Powell didn‘t disappoint… Wall Street, that is. The hazy taper silhouette remains just that, and his speech brought more implicit assurances that any dreaded hawkish turn, which was what the markets were clearly fearing given the jubilee thereafter. Practically everything caught a spark – tech, value, amazingly smallcaps, silver, gold, copper, a little lagging oil. It‘ll take a while for the currently undervalued emerging markets to catch up – look for that to happen once the dollar bids farewell to its trading range (it looks getting ready to test its lower border, in due time).

Q2 2021 hedge fund letters, conferences and more

Credit market spreads haven‘t yet decidedly turned, but it‘s my view they‘re in the process of doing so, in confirmation of the medium-term risk-on turn. The 10-year to 2-year, or to 3-month, all signal that the financial stress of recent weeks is abating. While stocks went sideways, commodities took it on the chin while precious metals and cryptos stood kind of in between. September taper surpise appears banished, so look for more of Friday‘s dynamic to have the upper hand.

The leading indicators‘ slowdown, strained supply chains and need for replenishment of investories almost across the board, is though set to carry the bull markets ahead – as stated in Friday‘s extensive analysis, Fed isn‘t interested in pulling the rug from beneath. It‘s still more about sweet sugar than bitter medicine, so look for the reasonably loose monetary conditions to continue. Reasonably – what‘s that, is always in the eye of the beholder.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

