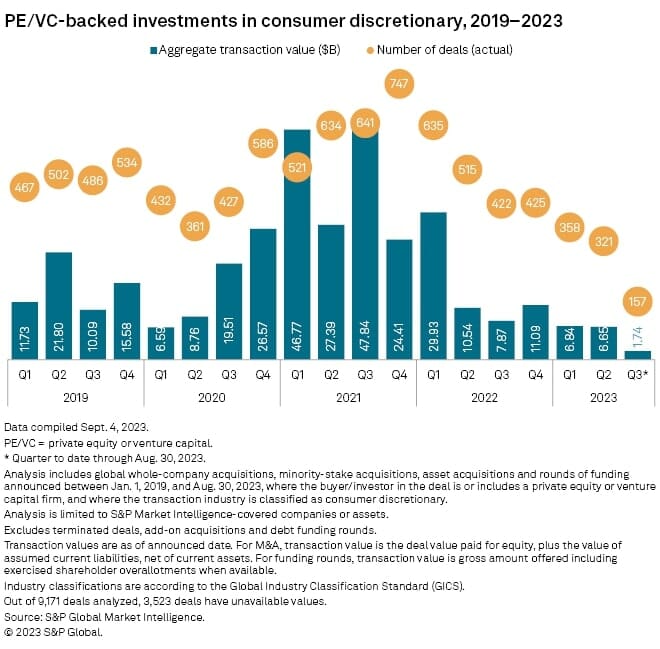

Global private equity and venture capital interest in the consumer discretionary sector fell sharply in the first half of 2023 with total deal value plunging 67% year over year to $13.49 billion, according to new S&P Global Market Intelligence data and analysis. Transactions in the space totaled 679, down 41% from the first half of 2022.

Key highlights from the analysis include:

- Consumer discretionary remains the most-shorted sector on all major US stock exchanges, reflecting an unfavorable outlook for consumer demand due to persistent inflation, rising interest rates and the possibility of a recession.

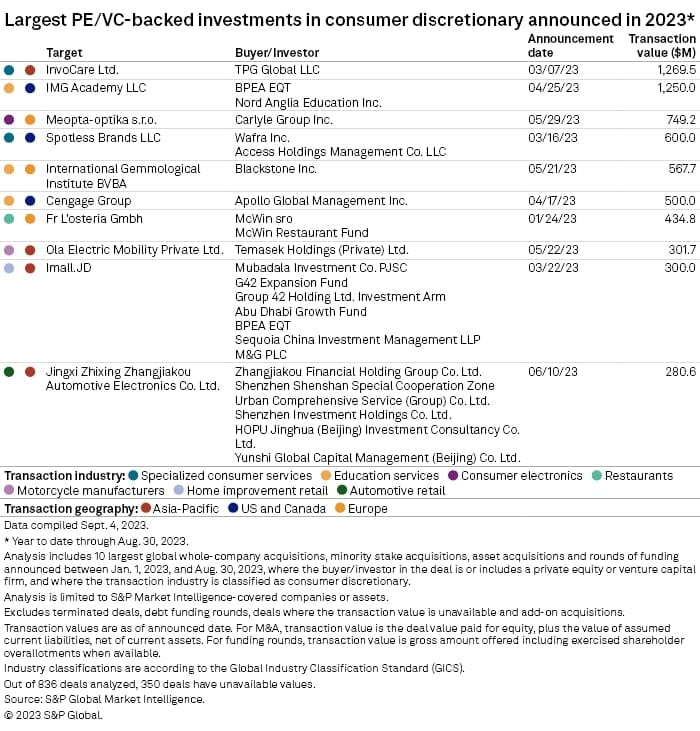

- Through Aug. 30, the largest private equity transaction in the consumer space thus far in 2023 is TPG Global LLC’s proposed acquisition of InvoCare Ltd. for roughly $1.27 billion.

- Deals involving educational services accounted for three of the top 10 consumer discretionary private equity deals so far this year.

- Private equity was involved in 111 announced deals in the consumer discretionary sector year to date through Aug. 30. The education services subsector was the standout in the second quarter with the value of private equity-backed deals in that space globally jumping roughly 47% year over year.