The Broad Market Index was up 0.32% last week and 36% of stocks out-performed the index.

A deal has been reached that would see a congressional vote to extend the debt limit. The vote should come this week, meaning we have another few days of uncertainty before this story comes to an end.

Large Companies Are Still On Top

The recent rally in the major stock indexes is dominated by a very short list of the largest companies. This has created opportunities to sell falling growth companies at premium prices. That has increased cash balances in most strategies.

Broadly lower sales growth, falling operating profit margin and lower index profitability all signal lower corporate growth. Persistently high inflation and some recent evidence that the headline inflation rate is moving up will require a new round of higher interest rates.

Falling growth and higher interest rates are very negative for asset prices and with stock indexes at near the all-time high relative to bonds we still face too much risk to buy stocks now.

Stick To Your Disciplines

Rising growth companies are few but most stock prices are depressed. Because the recent advance in stock indexes is the result of advances in a small number of the largest companies, stocks of the larger number of companies have dropped relative to the market average.

Meanwhile it is important to keep our portfolio positions with accelerating attributes (tall green Moneytree in a golden pot) and sell stocks of companies that lose those attributes.

That means raising more cash but with return to cash at over 5%, it is our only haven until growth improves more broadly.

Maintaining large cash balances to defend against a market decline is now easier than ever. With short-term interest rates near 5% makes the loss to inflation lower. Still, cash is not a good long-term.

Be suspicious of Large Companies starting to display sudden margin pressure. Attributes of companies such as:

Texas Instruments Inc $176.290 SELL This Rich Company Getting Worse

Texas Instruments Inc (NASDAQ:TXN) has been an exceptionally profitable company with inconsistently high cash return on total capital of 22.2% on average over the past 21 years. Over the long term the shares of Texas Instruments Inc have advanced by 93% relative to the broad market index.

