Most luxury brand lovers favor Saks Fifth Avenue. You might also be one of them. Whether you require a new handbag, shoes, or luxury women/ menswear, Saks Fifth Avenue can be the best option if you are looking for classic yet modern items. Saks Credit Card program is another excellent opportunity you must avail yourself of.

Saks Credit Card comes up with exclusive credit cards rewards and discount offers. Who doesn’t like to save a few bucks from each purchase? Get it now to enjoy exclusive and VIP sales and events. In this blog, you’ll explore the benefits of the Saks Credit Card and how to apply, register, and log in for your Saks Credit Card!

Benefits of Saks Credit Card

Saks Credit Cards are issued and managed by Capital One Bank Holding Company.

- No annual fee.

- You get a 10% discount on your first purchase with Saks Credit Card.

- You earn points with each purchase. You can redeem these points to get gift coupons and other rewards.

- You earn 2 to 6 points for every $1 purchase with your Saks Credit Card.

- For every 2500 points, you get a 25$ Saks Gift Voucher.

- You can access exclusive Members-only Events.

- You can get free basic alternations.

- In-home styling sessions and various VIP experiences for Saks Diamond Cardholders.

Note: If you fail to pay your card amount on time, you’ll be charged with maximum late fee of $40.

Online Account Access

Online accessibility is the best feature that any credit card program can have. Saks Credit Card also provides online account management facilities. You can pay your card bills, manage your purchases and check interest rates from your mobile phone via an online service. If you still haven’t applied for Saks Credit Card, follow these steps:

- Go to Saks Credit Card’s official website.

- Click on Apply Now button.

- Enter the required information such as your Name, Account Number, SSN, address, contact info, and net income.

- Review the terms & conditions section.

- Click on Submit Application button, and that’s it!

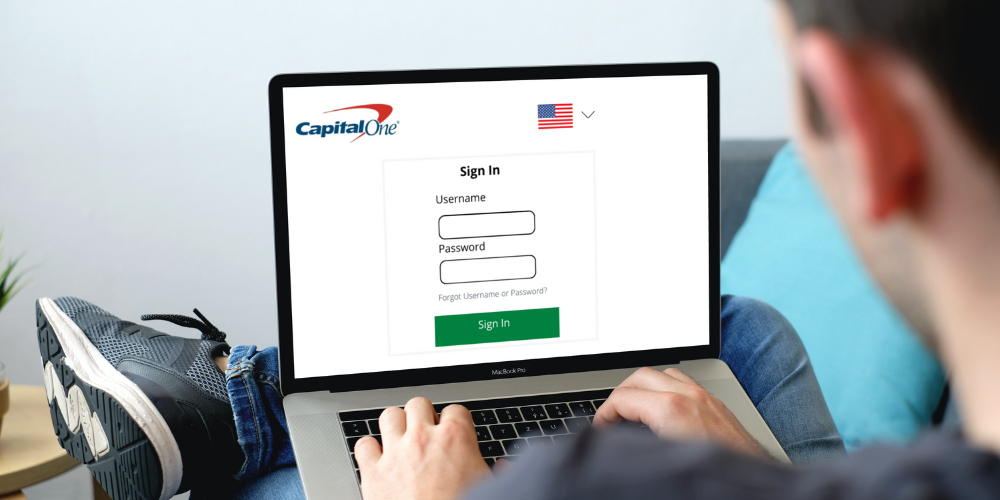

Saks Credit Card Login

Follow the given steps to access your online Saks account easily:

- Enter this https://saks.capitalone.com/#/sign-in in your device’s browser.

- Click on the Sign In button.

- Enter required credentials such as your Username and Password.

- Click on Sign In, and you’re done!

Register Online

If you still haven’t registered for your online Saks Credit Card account, follow these steps:

- Go to Saks Credit Card Login Page.

- Click on the Set Up My Account button.

- On the following page, enter required details such as your Account Number, SSN, and Date of Birth. Click Continue.

- After verifying your identity, choose your username and password and log in!

