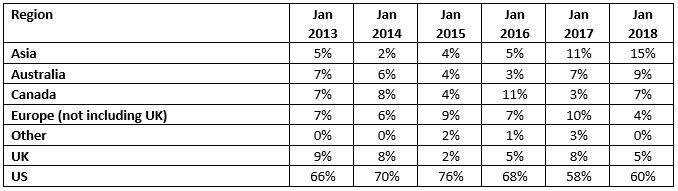

Despite the haul, January was not a record-breaker for U.S. campaigns. January 2016 saw 50 companies publicly subjected to demands, one better than January 2018. Last month saw the highest totals recorded for a January in Asia and Australia, with Canadian activity also rising after a sleepy start to 2017.

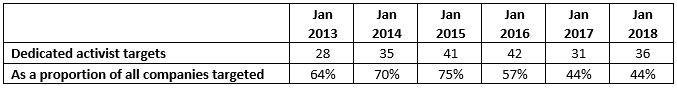

The proportion of companies targeted by dedicated activists remained flat with 2017 at a five-year low, representing just 44% of the total. Starboard Value and Elliott Management led the way, making demands at three companies each in the first month of 2018, with Carl Icahn and ValueAct Capital Partners close behind on two companies apiece.

Companies publicly subjected to activist demands in January each year by region

Proportion of companies publicly subjected to activist demands in January each year by region (%)

Companies publicly subjected to activist demands by dedicated* activists in January each year

*Dedicated activists are those which Activist Insight deems to have a primary or partial focus on activism

Activist Insight can help with bespoke data requests. Please note that requests may require 24-48 hours to complete, depending on their complexity. For futher information please email [email protected].

Kind regards,

Josh Black

Article by Activist Insight