New survey reveals that over 70% of investors are disappointed with clean energy’s performance this year, and 13% will sell their clean energy investments less than a year into Biden’s presidency

Q3 2021 hedge fund letters, conferences and more

Similarities Between The Clean Energy Sector And The Dotcom Crash

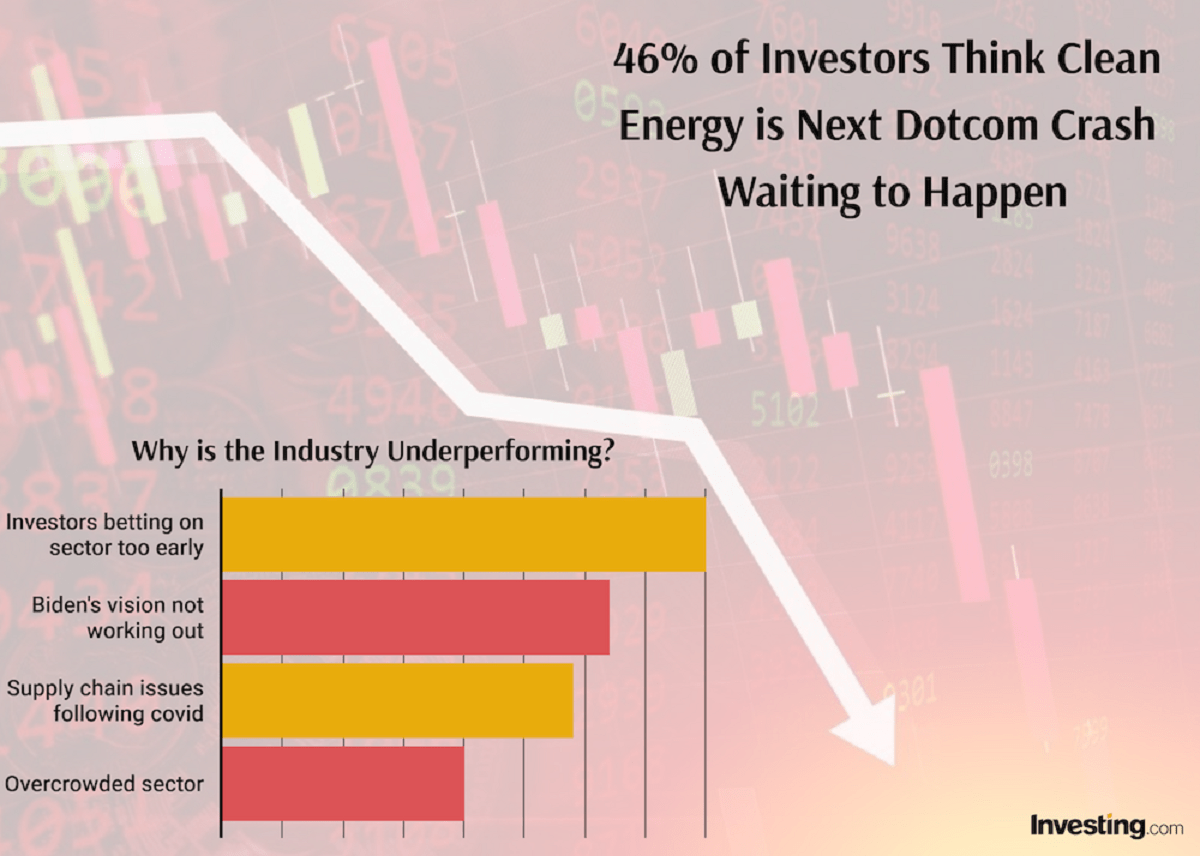

New York, NY, October 18, 2021 – Almost half (46 percent) of U.S. investors see similarities between today’s clean energy sector and the dotcom crash of 2000, Investing.com has revealed today in newly released data.

According to a survey of more than 1,200 respondents, 70 percent of investors are disappointed with clean energy’s performance under President Joe Biden — including 41 percent who said the investments have “fallen significantly short” of their expectations. Thirteen percent confirmed that they will sell their clean energy investments now, less than a year into Biden’s presidency.

The survey results come amid clean energy’s relative underperformance in the market compared to the lofty expectations which were set at the onset of the Biden administration. More than 40 percent of respondents said that investors are jumping on the clean energy bandwagon too early. Thirty one percent attributed the sector’s underperformance to Biden’s failure to live up to his campaign promises, and 29 percent cited supply chain issues associated with the reopening of the economy following the COVID-19 lockdown. More than 90 percent expressed that clean energy stocks’ performance are connected to government policy, including 46 percent who described that connection as “strong.”

“The underperformance of many clean energy stocks this year comes as investors book some profits, following the sector’s significant gains throughout 2020,” said Jesse Cohen, senior analyst at Investing.com. “As the trade became progressively more crowded in Q1 of this year, the smart money - which poured into the sector even before Biden was elected - headed for the exits.”

