Homeowners are feeling the pinch as searches for Home Equity Line of Credit (HELOC) hit their highest point in U.S. internet history

Searches For HELOC Surge In The U.S.

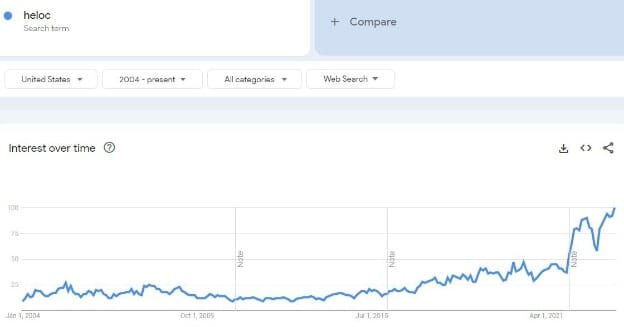

Analysis of Google search data reveals that searches for heloc skyrocketed 305% in the United States as of July 2023 – the highest level in internet history for America. This comes as Americans face rising property and rent costs, with fears of a recession looming.

The analysis, by luxury real estate platform RubyHome reveals that searches for ‘heloc’ exploded to its highest point ever in American search history, an unprecedented increase in Americans looking to remove equity from their property, according to Google search data analysis.

A HELOC, or Home Equity Line of Credit, is a loan that homeowners can receive based on the equity they’ve built in their home.

Imagine a home being like a piggy bank. As a homeowner pays off their mortgage, they’re essentially filling this piggy bank, creating what’s known as “equity”. If the homeowner requires extra cash, a HELOC allows them to borrow from this piggy bank (their home’s equity), which can be used for significant expenses like a new roof or to pay off other debts like car loans. They only borrow what’s necessary and pay interest only on what’s borrowed.

This comes as the U.S. housing market sees mortgage rates rising by more than 22% from this time last year and according to Zillow, the average house price in America is up 1.2% on last year at $348,853.

The top ten states searching to HELOC the most are:

- Hawaii

- Utah

- Colorado

- Washington

- Idaho

- Tennessee

- California

- Arizona

- Nevada

- Florida

Tony Mariotti, CEO of RubyHome, commented on the findings: “Homeowners that bought a few years ago, at lower prices and at lower interest rates, can feel trapped. If they’ve considered buying a new home, they’ve looked around at today’s higher home prices and also know they can never replace the historically low interest rate they have now.

Even though home equity loans carry a higher rate, a small loan for home improvement still works in their favor – the blended rate of the HELOC with their first mortgage is still below market rates for a new first mortgage.”