Open Square Capital commentary for the third quarter ended September 30, 2018.

Dear Limited Partners,

We’ve been watching ripples form, small at first, but gaining in size. As drops of realization fall into the market signaling an impending oil shortage, it’s beginning to raise consciousness and spur action. Recently the rhythm of the patter has been changing, becoming increasingly insistent, gaining in intensity. Musically we’re experiencing an accelerando, but mechanically we’re seeing momentum as market participants realize that something’s amiss. The initial acceptance that perhaps their vague notions of how the energy complex works are wrong, and a new energy crisis is approaching. They are right.

As the waves carom around the market, they’re setting-off a systemic cascade as multiple hands reach for the same umbrella. Naturally, those most sensitive to price changes have already begun moving, securing forward supplies and locking in prices before a further spike. The shift from apathy to concern, however, is attracting attention, forcing peers, competitors and even speculators to react. Action begets reaction and hedging begets more hedging. This low grade hoarding will now feed upon itself and drive prices higher for all. After that? Panic, when all realize that there simply isn’t enough. Then?

Q3 hedge fund letters, conference, scoops etc

“A rationally based, fundamentally induced, price increase will give way to an emotionally driven rally when oil crosses the threshold from a supply shortage to an inventory shortage.”

So here we are, experiencing the start of what we’ve long expected. Here we are, seeing the drizzle, but prepared for the rain. As the market seeks shelter, we’re protected by the knowledge that the assets we’ve collected will soon be demanded, and as the market runs, we’ll exact our price for its folly.

Our Quarter

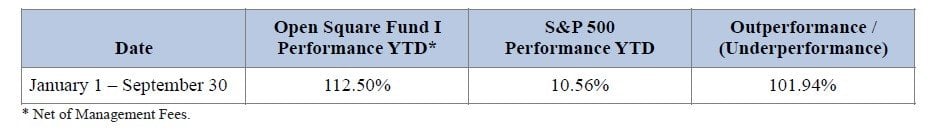

For investors concentrated in energy stocks, Q3 was volatile. While we achieved a positive quarter (having notched a 12.65% increase vs. the 7.71% for the S&P 500), had we reported our results to you a few weeks ago, the numbers would have looked quite different. Were we positioned differently a few weeks ago? Not at all, sometimes volatility is just volatility.

In Q3, fear, uncertainty and doubt (“FUD”) dominated as concerns of an emerging market contagion coupled with a trade-war induced China deceleration blanketed the media. The argument was easy to make, slower growth means lower oil demand, and lower demand means higher inventories and lower oil prices. Simple enough, but like many simple explanations, we found it inadequate.

So how did we overcome the FUD? We tuned out. Specifically, we tuned out the fear perpetuated by experts who appeared after oil prices fell, proclaiming to have greater insights into the oil market (they didn’t) or better strategies to employ (they don’t). Yet the negative sentiment propagated because fear is contagious. Uncertainty creates a void that demands filling, and it’s usually filled by the loudest and most confident (if not competent) of voices. Spouted by charlatans masquerading as saviors, the methods are the same . . . exploit your fears for their benefit. Their chatter is internalized by a rapt audience, willing to suspend and eventually supplant their own independent thinking for just a momentary respite from the uncertainty. Inevitably the salve proves costly because it steals your common sense so they can take your common cents.

To prevent this, we try to stay rational and calm. Other than buying more because of investor inflows, we made very little changes to the portfolio. We know, rationalism doesn’t sell, emotion does. Selling rational thinking is like marketing a Kardashian brother, it lacks appeal. Regardless, would you want us to manage capital any other way? Despite how it can make investors feel, volatility is not risk, and fear isn’t a reason to abdicate sound judgment. Much of the time, price moves are byproducts of liquidity, the residual wake of buying and selling. It’s to be endured, and if anything it should motivate us to dig deeper, and if all checks-out then the best action may be inaction.

