Jharonne Martis, Director of Consumer Research at LSEG, comments: “Abercrombie & Fitch Co (NYSE:ANF) smashed its Q2 revenue and earnings estimates. The teen retailer reported a robust 13% SSS gain, above its 5.2% estimate. Likewise, its Hollister division beat its -2.5% SSS estimate, with a 5% SSS. Its merchandise is resonating well for the back-to-school season, and the teen retailer is bullish it can maintain the strong momentum into the holiday season. As a result, A&F raised its full-year guidance.

On the flip side, Williams-Sonoma, Inc. (NYSE:WSM) beat its Q2 earnings, but missed its revenue and same store sales estimates as the retailer is facing difficult comparisons. In addition, sales in the home category have slowed down.

Likewise, Kohls Corp (NYSE:KSS) beat its Q2 earnings, but missed on revenue and same store sales. The department store reiterated its full year guidance, and in Q2 received a boost from its Sephora collaboration. During its earnings call, Kohl’s said, “Sephora at Kohl’s continues to exceed our expectations, driving a total beauty sales increase of nearly 90% year-over-year.

We opened nearly 200 Sephora shops in the quarter, and momentum in our existing Sephora shops continues to accelerate with greater than 20% comparable beauty sales growth in the Sephora shops opened in 2021 and 2022.” (Source: Kohl’s Q2 2023 earnings call).

The beauty category continues to do well with the post-pandemic reopening. Accordingly, Ulta is expected to report a robust 6.3% SSS gain for Q2 2023.”

Q2 2023 Earnings And Same Store Sales Estimates

Here are the Q2 2023 earnings and same store sales estimates for the companies reporting this week:

Exhibit 2: Same Store Sales and Earnings Estimates-Q2 2023

Source: LSEG I/B/E/S

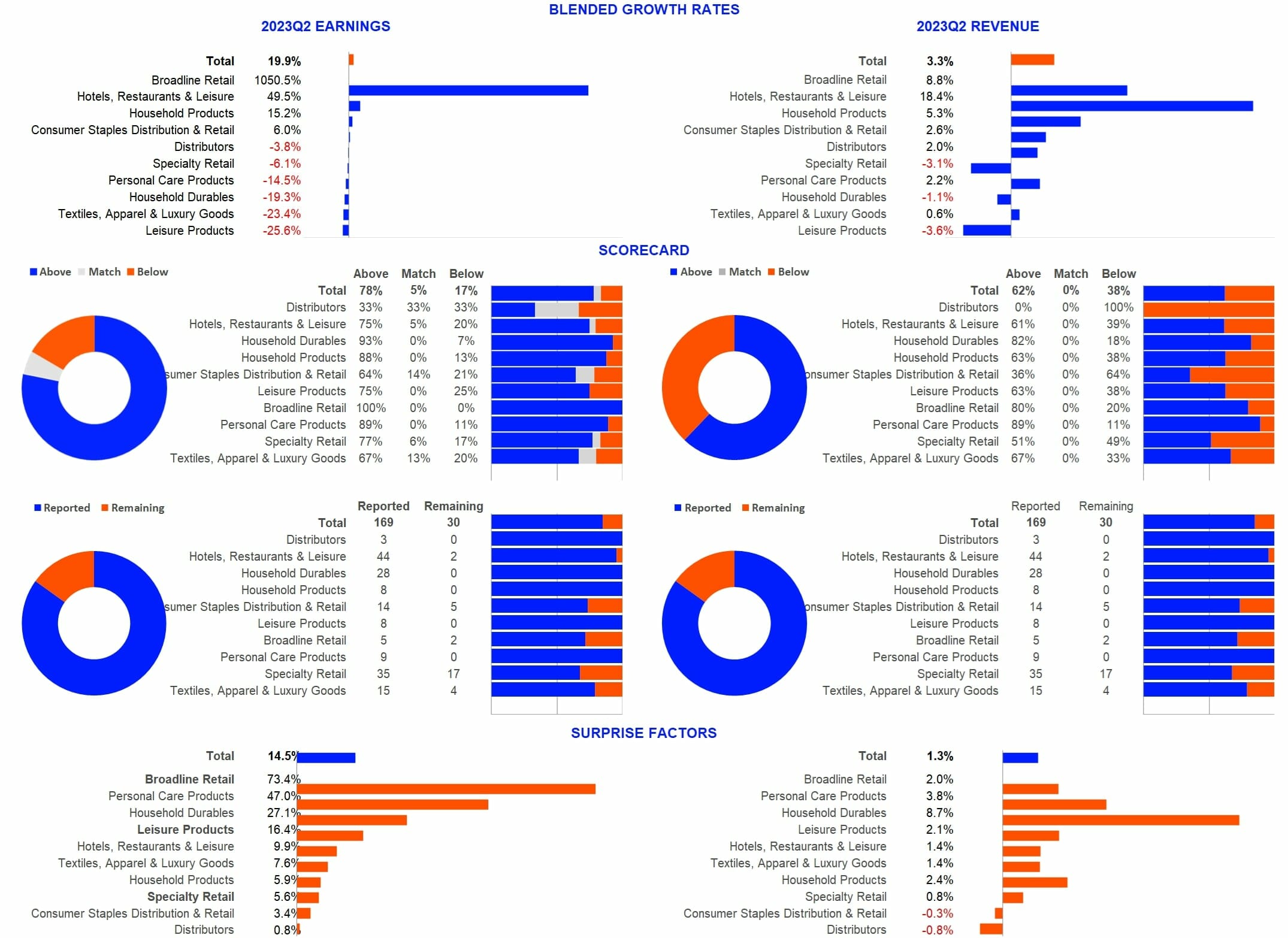

Below is the latest Q2 2023 Retail Earnings Dashboard:

- EARNINGS: The Q2 blended earnings growth estimate is 19.9%

- Of the companies in the index that have reported earnings to date for Q2 2023:

- 78% have reported earnings above analyst expectations

- 5% have reported earnings matching analyst expectations

- 17% reported earnings below analyst expectations.

- REVENUE: The Q2 blended revenue growth estimate is 3.3%

- 62% reported revenue above analyst expectations

- 38% reported revenue below analyst expectations