The Broad Market Index was down 0.31% last week and 46% of stocks out-performed the index.

Maintaining large cash balances to defend against a market decline is now easier than ever. With short-term interest rates near 5% makes the loss to inflation lower. Still, cash is not a good long-term strategy. Buy shares of accelerating companies displaying accelerating top line attributes companies, such as:

Leidos Holdings Inc. (LDOS) $97.660 BUY This Poor Company Getting Better

Leidos Holdings (NYSE:LDOS) Inc has been an unprofitable company with frequently low cash return on total capital of 7.3% on average over the past 15 years. Over the long term, the shares of Leidos Holdings Inc have declined by 20% relative to the broad market index.

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is EBITDA profit margin which has been 92% correlated with the share price with a four-quarter lead.

Sales Growth Continues

Currently, sales growth is 5.5% which is high in the record of the company and higher than last quarter. Continued sales growth has produced a rising profit margin for the first time since early 2022.

Margins Stay Steady

The company is recording a falling gross-profit margin. SG&A expenses are low in the record of the company, but falling. SG&A expenses are falling at a more rapid rate than the gross margin, producing a rising EBITD Profit margin

The robustness of the gross margin is significant since reducing cost has been key in supporting the bottom line. SG&A expenses reductions are not limitless however Leidos managed further contain cost last quarter. A healthy gross margin with continued cost management made an immediate impact on reversing last quarter’s falling EBITDA growth rate relative to sales. Interest costs continued to increase relative to sales but remains around the lowest point in the record of the company.

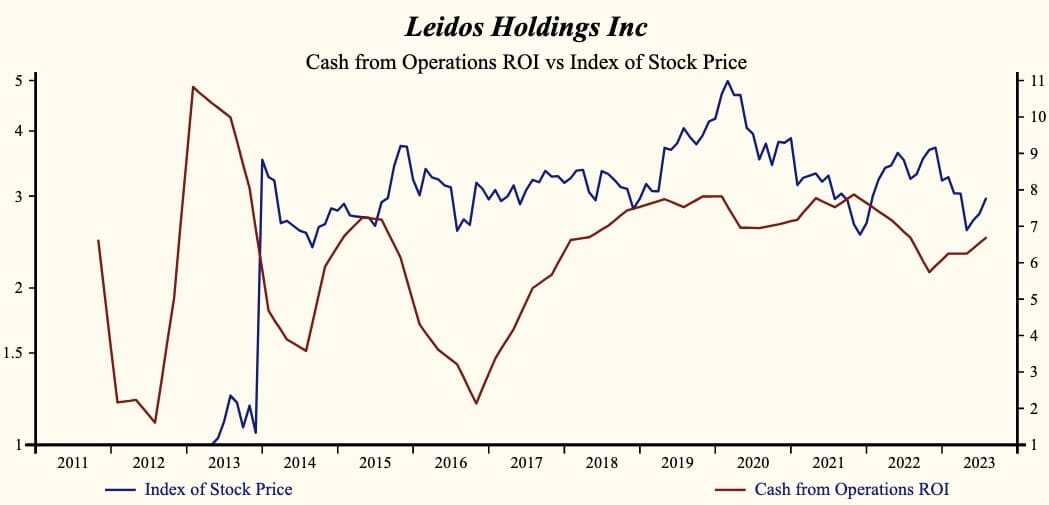

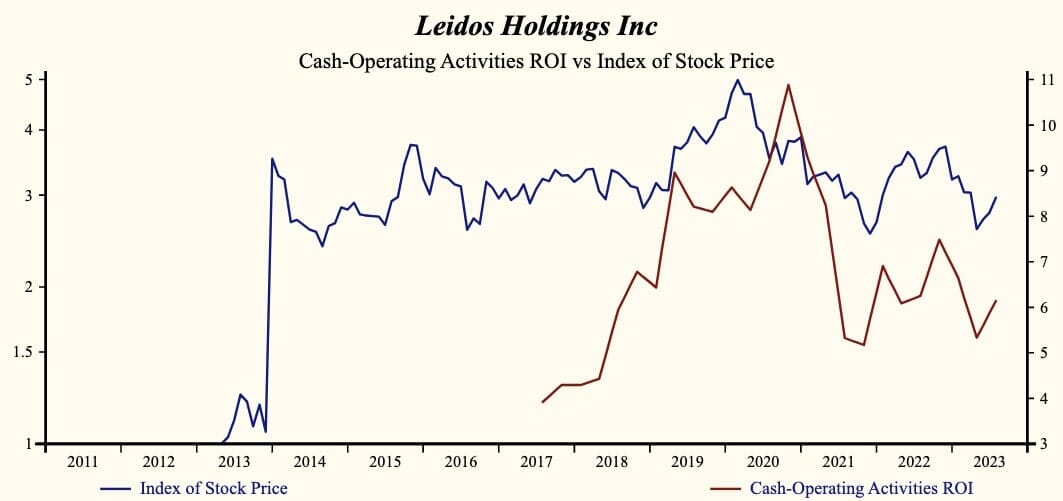

Cashflow Rebounding

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth. The bottom line has increased 13.2% from $1.59 per share registered a year ago.

Strong Buy

The shares are trading at upper-end of the volatility range in an 8-month falling relative share price trend. More recently, the shares of Leidos Holdings Inc have declined by 20% since the December, 2022 high.

The current depressed share price and the broad improvement in fundamentals provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.