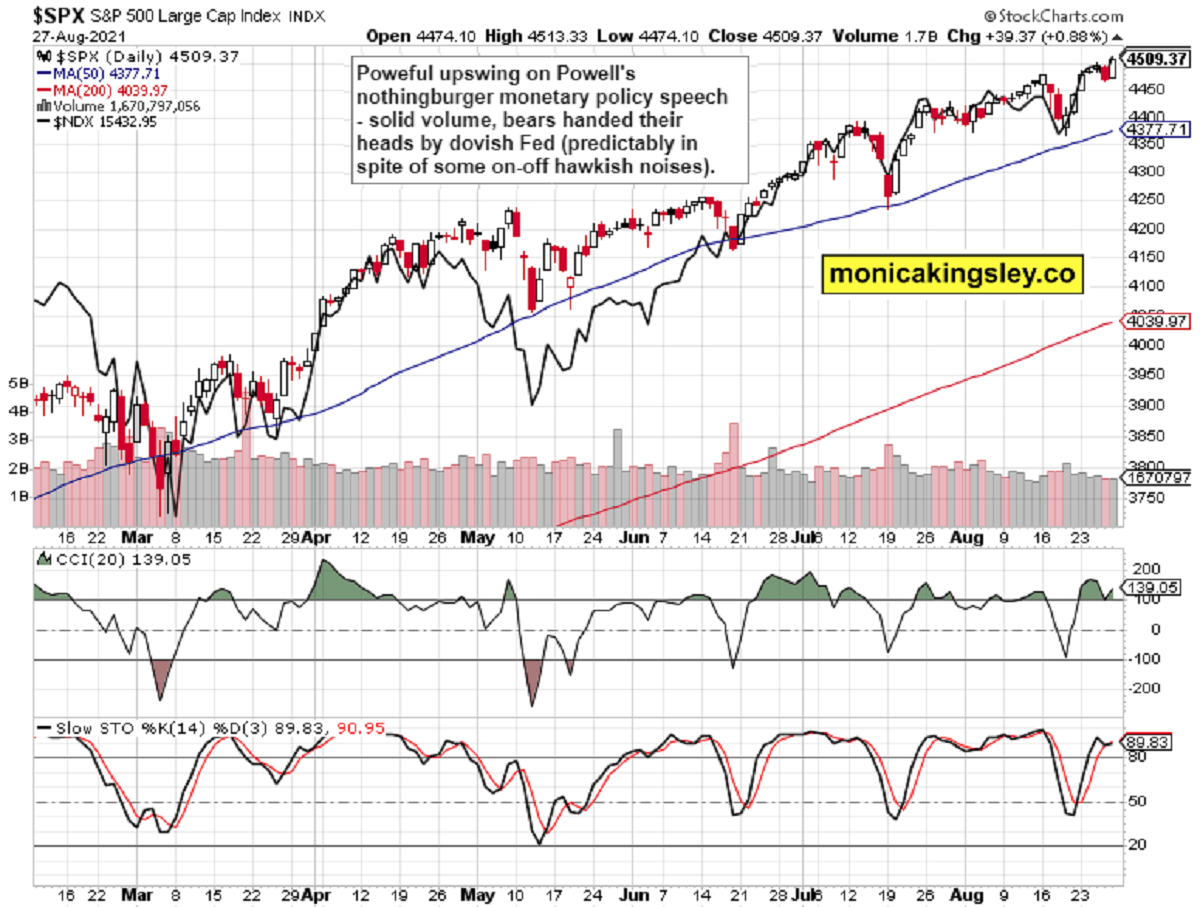

S&P 500 and Nasdaq Outlook

Stocks welcomed the pleasantly dovish tone with open arms – path of least resistance remains sideways to up no matter the distance from the 50-day moving average.

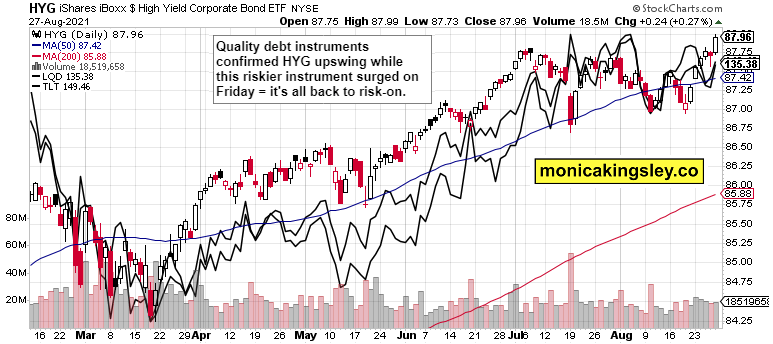

Credit Markets

Credit markets got back behind the stock market upswing, and while the quality debt instruments are underperforming, the benefit of the doubt remains with the bulls.

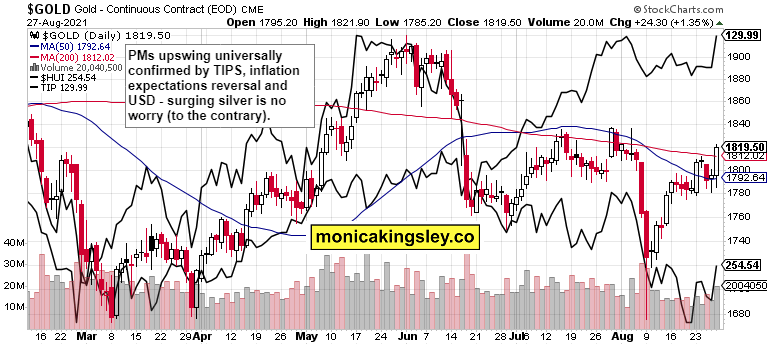

Gold, Silver and Miners

Gold, silver and miners are catching up in the risk-on moves, as immediate monetary policy uncertainty is removed, and remain primed for more gains.