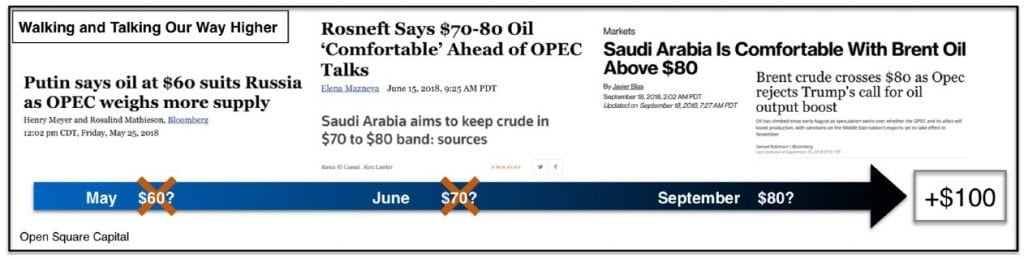

The market will experience increasingly volatile price swings moving forward as the shortage heightens emotions. We’ll pay attention to it, but we’ll continue to stay rational and hopefully exploit the conditions. With luck, we’ll generate more positive returns in the near future by sitting on our hands.1 Now as oil prices have climbed past $80/barrel, you may be wondering what gives us confidence that there’s more upside ahead. Incentives. To explain, we’ll use an analogy, one about the game, who’s playing it, and who’s getting played. Let’s start.

The Confidence Game

You can see it if you step back. Tilt your head and it’ll become clear. You’re seeing a long-con, an elaborate one that’s taken years to develop. You know, a confidence game, a grift, a hustle, a scam. An attempt to defraud a person or group of persons after gaining their trust. Who’s running it? OPEC 2.0. The mark? Everyone else.

It’s a thinly disguised scheme, one designed to convince the world that the consolidation and control of almost half of the world’s oil production in the hands of a cartel led by Saudi Arabia and Russia is a beneficial thing, a good thing. Ignore the monopolistic characteristics because we’re the #goodcartel, the one that provides a stabilizing force on an increasingly chaotic and volatile oil market.

We know better. We’ve known better because we know a hustle when we see one. A con has roughly six stages: the preparation, approach, build-up, convincer, hurrah, and in-and-in. Each stage is part of a larger choreography designed to build increasing levels of trust, until eventually the shills are brought to a finale. Today, we’re past the mid-point.

We’ve already experienced the build-up, because we’ve been given the opportunity to profit from the scheme. OPEC 2.0’s concerted effort to drive-up oil prices has been successful as bloated inventories have fallen below five-year averages. Conversely, oil prices today are over $80/barrel, lifting the value of oil producers worldwide, and placating politicians and their incumbents in oil producing regions.

The build-up was quickly followed by the convincer, where victims receive a small payout that further persuades them that the scheme will work, when in fact it needs to work. This came after the US asked Russia and Saudi Arabia to increase production to offset lost supplies when US Iranian sanctions begin November 5. Russia and Saudi Arabia agreed and proactively increased exports in Q2, resulting in a timing mismatch as higher exports momentarily flooded the market before sanctions begin, dampening expected Q3 inventory draws, and weakening oil prices. So in a sense, mission accomplished, oil prices managed ... at least temporarily.

Now the real fun begins as falling inventories, declining spare capacity, looming Iranian sanctions and collapsing Venezuelan production converge. We are blithely heading towards the endgame, where a crisis forces us to act (the hurrah), and OPEC 2.0 goes “all-in” for that final appearance of legitimacy (the in-and-in) before the curtain falls. It’s frankly not dissimilar to the hustle my kids orchestrated last month:

The Hurrah

Carnival Lady: Honey, your ball didn’t go in, but do you still want a goldfish?

Me: uh oh . . .

Addy: Yes! Can we keep her? Pleeease???

The In-and-In

Me: We don’t have any food or a tank, and daddy will end up taking care of it.

Addy: I can take care of her! Really, really . . . pleeease??? Promise!!!

Me The Mark: . . . . . . where’s PetSmart?

