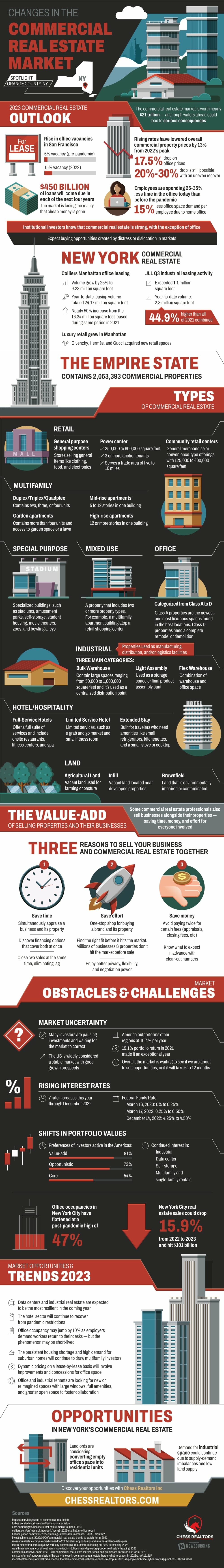

The 2023 commercial real estate outlook highlights the significant changes in the industry, with a focus on San Francisco and New York City. San Francisco has seen a rise in office vacancies, with the vacancy rate increasing from 6% pre-pandemic to 15% in 2022.

The increased office vacancies have resulted in a 13% decline in property prices from the 2022 peak, with office prices dropping by 17.5%. The trend is expected to continue, with prices dropping by 20-30% in the future.

Q4 2022 hedge fund letters, conferences and more

Opportunities And Challenges For Commercial Real Estate

The reduced demand for office space is due to employees spending 25-35% less time in the office today than before the pandemic, which translates to a 15% reduction in office space demand per employee. Additionally, the market is facing the reality that cheap money is gone, with an estimated $450 billion of loans coming due in each of the next four years.

New York City's commercial real estate market has had a different experience, with Colliers Manhattan office leasing volume increasing by 26% to 9.23 million square feet. The year-to-date leasing volume totaled 24.17 million square feet, nearly a 50% increase from the same period in 2021.

The industrial leasing activity has also exceeded expectations, with the year-to-date volume of 2.3 million square feet being 44.9% higher than all of 2021 combined. The luxury retail sector has grown in Manhattan, with brands such as Givenchy, Hermès, and Gucci acquiring new retail space.

The commercial real estate market has different types of properties to choose from, including retail, multifamily, office, industrial, hotels/hospitality, land, mixed-use, and special purpose. However, multiple factors are impacting the commercial real estate market, from market uncertainty and rising interest rates to inflation and shifting investment priorities.

For instance, market uncertainty has led to many investors pausing investments and waiting for the market to correct, while rising interest rates have led to seven rate increases this year through December 2022.

Despite the challenges, opportunities exist in the commercial real estate market for those willing to embrace the risk. Industrial real estate and data centers are expected to be the most resilient in the coming year.

Additionally, the hotel sector is expected to recover from pandemic restrictions, and office occupancy may jump by 10% as employers demand workers to return to their desks, but this phenomenon may be short-lived. The persistent housing shortage and high demand for suburban homes will continue to draw investment in the multifamily sector.

Source: ChessRealtors.com