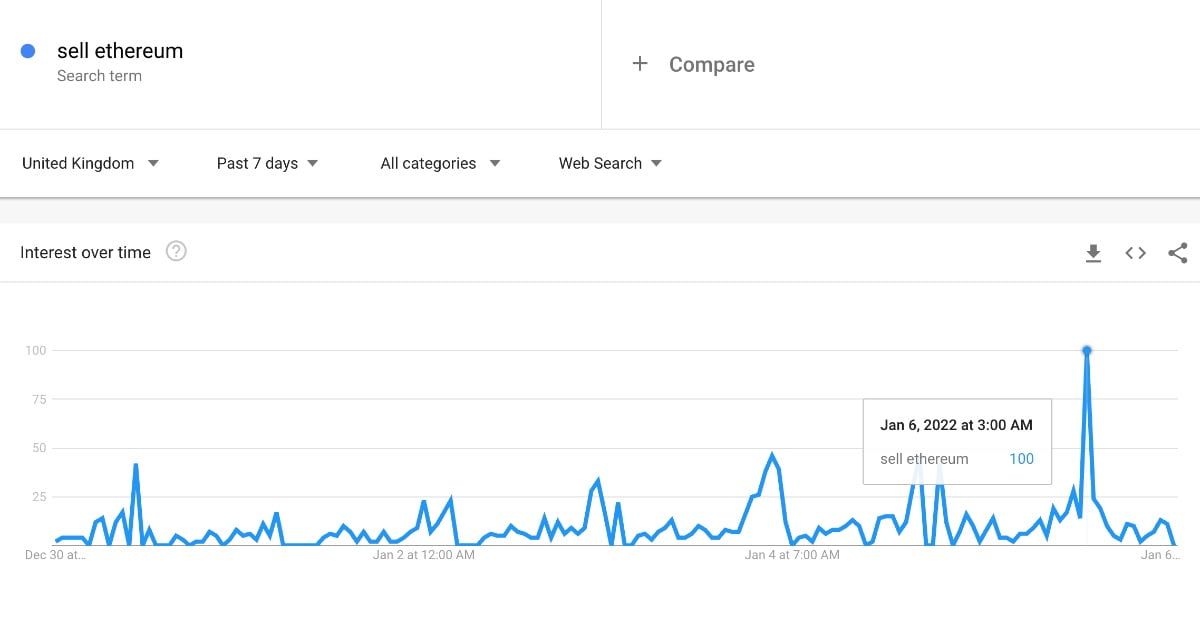

Analysis of Google search data reveals that online searches for “Sell Ethereum” exploded 972% in the United Kingdom on 6th January 2022, the same day that the cryptocurrency drops by over £300.

Q3 2021 hedge fund letters, conferences and more

Analysis by Payback Ltd reveals that online interest for selling Ethereum skyrocketed to almost ten times the average volume in one day as the value of cryptocurrency dips by over £300.

The Surge In Interest To Sell Ethereum

A spokesperson from Payback Ltd commented on the findings:

"Whilst the cryptocurrency market is often volatile, this surge in interest to sell Ethereum is concerning for those who are still invested. This drop will undoubtedly coincide with the announcement of new regulations from China as well as Tesla Inc (NASDAQ:TSLA)’s U-Turn to accept Bitcoin as currency, causing a ripple effect across the entire crypto-market.

These findings offer a fascinating insight into the reaction towards these recent events and it will be interesting to see the extent that these regulations and decisions have on the market, especially for Ethereum that are part of the blockchain used for NFT's, which have seen a surge in interest over the past few months."

Google searches for “Why has Ethereum gone down?” also increased 2,028% on the same day as well as “Sell Bitcoin” rising 400%.