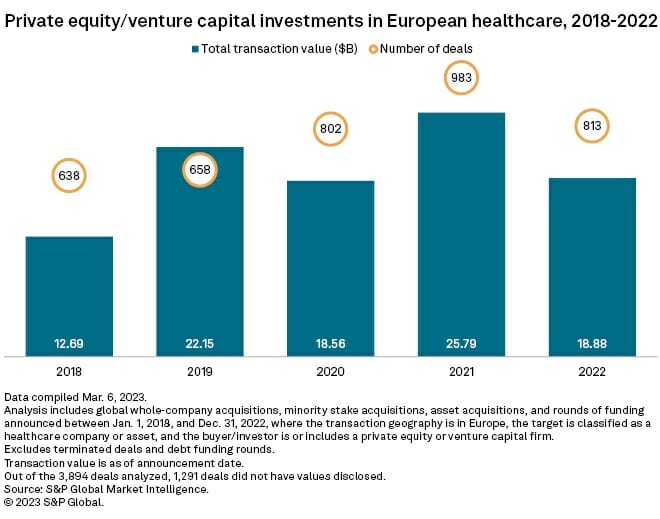

Global private equity investment in the European healthcare industry fell by more than a quarter in 2022, with the second half of the year seeing a particularly sluggish performance, according to S&P Global Market Intelligence analysis.

The aggregate transaction value for private equity investments in the space came to $18.88 billion across 813 deals in 2022, compared to $25.79 billion from 983 deals a year earlier, according to S&P Global Market Intelligence data.

Q4 2022 hedge fund letters, conferences and more

Key Highlights

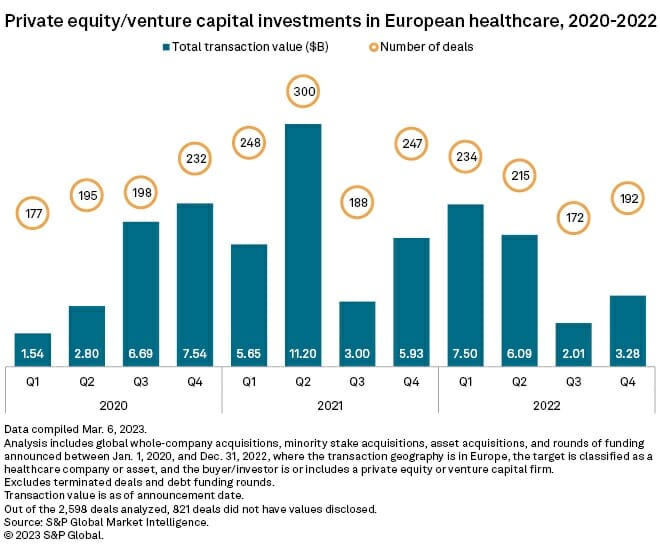

- Deal volume for all of 2022 ended up peaking in the first quarter, with 234 transactions bringing in $7.50 billion. In the final three months of the year, investments were down by more than half at $3.28 billion.

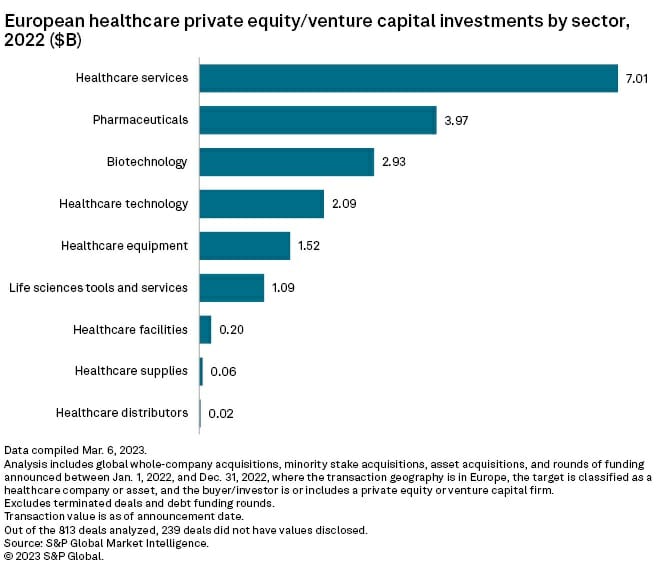

- Healthcare services received the greatest investment, with private equity pouring in $7.01 billion, followed by pharmaceuticals at $3.97 billion and biotechnology at $2.93 billion. The three subsectors accounted for more than 70% of the total private equity investments in European healthcare.

Largest Deals

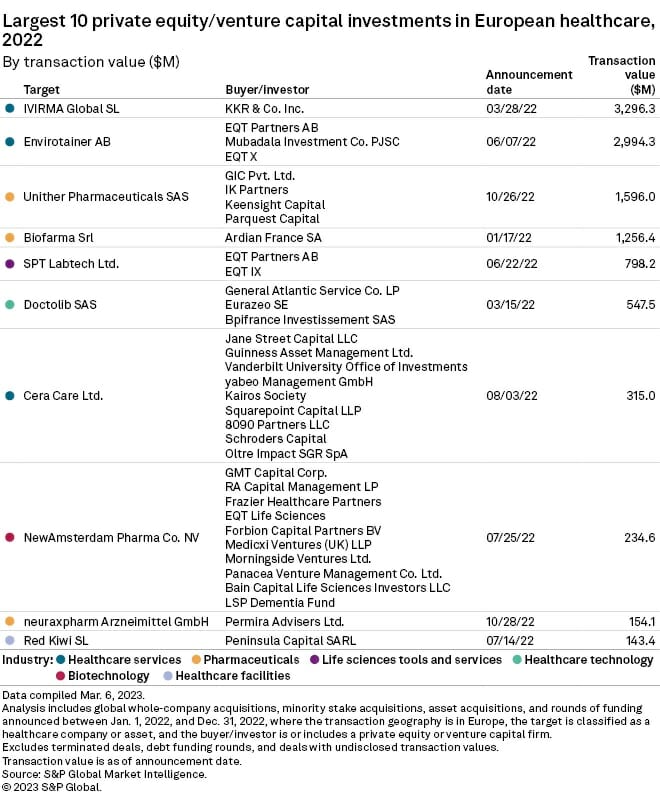

- KKR & Co. Inc.'s acquisition of Spanish fertility company IVIRMA Global SL for $3.30 billion was the largest private equity investment in the European healthcare industry in 2022.

- The pending acquisition of Sweden-based Envirotainer AB by EQT Partners AB and Mubadala Investment Co. PJSC for $2.99 billion marked the second-largest deal of the year. The investor group agreed to acquire the healthcare services company from Cinven Ltd. and Novo Holdings A/S in June 2022.

- Next was Unither Pharmaceuticals SAS' proposed buyout by an investor group that included IK Partners and GIC Pte. Ltd. for $1.60 billion from Keensight Capital, Parquest Capital and Ardian. Unither's management team, along with Keensight and Parquest, are reinvesting in the pharmaceuticals company.