European equity market returns were subdued for the month of January – with the Eurostoxx 500 mustering up a few percentage points of return by mid-January only to fall under 2017 year-end levels into the start of February. Overall, it was a month of sideways trading. Based on continued low volatility across European equity markets, and spikes in local bond market yields, recent research from BAML indicates it could be fruitful to replace European stock underlying positions with calls. The research highlights isolating negative correlation exposure of equity market volatility to the sizeable sell-off in German bunds and further speculates attempts to pinpoint an equity market top will most likely be futile. 1

Bund Exposure – Accelerating Yield Trend

The ECB announced at the latest meeting (25th January 2018) that rates will remain unchanged, triggering a hastened sell-off in German bunds. 2 From a volatility perspective, the vol-adjusted spike in 10y bund yields over the past 2months reached close to a near 30-year high. BAML suggests investors would be wise to replace stock positions in equities which are most negatively exposed to rising bund yields – specifically looking at the 2m correlation to German 10y bund yields. Further, looking at the supply parameter of bund yield exposure we can expect net supply to peak in Feb/Mar of this year, fuelling more volatility. The call option replacement strategy will provide positions that benefit from the commensurate upside risks.

Optimised Selection

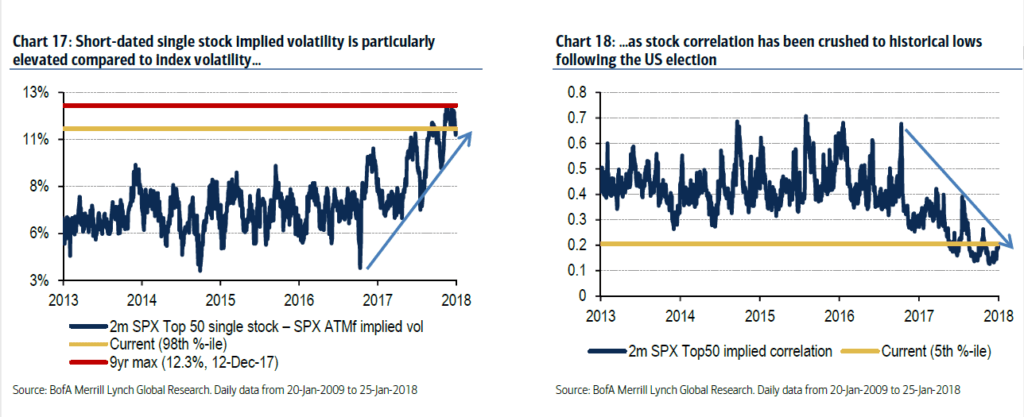

Whilst this positioning can be favourable for optimising bund volatility exposure in equity allocations, investors would be wise to pick equity call positions that offer low (i.e. cheap) implied volatility vs historical (BAML suggests seeking the lowest 5year percentile of 2month ATMf vol) as well as stocks that offered strong momentum through 2017 (BAML suggests seeking the highest EUR stock returners from 26-Jan-17 to 26-Jan-18.) Meanwhile, the bank also recommends trading only the most tradable options in addition to the above asset- based criteria – i.e. the most liquid names. Specifically, the bank focusses in on identifying allocations within STOXX600 companies with the highest equity market cap and highest average daily notional traded in options over a 1month lookback period.

Seek & Ye Shall Find..

Finding low implied vols will not be too tricky in today’s European equity market. The Eurostoxx 50 volatility ratio is at a jaw dropping 10 year low against the DAX 1M ATMf. At the same time Europe’s benchmark stock index is reaching 10 year lows against its own historical vol at the 3month ATMf vol level. To give you an idea of the numbers – while the Eurostoxx is trading at a 1.6% vol ratio for this parameter, the S&P is producing 6.4% and the Nikkei 7.8%.1

The levels are astoundingly low. However, these types of extremes also provide ideal opportunities for extracting alpha. For those who want to stay long in the underlying equity market, keep in mind that the current bargain- basement implied vols are a little too cheap to ignore. These investors might consider put strategies as an alternative to switching out of equity positions – put spreads for example. These downside strategies look very attractive at current prices, offer juicy volatility exposure and the ability to provide some respectable hedging protection.

Sources:

1BAML, 30th January 2018, Global Equity Volatility Insights

2ECB, https://www.ecb.europa.eu/press/pr/date/2018/html/ecb.mp180125.en.html