Global private equity and venture capital investments in the banking sector dropped in 2022, reflecting the overall downturn in deals as interest rates rose and concerns over the direction of the global economy increased, according to a new S&P Global Market Intelligence data analysis.

Q4 2022 hedge fund letters, conferences and more

Key highlights from the analysis include:

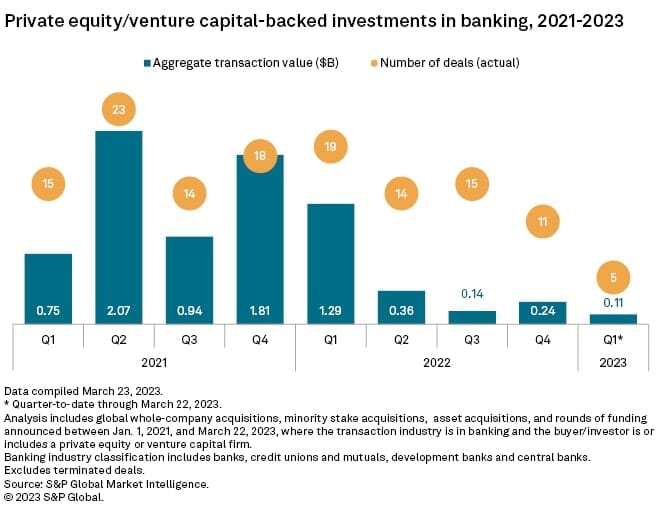

- The aggregate transaction value stood at $2.03 billion in 2022, down 63.5% from $5.57 billion the previous year, according to S&P Global Market Intelligence data. The number of transactions also fell to 59 from 70 in 2021, according to S&P Global Market Intelligence data.

- The U.S. and Canada recorded the highest deal value in 2022 with $992.6 million worth of announced investments, followed by Europe with $811.3 million.

- So far in 2023, private equity and venture capital firms have either announced or completed five deals totaling $110 million.

- The largest private equity transaction between Jan. 1, 2022, and March 22, 2023, was the $620 million financing round of CRB Group Inc., the parent company of Cross River Bank.