Mason: I want one too.

You know exactly how this story ends if you’ve ever de-chlorinated, filtered, and conditioned a fish tank, or fed your children’s shark baits. It’s the same for carnival fish or oil supplies, sometimes promises come with expiration dates. Nevertheless, whether out of adoration or necessity, we trust, and at this stage, in OPEC we trust.

“The kingdom (Saudi Arabia), the members of OPEC that are opting their production to be able to make sure that the citizenry of the world does not see a spike in oil price ... are to be admired and appreciated, and Russia is one of them.” Rick Perry, Secretary of Energy (Reuters, Sept. 13, 2017)

We highly doubt OPEC 2.0’s aspirations were to achieve “admiration and appreciation.” It’s never been about stability or insuring sufficient supplies, nor about low oil prices as dictated by OECD importers. This has always been about maximizing oil prices for certain countries to achieve their goals. So is this political messaging or naiveté? Does it matter? We have no other choice. Self-interest corralled us down the path to the point where we’re effectively reliant on Russia and Saudi Arabia. Yet, is it truly surprising that Russia and the Saudis would want higher oil prices? It shouldn’t be ...

Today there’s much ballyhoo about Russia and Saudi Arabia’s spare capacity. 2 Do they have enough easily accessible production to relieve the current shortage, and if so, when will they use it? We think those are premature questions. The question to be asked isn’t if they have enough, the real question is why would they choose to produce more at this stage? Thus, the issue surrounding spare capacity is moot because where there’s no incentive, there’s no will to act.

The Endgame

“Show me the incentive . . . and I will show you the outcome.” Charlie Munger

We shouldn’t expect anything less because today’s game is being played by the desperate and for survival. We have a 34 year old prince in Saudi Arabia who needs to pivot his country from a oil-centric economy before a demographic wave of young, unemployed and disenfranchised males schooled in an education systems emphasizing Wahhabism come of age. Can you truly doubt his conviction if this generation threatens the stability of his future monarchy? In Russia, we have Putin, a leader who’s strategic calculations and actions are designed to extend his power and influence (and those of his oligarchs) globally over the coming decades; someone who brooks so little dissent he has forcibly silenced critics domestically and abroad. Both leaders and their countries effectively drive OPEC, and where they go, oil goes.

What was tacit acceptance as oil prices rose has now turned to general concern, but there’s little oil importers can do. There simply isn’t enough oil and jawboning to perpetuate the illusion that there are have worsened the impending crisis by tightening supplies and dampening the urgency to invest in long-lead projects. Moving forward even President Trump’s exhortations will prove less effective because you can’t tweet oil into existence, and as his increasingly fractured administration advances its conflicting agendas, it will drive prices higher. Mind you this is not a criticism of the current administration. Regardless of politics, this is at its core all about incentives and human nature. In short, incentives dictate goals, goals dictate plans, and plans dictate actions.

We’ve intentionally not shown any charts or figures of declining inventories and underwhelming supplies in this letter because it’s not about those things today. Those are the results, the pictorial consequences of disparate short-term incentives that have weakened the world’s global energy reserves. They’re the consequence of actions that now leave the world directly exposed to the whims and personal motives of leaders whose agendas may not align with ours. At its core, this oil thesis has as much to do with predicting the actions of leaders based on incentives as it does forecasting oil inventories. Our calculations were simply tools to better understand the ramifications of those actions, and whether that reality would play out within the time frame of we thought.

