100 public pharma and CMOs took PPP COVID-19 small business loans, says GlobalData

Q2 2020 hedge fund letters, conferences and more

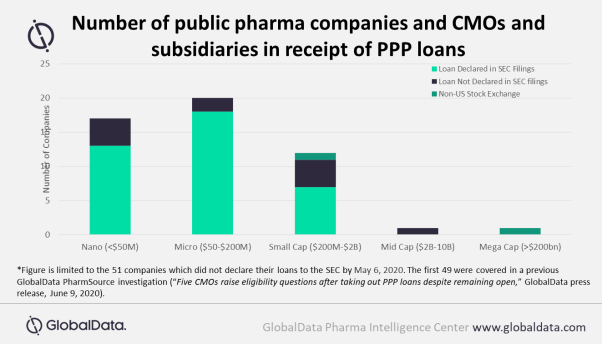

At least 100 publicly owned pharma companies and contract manufacturing organizations (CMOs) – many with substantial market value and access to capital markets – were approved to receive PPP loans that were intended to help small businesses in the US to pay workers during the COVID-19 pandemic, a GlobalData analysis of a partial release of information by the Small Business Administration (SBA) shows. PPP (paycheck protection program) loans are a US federal government initiative.

PPP COVID-19 loans Data

Fiona Barry, Associate Editor of GlobalData PharmSource, comments: “These PPP loans were intended for small companies that were hit hard by the COVID-19 pandemic and that couldn’t otherwise afford to retain their staff. While some of these publicly owned pharma companies have small market caps and could argue that they had genuine financial pressures, others are very large. The two largest, Sorrento Therapeutics and a US-based CMO subsidiary of Japanese firm NOF Corp, had market caps in the billions of dollars, while a further 12 had market caps over $200m.”

The GlobalData investigation also found that 14 of the companies had not declared their PPP loans in their SEC filings by August 12.

Barry explains: “While there is no legal requirement for companies to disclose PPP loans, a senior securities fraud and corporate governance litigator I interviewed stated that it comes down to materiality: is it information that a reasonable investor would want to know? A good argument could be made that it certainly is, because of regulatory scrutiny and potential reputational harm.”

Notes:

- Treasury guidance states ‘It is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith, and such a company should be prepared to demonstrate to SBA, upon request, the basis for its certification.’

- Treasury Secretary Steven Mnuchin stated in April that loans over $2m will be audited before they are forgiven.

- Of the 100 companies, 49 companies were reported by GlobalData PharmSource in May based on its investigation of Securities and Exchange Commission (SEC) filings - (Bio/Pharmaceutical Outsourcing Report, May 2020).

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.