It was neigh on ten years ago, the world was just about half way through the ‘Great Recession’ and I was sending out a newsletter wondering how much lower the Dollar could plunge.

Q2 hedge fund letters, conference, scoops etc

The Euro/USD pairing was touching 1.50 at one point.

How the times have changed!

Because here I’m wondering how much further the Dollar can rise. #Thedollarhaslegs

Yes, I know that Morgan Stanley and State Street Corp have put Wall St. on notice that the US dollar is about to plateau, and I’ve heard their reasoning as well; The Dollar has been on the rise since April, 2018, its gained more than 5% against the Euro, the price of Gold is at a two year low from a high of 1377 in July, 2016 to a low of 1,190 at the moment, the Euro zone data (and inflation) is due for a spurt, etc. etc.

The above view with small variations to the cause is endorsed by giants like JPMorgan Private Bank, and Wells Fargo & Co among others as well.

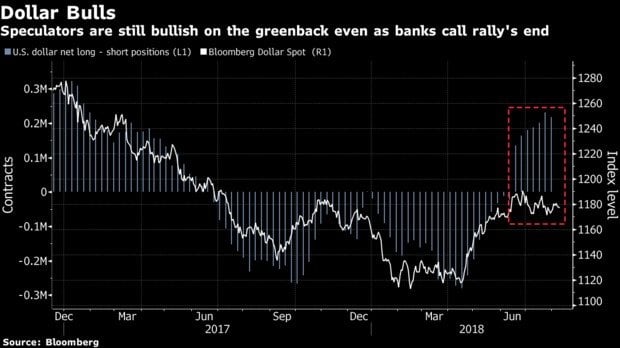

However to some the Greenback is seen to have the legs to go a few more rounds with the competition. From Sydney to Singapore, London to New York, more and more hedge fund managers are, pardon the pun, hedging their bets on the dollar.

According to Guillermo Osses, head of emerging markets debt strategies at Man Group GLG, a unit of the fund;

“From a longer term perspective, the U.S. is potentially on track to impose a meaningful amount of tariffs on China which may have a transmission to all those countries that sell into China, including Europe, on a trade-weighted basis you may continue to see dollar appreciation, especially relative to the euro.”

The economy is affected by numerous factors, not the least of which is herd mentality – remember the rush to buy CDOs back in the days of the wild wild Wall Street?

My top reasons as to why Hedge Funds are betting on the Dollar are as follows:

The Trade Wars: The trade and tariff wars initiated by president Trump could not have come at a worse time for the Chinese, they are heavily invested in infrastructure projects across the Globe, from the Sudan to Sri Lanka, not to mention Chinese Premier XI Jinping’s pet prestige project – The Belt and Road – which aims to connect Eurasia and China in a modern version of the Silk Road.

The Chinese Yuan is now under immense pressure as infrastructure spending and export slowdowns don’t really go well together. Despite the meetings between low-level trade delegates of the two countries, it’s probable that some tariffs are here to stay for the long term.

The trade war has had a ripple effect; the uncertainty on future contracts has led to lower than average orders for European machinery and other technical doodads, which in turn has softened an already soft Euro market.

The Turkish Lira and the Euro: Turkey is a de-facto member of the Union, and the EU is its largest trading partner. As a gateway to the Middle East, Turkey in turn reaps enormous dividends from this relationship. Thus when the Turkish Lira tanked (thanks to some unorthodox theories on central bank Interest rates espoused by president Erdoğan) it had a negative impact on the Euro.

Keep in mind a large part of the national debt in Turkey is funded by banks in Europe – Greek Crisis anyone?

The crisis sparked between the US and Turkey in regards to the detention of the US Pastor has just speeded the fall of the Turkish Lira, dragging down the Euro along with it. This was further exacerbated after President Trump sent a tweet threatening to double tariffs against Turkey:

“I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar! Aluminum will now be 20% and Steel 50%. Our relations with Turkey are not good at this time!” – August 10, 2018

Brexit and a low inflationary trend in Europe, particularly Germany, are not helping things either.

The Debt that Emerging Markets Bear: Apart from the afore mentioned Turkey, other emerging markets like South Africa, Brazil, India etc. take on debt to finance infrastructure projects, this debt largely and uncomfortably denominated in USD, the rise in the rate of the dollar is bound to force them to dig deep, and for some that means to borrow more, all in USD.

Interest Hike by the Fed; there has been a rise in core inflation rates which hit a decade high last week. This has prompted traders to eye a probable hike in the interest rates by the Fed in support of the dollar.

Yes Greg, but Morgan Stanley and Co. Say…!!

They are not completely wrong, but neither are they completely right!

Katherine Greifeld of Bloomberg news said it best when she paraphrased what a lot of the outlier hedge fund managers are saying: “It comes down to a Time in Trade, and in the weeks ahead there is still room for this dollar rally to continue.”

Most of the Sell side strategists who are bearish are looking at things far down the road, five maybe ten years down the road where numerous unforeseen factors could come into play. The factors as they are at the moment support a further strengthening of the US Dollar.

The way I see it, The Dollar is some ways yet from the highs of 2016, as seen in the Bloomberg chart below:

Furthermore contrary to popular doom and gloom merchants predictions vis-à-vis the trade tariffs, the US economy has been on the rise year on year since 2011. Unemployment is at its lowest since 2009, and a high inflationary trend suggests that the Fed may step in to increase interest rates as early as September or October.

All of which indicate that the dollar is yet to see some of the highs, and more and more hedge Fund managers are looking to making $$$ while the sun shines.

Do also keep an eye out for the upcoming Jackson Hole Economic Policy, “Changing Market Structure and Implications for Monetary Policy,” between august 23-25, 2018.

Thank you for reading my post. I regularly write about private market opportunities and trends. If you would like to read my regular posts feel free to also connect on LinkedIn, Twitter or via Atlanta Capital Group Investment Management.

Greg Silberman is the Chief Investment Officer of ACG Investment Management LLC (“ACGIM”). ACGIM specializes in creating custom private market solutions for RIA/Family Office clients.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. It is not possible to directly invest in an index. An index fund is a type of mutual fund with a portfolio constructed to match or track the components of an index. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. Advisory Services offered through ACG Investment Management, LLC. ACG Investment Management is an affiliate of ACG Wealth Inc.

Source for the figures:

https://currencynewscentre.com/index.php/2018/08/18/pound-euro-us-dollar-gbp-eur-usd-exchange-rate-forecast/