The Curtain

We believe OPEC 2.0 will agree to raise 2019 production in the upcoming December OPEC meeting, softening the self-imposed cap agreed to in November 2016 and modified in May 2018. Lifting the cap allows Saudi Arabia and Russia to effectively take market share from Iran and Venezuela, who are unable to increase production. Now whether lifting that cap means oil production will actually increase overall is an entirely different matter, which is why this is the “in-and-in.” It’s the final appearance of legitimacy that Russia and Saudi Arabia (and by extension OPEC 2.0) want stable and lower oil prices. OPEC 2.0 can’t openly call for much higher oil prices without inviting backlash, but delaying production increases in a tight market sends a message loud and clear.3

As the long-con comes to a conclusion, Russia and Saudi Arabia will turn to consolidate their gains. Shortly after mid-term elections, the Trump administration will shift its focus to campaigning for reelection in November 2020. As the prospects for Republicans losing control of the White House increase, Russia will hedge and solidify its global standing in the coming year because any new administration could be less accommodating. For its part, Saudi Arabia will need to secure funding for its Vision 2030 program after delaying the initial public offering for Saudi Aramco. Without the cash infusion from an immediate partial sale, ongoing cash flow generated from higher oil revenues become even more important as the country increasingly relies on its cash flows and external debt. Moreover, if the Aramco is delayed for another year or two, Saudi Arabia’s incentives to maintain high oil prices remains. Hence we’ve been seeing headlines like this, as the hustle morphs into something more permanent:

So we repeat what we wrote a few letters back.

“What’s coming around the corner for energy and energy prices will soon disrupt and then dictate the day’s conversation. What’s neglected will command attention and what’s forsaken will be coveted. The world has failed to invest in long-lead oil development projects and the repercussions of that collective failure is now playing out.”

As that reality comes to fruition, we’re at the stage where the veneer of adequate supplies has worn away. We are short on energy and those who have it will begin to wield it as a source of power. The US and other oil net importers have been under the impression that they’ve been guiding global energy policy, but that stance only had a semblance of believability when global inventories were filled and energy was cheap. Now? It’s the endgame. The long-con continues, but not for much longer. Don’t blame OPEC 2.0 though, we’re just as guilty for having conned ourselves.

Parting Thoughts

After reporting our results last quarter, we fielded a slew of inquiries from prospective investors, family offices, institutional investors and individuals. More than doubling capital over three years will do that, and we’re pleased with the interest. We spent a few weeks answering detailed questions, fielding conference calls, etc., and then began tapering the time we spent on such activities.

It’s not that we don’t want to increase assets under management or grow the firm, not at all, as we recently added new partners. It’s simply that the more time we devote to “sales and marketing” means the less time we have to dedicate to what led to our outperformance. Much of what we do is researching, reasoning, and exercising good judgment, and that takes time, and actively conducting marketing detracts from that, something we are loath to do.

So halfway through the quarter, we made a conscious effort to refocus our energy on what allowed us to outperform, our analysis. Going forward, we will eschew traditional marketing if and when it detracts from our craft and what makes our product extraordinary. While our historical performance affords us this luxury, we believe our existing partners deserve this. Our first priority is the compounding of your capital, and our attention must be focused on that. If you’ve placed your capital in our trust, we’d expect you’d want us to act in a manner befitting such trust.

Recently our fund was included in the Interactive Brokers Hedge Fund Capital Introduction Program, so new investors can contact us directly or find us there, but while our fund remains open to investors, we are seeking partners who understand our principles. Our strategy has always been predicated on being a fund for thoughtful contrarians. We think a market exists for investors seeking a differentiated approach. While the market pushes index products, we advocate selective concentration. Short-term thinking? We’ll take long-term focus. Momentum, black-box quant models? How about simple strategies with clear and well researched themes. Accumulate assets and closely hug indexes to preserve management fees? We’ll accept volatility for the opportunity to create and compound generational wealth.

Should new partners seek us out and wish to join, or should you recommend any to us, we welcome them. Just know that we’ll reserve the bulk of our time and efforts on benefitting our partnership, improving our process, and generating exceptional returns. In the end, that’s what matters, and that’s what we care deeply about. Unconventional? Yes, but then again we’ve never been conventional. Imagine that, an asset management firm that doesn’t actively gather assets so we can focus on outperforming ... contrarians indeed.

As always thank you for investing and please let us know if we can explain any of our ideas above in more detail.

Sincerely,

Nelson Wu

Managing Director