Forgot Password

If you forget your password, follow the given instruction to change it:

- Go to Saks Credit Card Login Page.

- Under the login section, click on forget Password.

- On the following page, enter required details such as your Last Name, SSN, and Date of Birth.

- Click on the Find Me button.

- Change your Password and log in with it!

Forgot User ID

If you forget your username, follow the given instruction to retrieve it:

- Go to Saks Credit Card Login Page.

- Under the login section, click on forget Username.

- On the following page, enter required details such as your Last Name, SSN, and Date of Birth.

- Click on the Find Me button.

- Note down your username once you get it!

Saks Credit Card Services

Saks Fifth Avenue offers a variety of credit card services that make it easy and convenient to shop. Their online account access makes it easy to keep track of your spending and make payments. You can also take advantage of their various payment methods, including online and mobile options, to make shopping even more convenient.

Best of all, their credit card services are backed by the strength and security of Saks Fifth Avenue. So you can rest assured that your transactions are safe and reliable.

Saks Credit Card Bill Pay Phone Number

If you can’t get time to pay your card bill, you can use this simplest method. Call at 1-800-221-8340. A representative or automated system will pick up your call. Follow their guideline to pay your card bill from the comfort of your home.

Saks Credit Card Payment Address

Another uncomplicated way to pay your credit card bill is the mailing service. Write a check in the name of Capital One. Attach the relevant documents and post them to Saks Credit Card Mailing Address:

Saks Fifth Avenue Credit Card

PO Box 71106

Charlotte, NC 28272-1106

Customer Service Hours

If you have any concerns about your Saks Credit Card or Saksfirst world elite Mastercard, contact them at 1 877 551 7257. They provide 24/7 customer support.

How to Pay Saks Credit Card?

Here are Saks bill payment methods to choose the one most convenient for you.

Online

- Login to your Saks Credit Card online account.

- Go to the Payments section.

- Click on the Make and Manage Payments option.

- Enter card payment details.

- Click on Confirm Transaction, and that’s it!

By Phone

Paying your Saks Fifth Avenue Credit Card login bill by phone is easy and convenient. Follow these simple steps:

- Dial 1-800-221-8340

- When prompted, enter your 16-digit credit card number followed by the pound sign (#)

- Enter your 4-digit security code followed by the pound sign (#)

- Enter the amount you wish to pay, followed by the pound sign (#)

- Confirm the payment amount and date, then press 1 to confirm

- Your payment will be processed, and you will receive a confirmation number for your records

By Mail

- Gather your credit card statement and a pen.

- Find the address for payments on your statement. It will likely be different than the address for general correspondence.

- Write a check for the minimum payment amount, or the full balance if you can afford it, made out to Saks Fifth Avenue Credit Card.

- Include your account number on the check. You can usually find it on your statement or the back of your credit card.

- Put the check and any accompanying documentation into an envelope and address it to the payment address from your statement.

- Seal up the envelope and send it off via first-class mail, so it arrives on time. You may also want to consider using certified mail, so you have proof that your payment was received.

Paying your Saks Fifth Avenue Credit Card bill by mail is easy and only takes a few minutes. Just be sure to allow plenty of time for your payment to arrive, so you don’t end up being charged late fees.

Via the Mobile App

If you have a Saks Fifth Avenue credit card, you can use the Capital One mobile app to pay your bill.

Simply select the ‘Payments’ tab, and then add and choose ‘Saks Credit Card’ from the list of bills. Enter the amount you wish to pay, and then confirm the transaction. Your payment will be processed immediately, and you’ll receive a confirmation email once completed.

Paying your Saks credit card bill online is easy, convenient, and secure. With the Capital One mobile app, you can make a payment anytime, anywhere.

How to Avoid Late Fees?

If you’re a member of Fifth Avenue, then you know that one of the perks is getting to shop at some of the most high-end stores in the world. However, if you’re not careful, you could end up racking up some serious late fees.

