“In contrast to September, the October unemployment rate brought several solid surprises. IFR Markets would give this month’s overall report an ‘A-‘ letter grade,” says, Theodore Littleton, Economist, Refinitiv IFR Markets.

Q3 2021 hedge fund letters, conferences and more

October 2021 U.S. Jobs Report Brought Several Positive Surprises

Theodore Littleton, Economist, Refinitiv IFR Markets continues:

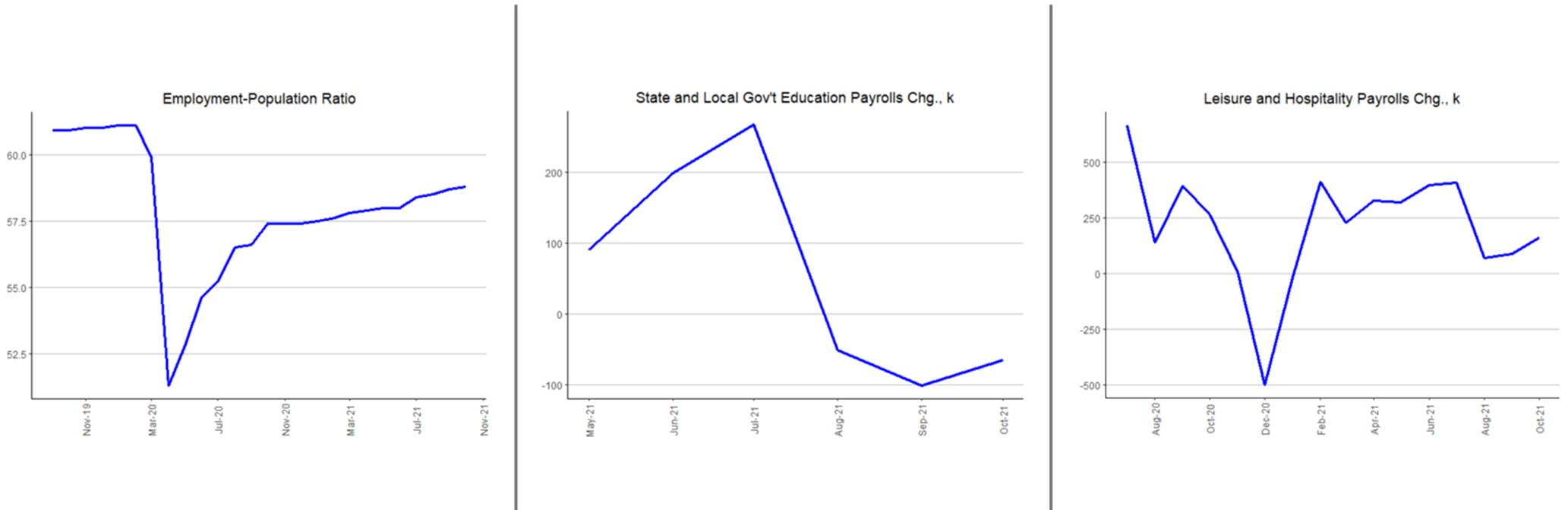

“Payrolls numbers were significantly above expectations, with overall nonfarm growth (mkt +450k) at +531k and private payrolls (mkt +400k) at +604k, combined with strong upward revisions to prior months; August overall growth rose from +366k to +483k and September growth rose from +194k to +312k. Important differences included a faster increase in leisure and hospitality payrolls (from +88k to +164k) as the Delta variant’s impact continued to weaken; rebounds in education and health services (from +13k to +64k), miscellaneous services (from -10k to +33k), and professional and business services (from +76k to +100k); and a great month for goods-producing sectors (from +65k to +108k). The only weakness we didn’t expect was another substantial dip in state and local education (-64.9k), where a large part of the September decline (caused by an inappropriate seasonal adjustment factor surrounding the beginning of the school year) appears to have been revised down and stuck into October instead.