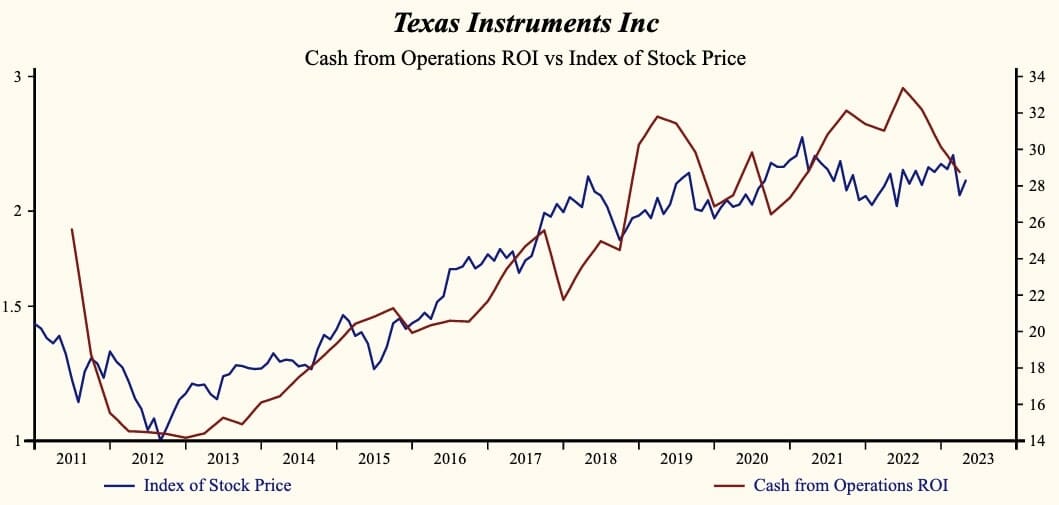

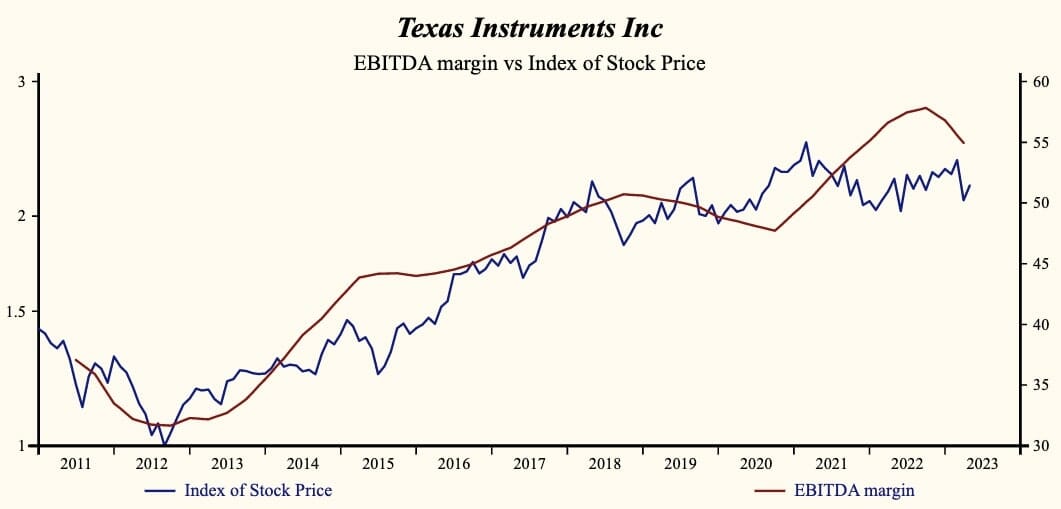

The shares have been highly correlated with trends in Financial Condition Factors. A dominant factor in the Financial Condition group is the EBITDA Profit Margin which has been 87% correlated with the share price with a one quarter lead.

Margins Are Starting To Fall

Currently, sales growth is 2.6% which is low in the record of the company and lower than last quarter.

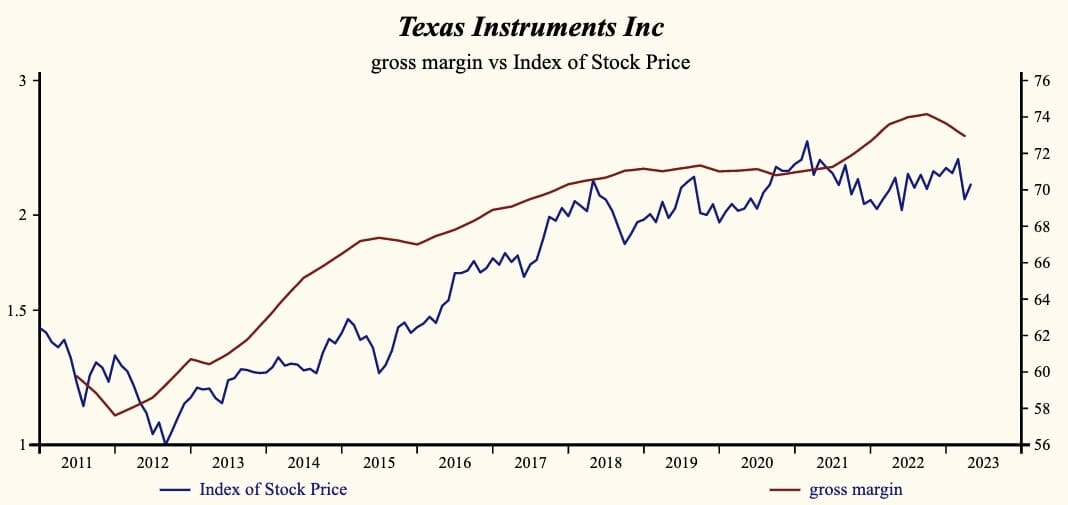

The company is recording a high and falling Gross Profit Margin. SG&A expenses are low in the record of the company and rising. That implies that the company has limited scope for further cost containment and rising costs are slowing the EBITD growth rate relative to sales.

Lower gross margins and higher SG&A expenses are producing a deceleration in EBITD relative to sales and overall Cashflow from Operation (ROI) has started to drop fast.

Sell Falling Growth

The current indicated annual dividend produces a yield of 3.0%. Five-year average dividend growth is 16.3%. Current trailing operating cash-flow coverage of the dividend is 2.0 times.

The shares are trading at lower-end of the volatility range in a 11-month rising relative share price trend. Despite the current depressed share price there is an opportunity here to sell the shares of this evidently decelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.