The only way to avoid late fees ($40) is to pay the minimum amount each month. If you fail to pay your card finances within time, you’ll also be subject to a high APR of 26.99%.

Here are a few tips on how to avoid late fees on your Fifth Avenue credit card.

- First and foremost, always make your payments on time. It may seem common sense, but it’s easy to forget when you’ve got a lot of bills to pay each month. Set up automatic payments if possible, or at least make sure you have a reminder system in place, so you don’t miss a payment.

- Set up automatic payments. Many credit card companies offer the option to set up automatic payments from your checking account. This way, you’ll never have to worry about forgetting to make a payment.

- Check your statement carefully. Sometimes, credit card companies make mistakes. If you see a charge that you don’t recognize, call customer service right away to dispute it.

- Use online bill pay. Saks bill payment services online are a great way to avoid late fees. With most credit card companies, you can set up automatic payments from your checking account. You can also schedule one-time or recurring payments.

- Keep a close eye on your due date. Your credit card statement will list your due date each month. Make sure you know when it is and make your payment accordingly.

- Be aware of any grace periods that your card may have. Some cards will give you a grace period of 20 or 30 days after your due date before they start charging late fees, so if you know you’re cutting it close, try to make your payment a few days early.

- If you do end up paying a late fee, don’t despair. In most cases, you can get the fee waived if you call customer service and explain why you were late. Just be sure to have a good excuse ready!

By following these simple tips, you can avoid costly late fees on your Fifth Avenue credit card. Just remember to stay organized and always make your payments on time.

FAQs

Is It Hard to Get a Saks Card?

It’s not hard to get a Saks card if you have fair credit or better. If you don’t have great credit, you might still be able to get a Saks card by applying for a store credit card instead. Store credit cards usually have lower credit requirements than major credit cards.

However, it’s always a good idea to check your credit score before applying for any type of credit card. That way, you’ll know if you’re likely to be approved or not. So if you’re worried about your credit score, start by applying for a store credit card at Saks. You can always try for a major credit card later down the road.

What Is Credit Score Needed for Saks?

If you’re looking to shop at Saks Fifth Avenue, it’s important to know what credit score is needed in order to be approved for a store credit card. Generally, you’ll need a score of 640 or higher to be approved. However, if you have a lower score, you may still be able to get approved if you have a strong history of making on-time payments and managing your debt responsibly.

If you’re not sure what your credit score is, you can check for free on sites like Credit Karma or Credit Sesame. Once you know your score, you can start shopping around for store credit cards that fit your needs and financial situation.

Can I Use My Saks Credit Card at Louis Vuitton?

No, you cannot use your Saks credit card at Louis Vuitton. Saks is a luxury department store chain that specializes in high-end designer labels, while Louis Vuitton is a French fashion house known for its expensive leather goods and accessories.

While both brands are considered to be luxurious and upscale, they are not affiliated with each other, so you cannot use one brand’s credit card at the other’s store. If you want to shop at Louis Vuitton, you will need to use a different form of payment, such as cash, debit or credit card, or Louis Vuitton’s financing program.

How Do I Pay My Saks Bill?

If you’re a Saks customer, you may be wondering how you can pay your bill. There are a few different options available to you. You can pay your Saks bill online, by phone, or by mail.

- To pay online, simply login to your account at the Saks website and follow the instructions.

- To pay by phone, call the customer service number listed on your statement and follow the prompts.

- To pay by mail, simply send a check or money order to the address listed on your statement. Be sure to include your account number so that your payment is properly credited.

Whatever method you choose, be sure to make your payment by the due date to avoid late fees and interest charges.

Final Considerations

Saks Credit Card can be the best addition to your wallet if you are an avid Saks Fifth Avenue shopper. With no annual fee, exceptional rewards, and VIP experiences, Saks Credit Card is worth getting.

Here are some of the benefits that come with owning a Saks Credit Card:

- No annual fee

- Exceptional rewards

- VIP experiences

So if you love shopping at Saks Fifth Avenue, make sure to get a Saks Credit Card and enjoy all the benefits that come with it!