Legislation seeking to restrict retirement plan sponsors’ ability to consider financial risks such as climate change would have threatened the pensions of millions of workers.

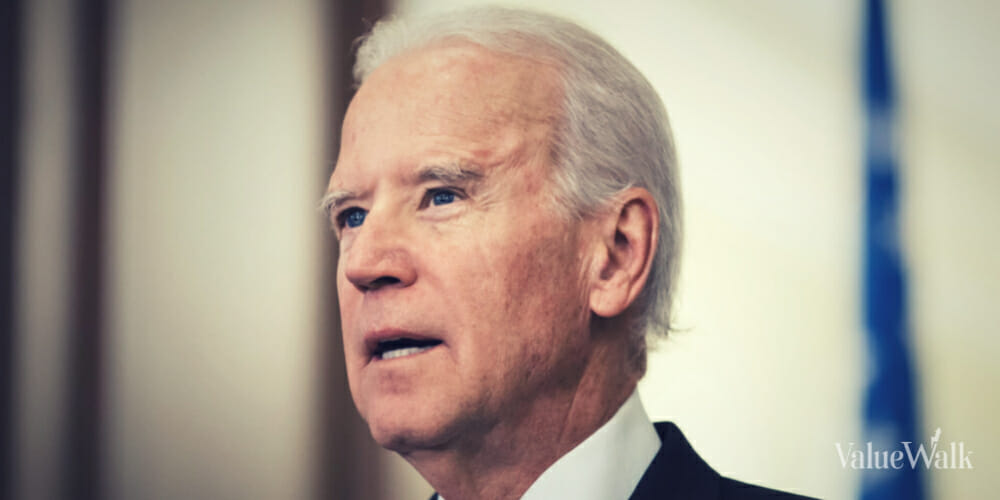

NEW YORK, NY, MONDAY MARCH 20TH, 2023 – Today, members of the Interfaith Center on Corporate Responsibility (ICCR) welcomed President Biden’s veto of legislation attempting to repeal the U.S. Department of Labor’s (DOL’s) rule clarifying that retirement plan sponsors are free to consider financial risks related to environmental, social, and governance (ESG) impacts in their investment decision-making.

Q4 2022 hedge fund letters, conferences and more

ICCR is a coalition of over 300 institutional investors managing more than $4T in assets who productively engage their portfolio companies on ESG risks including the social and economic threats of the climate crisis, worker health and safety, and the access and affordability of medicines.

The Congressional Review Act (CRA) resolution narrowly passed last week in the Senate and the week before in the House, sponsored by Republican lawmakers seeking to discredit the use of ESG as a risk mitigation framework for long-term investing. President Biden vowed to veto the bill if it were sent to him for signature and he did so today.

Biden's ERISA Rule

The President’s defense of the current DOL rule restores the government’s neutral stance vis a vis the management of risk in ERISA-managed pension funds. Employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans requiring fiduciaries to use their best professional judgment in the evaluation of risk.

The rule confirms that the evaluation of ESG factors in investment selection is consistent with fiduciary duty and acknowledges that ESG factors are no different from other material risk-return factors.

The rule does not mandate that ESG factors be considered, it simply states that pension fund managers can consider risks related to the environment or worker safety or supply chain disruptions, when making their investment decisions.

This leeway is critical for pension fund fiduciaries who are responsible for long-term investment strategies that safeguard the pensions of future beneficiaries.

Said Josh Zinner, ICCR’s CEO, “This misguided bill should never have been sent to the President’s desk. Many environmental and social factors such as climate change and the way that companies treat their workers present systemic risks that will have long-term economic impacts on companies, investment portfolios, and society more broadly.

The DOL’s current rule recognizes that ESG factors can be particularly relevant to long-term investors, including the retirement plans of pension beneficiaries who have worked hard all their lives and are entitled to the financial security a well-managed pension plan brings.

In voting to restrict pension funds from considering a broad range of investment risks Congress is endorsing a dereliction of fiduciary duty to the detriment of American workers.”

About the Interfaith Center on Corporate Responsibility (ICCR)

Celebrating its 51st year, ICCR is the pioneer coalition of shareholder advocates who view the management of their investments as a catalyst for social change. Its 300-member organizations comprise faith communities, socially responsible asset managers, unions, pensions, NGOs, and other socially responsible investors with combined assets of over $4 trillion.