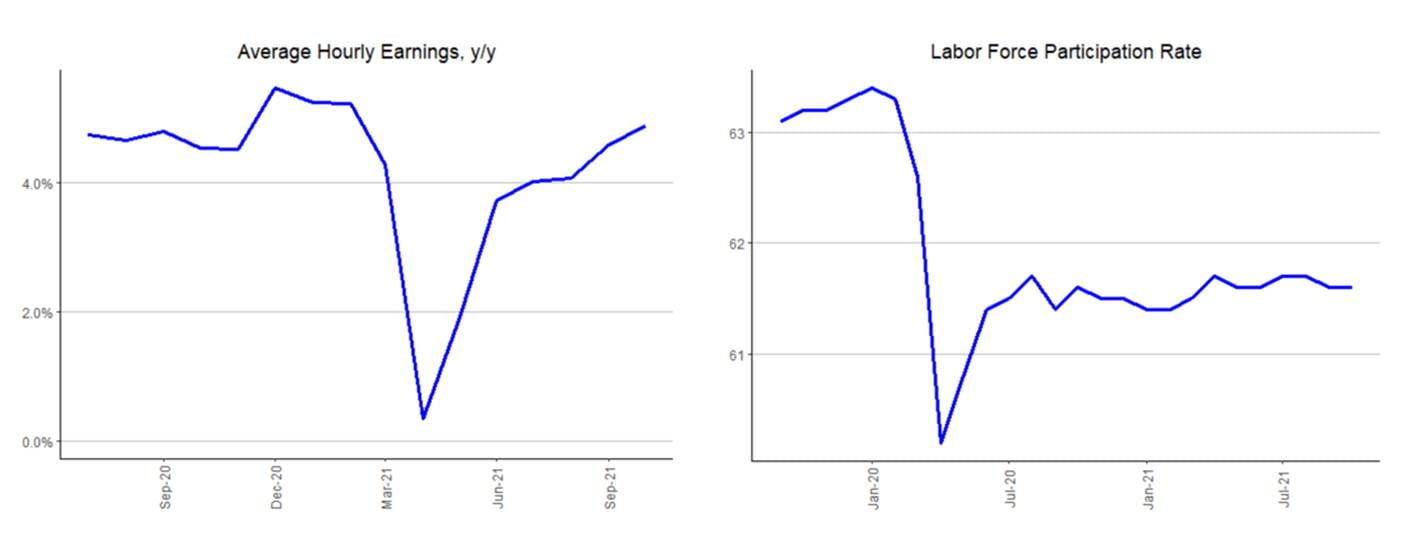

On the softer side, while the unemployment rate fell more than expected (down 0.2 pp to 4.6%, mkt 4.7%), it was thanks to moderately weaker than we’d hoped increases in both the household’s measure of employment (+359k) and the labor force (+104k). Many had expected labor force participation to increase as enhanced unemployment benefits ended, but that doesn’t seem to have materialized to a substantial extent. The participation rate barely changed, still rounding to 61.6%, and the employment-population ratio edged up 0.1 pp to 58.8%. It’s still far from February 2020’s 61.1%, but has come a long way from April 2020’s 51.3%. The U-6 underutilization rate was down 0.2 pp to 83.5%.

Average hourly earnings came in as expected, at +0.4% m/m and +4.9% y/y (up from +4.6%), with a significant composition effect thanks to the relatively quick increase in low-paying leisure and hospitality payrolls. Most sectors saw decent gains, with only a couple about flat and just one area of notable weakness (retail’s 0.8% drop).

The one headline figure to come in weaker than expected was the average hourly workweek (mkt 34.8 hours), which ticked down 0.1 hour to 34.7. It was the goods sector that brought the number down, falling from 40.5 hours to 39.9, its lowest since February. That was likely a side effect of the greater hiring, with the influx of new workers lowering the average while also easing the loads on existing workers. The average workweek for private service-providing industries actually ticked up from 33.6 hours to 33.7.”

Source: Refinitiv IFR Markets

Sources: Data - Refinitiv IFR Markets | Commentary - Theodore Littleton, Economist, Refinitiv IFR Markets