Investments In Clean Energy Stocks Or ETFs

Of the survey respondents, 45 percent identified as having investments in clean energy stocks or ETFs. One in five of those invested introduced clean energy into their portfolios after Biden was elected president, while about 1 in 4 specifically made these investments due to their perceptions surrounding the sector’s growth potential under Biden.

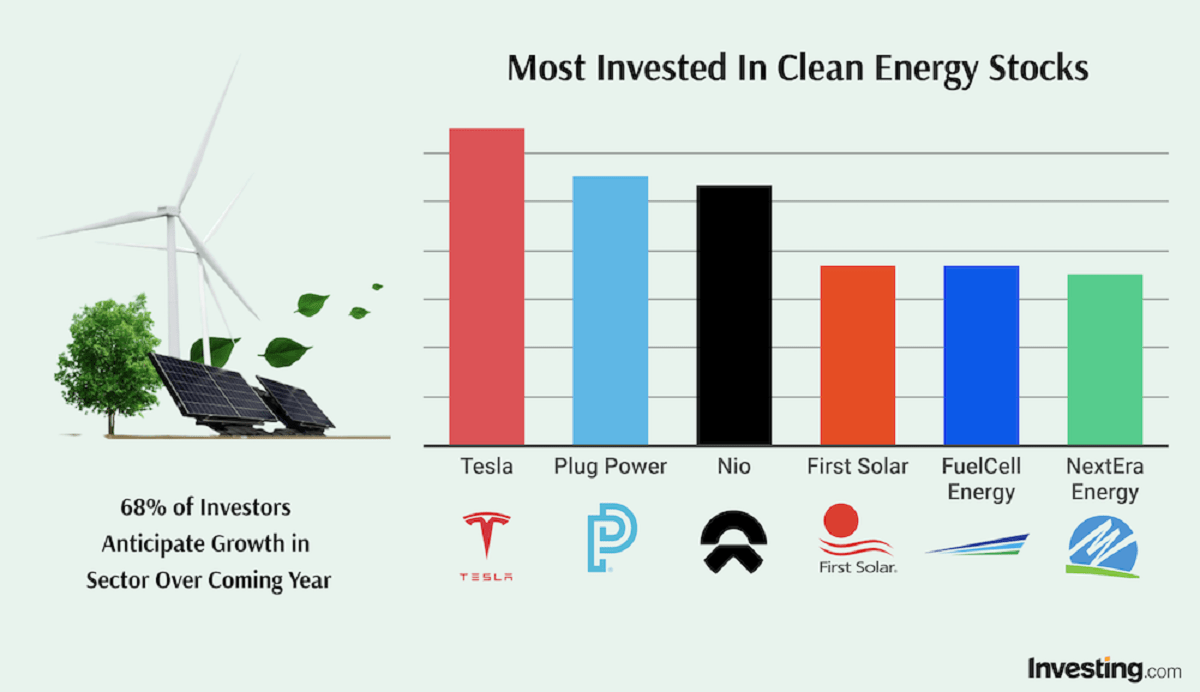

As it turns out, Biden was not the only public figure driving the investments, with 28 percent of respondents saying Tesla chief Elon Musk played a role in their decisions at least to some extent. Not surprisingly, then, Tesla stock was part of the portfolios for nearly 40 percent of clean energy investors in the survey, with nearly 35 percent investing in Pacific Ethanol as well as roughly 30 percent in Plug Power and Nio. The most popular ETFs for clean energy investors, meanwhile, were iShares Global Clean Energy (34 percent), Invesco Solar (23 percent), and First Trust Nasdaq Clean Edge Green Energy Index Fund (20 percent).

“Companies involved in the low-carbon energy industry, such as solar panel manufacturers and wind-turbine makers, as well as firms working throughout the EV supply chain, stand to benefit the most from the ongoing shift to alternative energy,” Cohen added. “Some of the names which are likely to outperform in the months ahead include NextEra Energy, which is the largest electric utility in the U.S., in addition to companies such as First Solar, SolarEdge Technologies, Plug Power, and Sunrun. Looking elsewhere, in Europe, Denmark’s Vestas Wind Systems, the world’s largest wind-turbine manufacturer, and Italian utility Enel should also do well.”

Among those who have avoided clean energy investments, almost 30 percent did so due to skepticism over the sector’s potential in the market regardless of who is serving as U.S. president, while 22 percent were driven away from the investments specifically because they believe Biden’s policies will not have a positive impact on the sector. Twenty eight percent of respondents said the performance of clean energy stocks in 2021 has reinforced their stance against these investments — although nearly half (47 percent) said this year’s events have made no impact on their outlook.

Moving forward, the survey found that there is at least some optimism regarding clean energy investments. Nearly 70 percent of investors anticipated some degree of growth in the sector’s value in the coming year, although 29 percent predicted that value would increase by less than 10 percent. About 14 percent expect a stagnant year in which the sector will remain at its current value.

The full story is on Investing.com.

Methodology: This survey was conducted on October 4-6, 2021 based on online polling with 1,229 U.S. adults from Investing.com's user database. The poll has a margin of error of plus or minus 2 percentage points.