Personal finance expert reveals New York is second furthest away from meeting this key savings milestone

- According to new findings from a personal finance expert, the average person in New York is a huge 70% behind having enough savings to retire

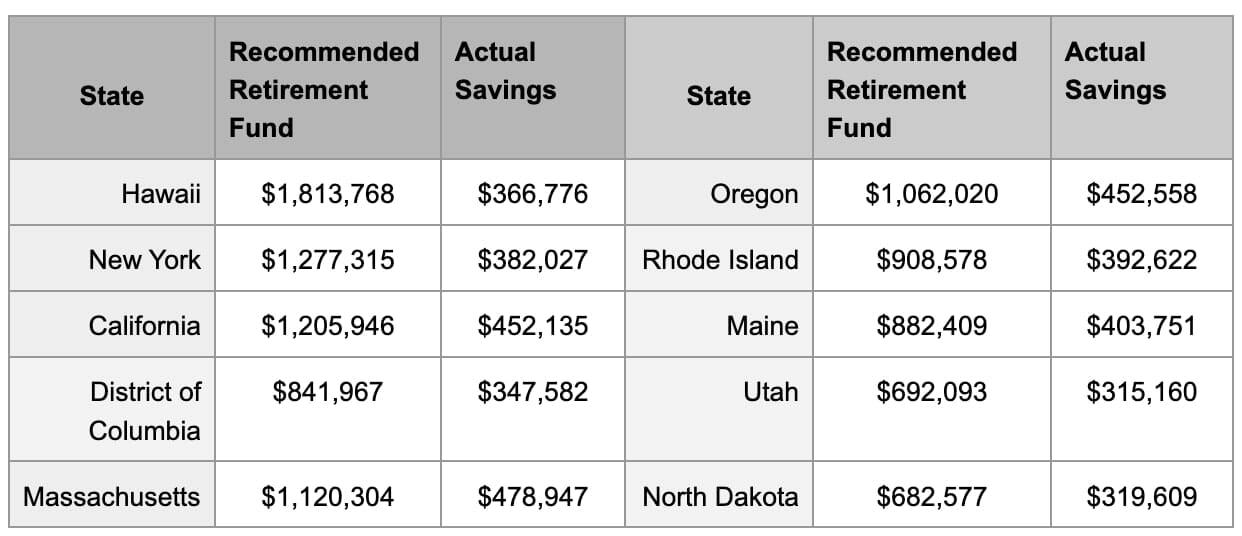

- A comparison of Federal Reserve System data and regional retirement goals reveals Hawaii is the furthest behind of any US state

- New York is faring significantly worse than the national average, as the typical state is two fifths (40%) behind meeting savings goals

- The personal finance experts at DollarGeek reveal a simple method to determine how much you should be saving each year, based on lifestyle

New findings from a personal finance expert have revealed that the average American in New York is a huge 70% away from recommended retirement savings.

Q1 2023 hedge fund letters, conferences and more

Personal Finance Advice provider DollarGeek analyzed data from the Federal Reserve System’s Survey of Consumer Finances (SCF) and compared this to national recommended savings benchmarks, to identify which states are behind and how much by.

And it turns out no state is currently on track with their savings, as the average state is 40% behind where they should be to retire - but are still doing considerably better than New York.

The savings benchmarks recommend that each person in New York save at least $1.2 million to fund retirement, based on the current cost of living after Social Security income - whilst the Federal Reserve data reveals the state actually averages $382,027 per person.

New York has the second-highest recommended retirement sum in America, based on the annual cost of groceries, housing, transportation, healthcare and utilities.

All of this means that the average New Yorker has just under $895.3k more to save before they can comfortably retire - which is bad news for those who are nearing the age of 64.

But that doesn’t mean the state’s workers are expected to start squirreling away every single hard-earned penny, as the personal finance experts recommend that each person save up to 20% of their income each year, based on the 50/30/20 budget rule.

The rule states that up to 50% of your post-tax income goes towards essential expenses - such as rent, bills and groceries, whilst 30% goes to anything else you need to spend money on (such as holidays, date nights and Netflix), and 20% goes straight into your savings.

With the typical post-tax salary in New York sitting at $71k annually, it’s recommended that you save around $14.2k per year - but for many, this will need to be a minimum annual contribution in order to meet the state’s recommended retirement sum.

And whilst some people can close this gap in savings by reaping their other assets before retirement, such as stocks, bonds and real estate, others will struggle to do so.

The 10 States Furthest Away From Recommended Retirement Savings

Meanwhile, the states closest to meeting their retirement savings target came out as Kansas (17% gap), Iowa (20%), Georgia (24%), Michigan (27%) and New Mexico (28%).

Speaking on the findings, Zina Kumok, Personal Finance Expert at DollarGeek, said: “All generations need to realize the importance of saving and investing as soon as possible. It doesn’t matter if you only have $5 a paycheck – start putting money aside now.

“This is particularly important for Gen X – also known as the Sandwich Generation – who are taking care of young kids and their aging parents. This will make it harder for them to allocate resources towards their own retirement and savings.

Plus, the sooner you start, the more you’ll see the benefits of compound interest - and the sooner you’ll chip away at large expenses like student debt."

Of course, the sum that people will need to save for retirement differs based on their personal lifestyle, income and state - but there is a simple way to form a savings plan.

A good way to determine how much you need to retire is by implementing the ‘rule of 25’, where you calculate the amount you need to live comfortably based on your monthly expenses. Multiply this monthly sum by 12 to get your annual withdrawal amount.

The annual withdrawal amount should then be multiplied by 25 to establish your retirement savings target, which you can then work backwards from to form your ideal saving schedule.