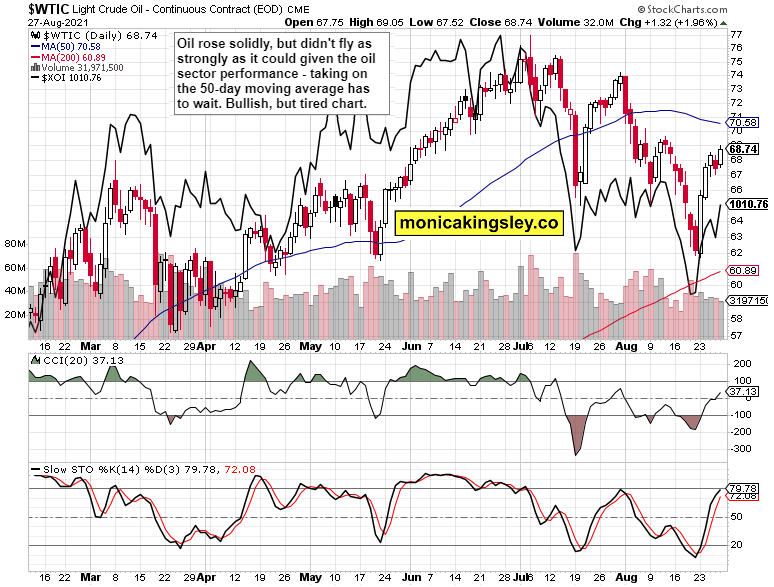

Crude Oil

Crude oil bulls dutifully stepped in, but the upswing wavered a little. Neither the volume was stellar, but prices are likely to trade up over the next few days. I‘m a bit on guard though as consolidation around $68 may continue beforehand.

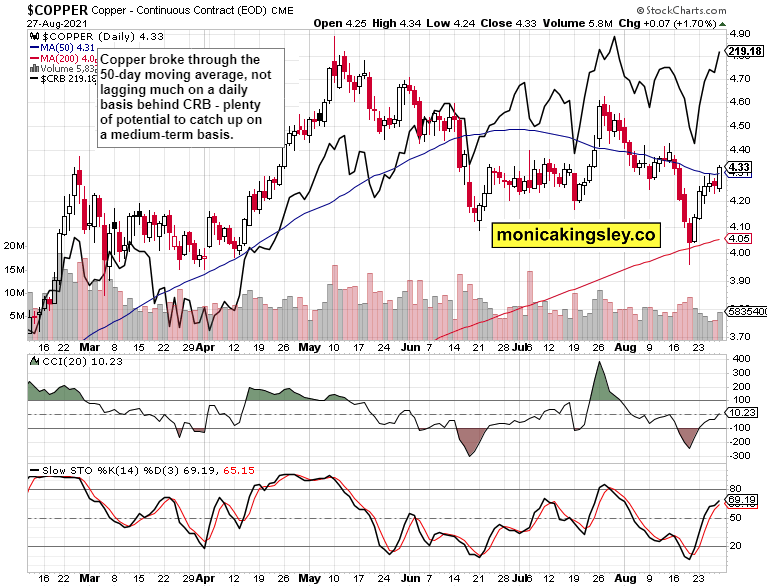

Copper

Copper participated in the risk-on moves more vigorously than oil, and looks likely to leave the 50-day moving average in the dust before the week is over.

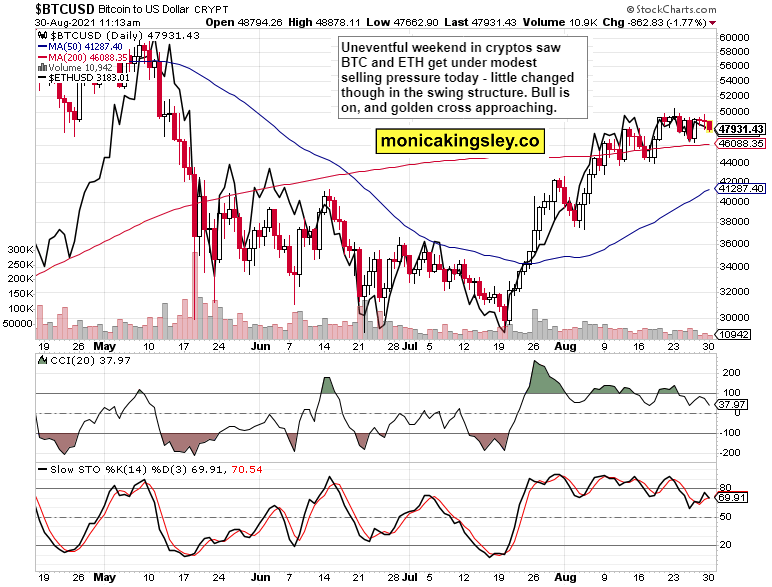

Bitcoin and Ethereum

Cryptos keep on consolidating, base building, making mostly higher highs and higher lows. It appears only a question of time before the fresh upleg comes.

Summary

Risk-on traders had a field day on Friday, and are well positioned to extend gains over this week. Jackson Hole didn‘t bring any curveballs, and Powell made sure that smooth sailing ahead is in our immediate future.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.