Amid a stock market sell-off in the US and around the world – the Nikkei 225, for instance, closed down 592 points, shedding 2.55% Monday – there stands China. The Shanghai SE Composite index was up 25.42 points amid the global price re-adjustment as concerns over the nation’s leverage reach a fever pitch. Goldman Sachs, for instance, noted China’s debt bubble is the “largest in history.” But can over the counter SWAPs transactions bailout the leverage problem? Or are they nothing more than a shell game where who is left holding a leveraged bag is unclear?

Debt to equity SWAPs being designed to reduce system leverage

In a February 1 piece, Moody’s analysts Gary Lau and his team that in debt-ridden China all may not appear as it seems.

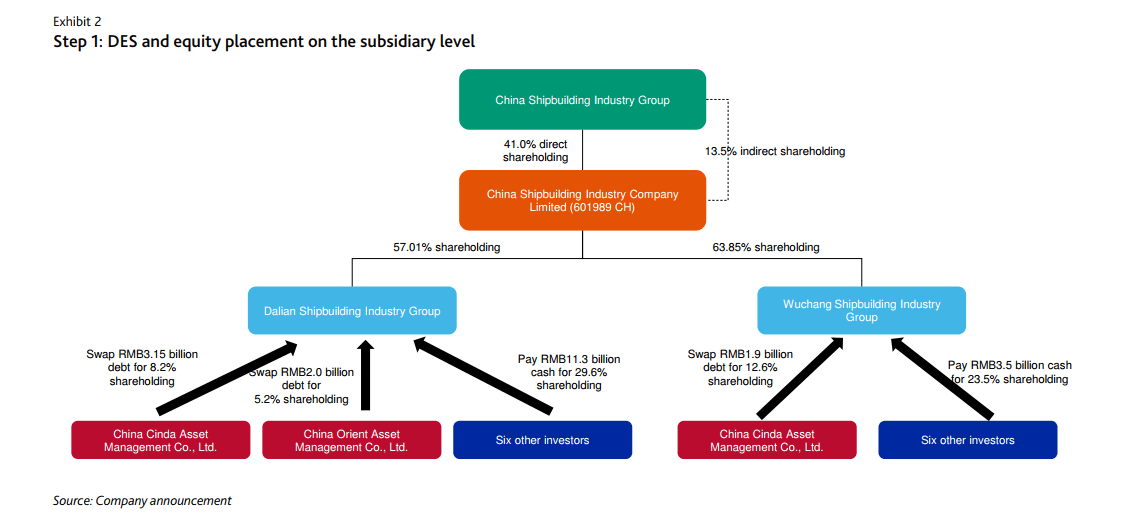

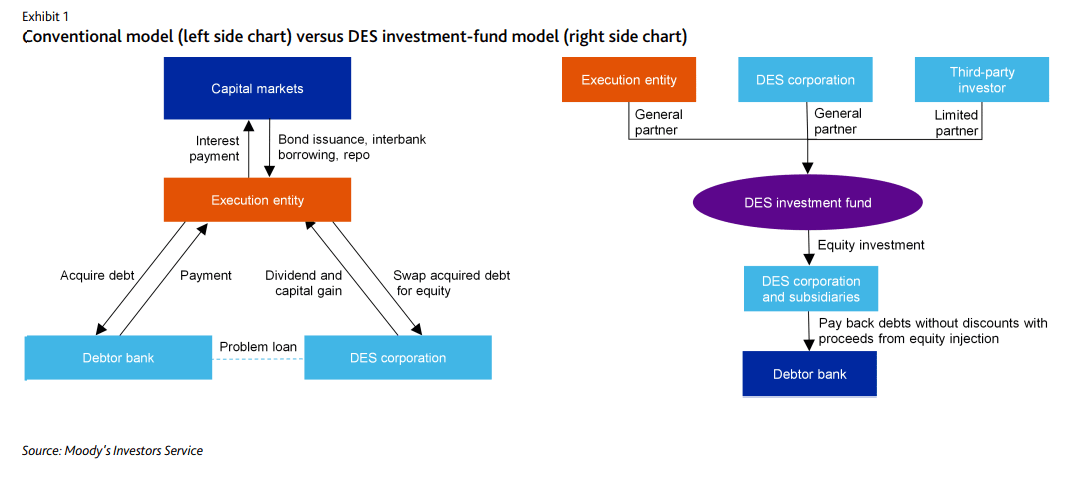

There are currently acts of financial engineering being used to de-lever the meaningfully leveraged Chinese corporations. Through debt to equity SWAPs over-leveraged companies can get on their feet by providing equity in return for much-needed cash. But such financial engineering comes at a cost, the report, titled “Debt-equity swaps provide liquidity relief, but some liabilities remain in system,” points out.

“The (debt to equity SWAP) investment fund then injects equity into heavily indebted companies, the majority of which would likely use the funds to repay outstanding bank debts in full,” the report pointed out. “The framework emphasizes market-oriented principles and the proper transfer of risks, in theory.”

While capitalism is supposed to work based on market generated pure supply and demand, that, too, is a theory that is not always practiced with purity.

In the case of Chinese SWAPs, how the system works is, in part, might be a lesson in the difference between the theory of capitalism and how it really works in practice.

Chinese debt to equity SWAPs don't mandate a turnaround plan and who is responsible if they fail remains unclear

In most debt to equity SWAPs transactions, the troubled company obtains a cash infusion in exchange for company equity ownership. These plans often include one key point: a plan on how the company is going to de-leverage, turnaround the business and recapitalize.

