The Broad Market Index was up 0.06% last week and 48% of stocks out-performed the index.

Stocks were very strong last month even with the higher volatility. With corporate growth high and rising it is not a surprise that stocks would perform well. What is changed is the support from the bond market. Rarely interrupted for nearly 30 years, the persistent increase in bond prices (lower interest rates) goes a long way to account for the broad increase in asset values.

Q4 2021 hedge fund letters, conferences and more

Long treasury bond prices have fallen 15% since their December peak and the yield has advanced from 1.7% to 2.4%. This illustrates the vulnerability of retirement savings. As people age toward retirement, the standard risk model moves assets into bonds for income and protection of capital.

Negative Return on Bonds

With inflation at 8%, real return to bonds is steeply negative now. Bonds fail to deliver on the income requirement and when bond yields rise high enough to compensate for inflation (always have), the price of bonds will decline. Bonds do not provide capital protection now.

Cannot hold currency because the inflation tax is too high. Cannot hold bonds because interest rates will rise and cannot hold stocks because growth will fall.

Toxic ETFs

The second vulnerability of retirement savings is stock indexes. Over the past 20 years most investors have been shifted into Exchange Traded Funds (ETF). The stock indexes that define the construction of the ETF portfolio have become dominated by a small number of jumbo companies.

That has benefited investors when interest rates fall because a less well diversified portfolio of high growth companies produces better ETF performance. Now with growth extended and falling more broadly, a narrowly defined portfolio is more vulnerable.

The problem is that ETF investors cannot adjust those risks and the very jumbo companies is where the evidence of growth slowdown is clearest. The technology sector where index weight has more than doubled since 2015 is the only sector with a drop in sales growth in the recent period. Frequency of improvement in sales growth was down from 75% to 51%.

1st Quarter Numbers Await

In the coming weeks we will collect financial statement from the first quarter period. Historically, growth slowdown in the US is led by demand for big ticket consumer goods-autos and housing. With interest rates remaining very low relative to inflation and now a chorus singing about higher interest rates, the rational decision is to buy now.

That will likely front-end-load sales for the next few quarters as purchasers of big ticket (i.e., financed) consumer goods are incented to buy now. The history of growth cycles shows that the end of the cycle can get very heated as fear of missing out causes an investor frenzy.

Energy Inflation

Inflation is moderated by lower energy costs and recently those costs have risen sharply after the virus impact and now after the Invasion. Capital expenditures in energy are advancing again after a 5-year decline and global supply growth has lagged demand.

Can energy costs decline steeply and persistently enough to moderate inflation and diminish the risks to capital? Probably not. The lead time between an increase in energy company capital expenditures and the resulting increase in oil supply is years.

For now, we are dealing with high and rising inflation, rising interest rates and falling growth. A combination that has been associated with the steepest stock market declines in US history. We must own accelerating companies. Only rising growth companies will defend our assets from rising interest rates.

Portfolio Attributes

The population of companies achieving that improvement will drop in coming quarters as we work through the downside of the growth wave caused by the virus. Evidence of that is clearest in the retailers where, in the recent update, sales growth was down from the highest in the history of the industry and 70% of companies are reporting a drop.

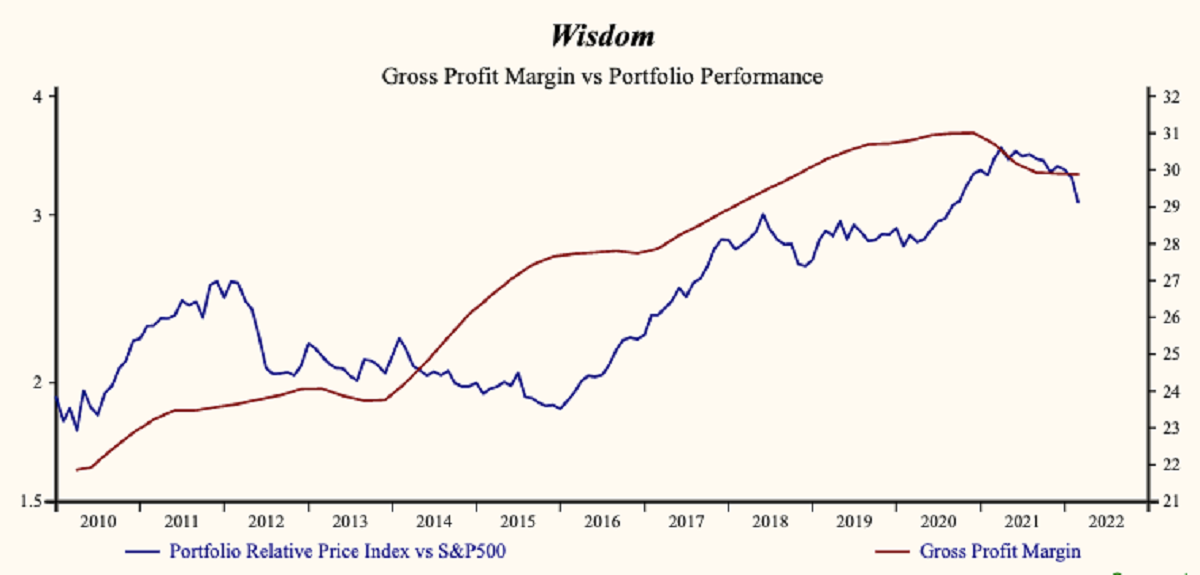

Your portfolio avatar should look like the Wisdom Portfolio displayed below and compared to the total market average. Make sure your portfolio money-tree has a tall dark trunk, a large green globe and sturdy shaped golden pot. That illustrates the attributes that will protect our capital in the volatile market ahead.