It seems with such Chinese SWAPs transactions, however, what is traditionally included is not part of the plan. “For lasting deleveraging of the corporate sector, (debt to equity SWAPs) would need to be combined with a well thought-out turnaround plan to enable the companies concerned to improve cash flow and recapitalize,” Moody’s pointed out with an eye for what is missing. “Such plans are absent in most of the transactions announced so far.”

But it’s not just the lack of a plan to nurture an overleveraged behemoth to health that is missing – the lack of a turnaround planning document is just the start.

In any funding situation, clear identification of the risk and reward paradigm – including who bears financial responsibility if the entity fails – is part of a SWAPs planning regime. But with the Chinese debt to SWAPs transactions, it remains to be seen who might be left holding the bag if the company fails:

In some announced transactions, third-party investors for DES investment funds are product proceeds of wealth management products (WMPs) originated by execution entities’ parent banks. Execution entities and their parent banks may have to bear potential losses of DES investment funds, given investors' general expectation that banks will ensure WMP principal and returns are paid in full. Central and/or regional governments may fund indebted companies' buybacks out of social stability concerns.

In other words, the government is financing bad businesses “out of social stability concerns,” but what remains unclear is: who pays if the investment goes bust?

Only weeks ago, in December of last year, the IMF warned that China’s ballooning levels of debt are creating credit risks that have the potential to destabilize the global economy – large enough to trigger the next global financial crisis. 1 The IMF report made it abundantly clear that China's economic and political leaders should not delay in taking major steps towards preventing debt levels from spiraling out of control – highlighting that the pace of change towards improving overall financial stability in recent years has been lacking.

...............

While a number of new financial regulations, in accordance with international Basel committee standards, have recently been announced for implementation over the next year in China, will this be enough to bring capital conditions under control? Additionally, potential shocks may be on the horizon as the new restrictions are added to the financial system of the world’s second-largest economy.

Internet-Based Lending – New Rules deliver Quality Enhancement

On a more positive note, new regulations from the People's Bank of China (PBoC) and the China Banking Regulatory Commission (CBRC) have been drafted to target internet based microloans. These changes look set to significantly enhance the quality of loans and credit in the ABS (asset-backed securities) segment of lending - with recent research from Moody’s supporting the hypothesis of a positive outcome. 2 Specifically, only strong loan originators will remain operational, and these parties will have to meet stricter underwriting standards and risk controls.

Further to this, the riskiest underlying based ABS loan structures have been banned altogether – with examples including ABS based on cash loans, student loans and loans used to finance down-payments.

Short-Term Pain, Long-Term Gain

The regulations have been designed to provide long-term stability. However, the short-term transitional period will face a number of challenges. As has historically been the case when regulation seeks to tighten credit quality standards, there will be an increased number of loan defaults over the short term.

The internet-based micro-lending market will shrink to meet the new standards. The highest risk products and parties involved in the market need to be weeded out and this will be a painful process in the near term as numerous outstanding debts are reneged upon.

The scale of this short-term pain will be significant as borrowers with weak credit profiles made up a large proportion of the market based on previous regulations. As to be expected, issuance of ABS backed by internet-based microloans has already declined since the new regulations were introduced at the end of last year – with issuance sharply falling from over 40 RMB billion in November 2017 to close to 5RMB billion only 4 weeks later in December 2017. 2

While these factors point to improved quality in the consumer ABS segment of the Chinese debt market, the overall outlook is still fragile. Only as we progress further on through 2018 will we see if the new regulations applied across the wider banking system are successfully reducing China’s credit vulnerabilities.

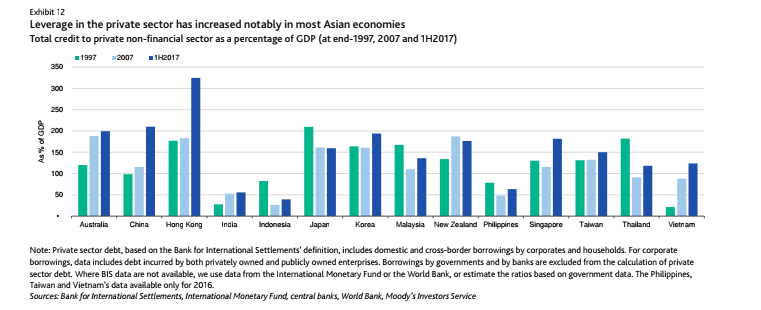

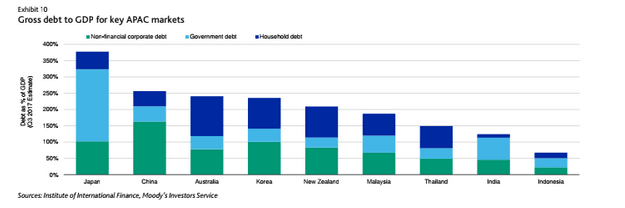

One interesting takeaway from a different but related report from Moody's notes that Chinese debt to GDP has surpassed Australia and it is now #2 in Asia, trailing only Japan. For leverage, China has also surpassed Australia, and Hong Kong is the leader in that area.

Sources:

2 Moody’s Investor Service, Consumer loan ABS, China, 22nd January 2018

Moody’s Investor Service, Asia Pacific Outlook