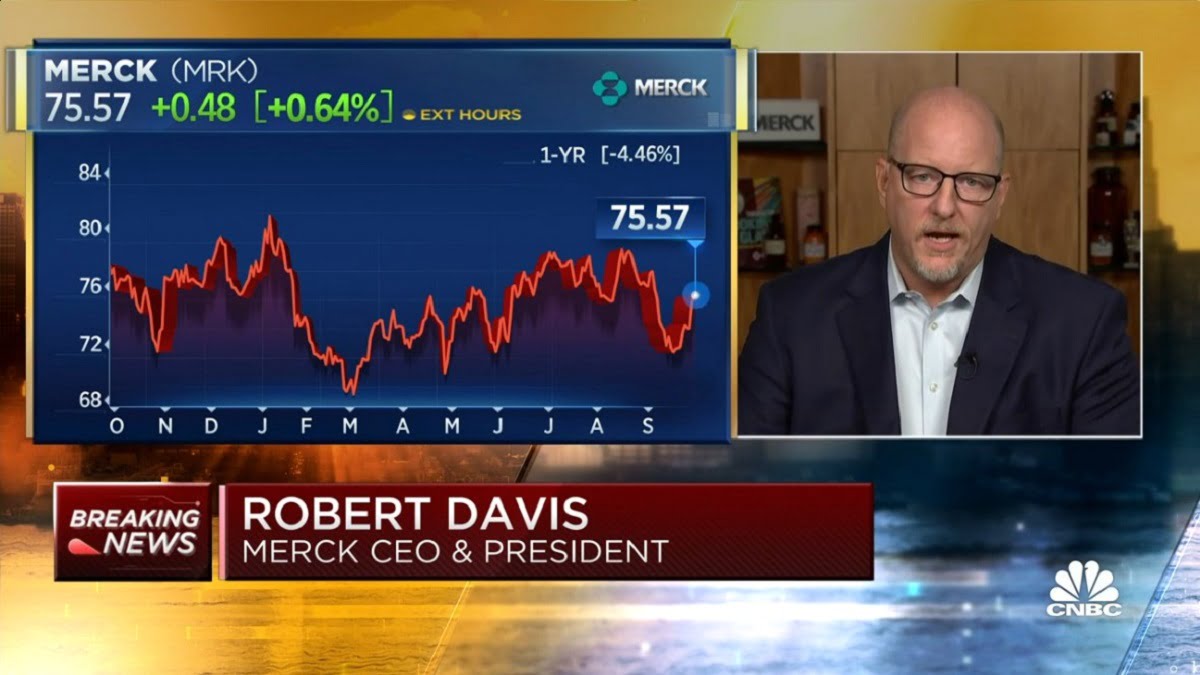

Following is the unofficial transcript of a CNBC interview with Merck & Co., Inc. (NYSE:MRK) President & CEO Robert Davis on CNBC’s “Squawk Box” (M-F, 6AM-9AM ET) today, Thursday, February 3rd. Following is a link to video on CNBC.com:

Q4 2021 hedge fund letters, conferences and more

Merck On Track To Deliver 3.1 Million Covid Pill Courses To U.S. Soon, CEO Says

MEG TIRRELL: Robert Davis, the CEO of Merck, he joins us now. Rob, thanks for being with us this morning, seconds after your release crossed the wire. Tell us about the drivers of the quarter for you.

ROBERT DAVIS: Well, thanks for having me, Meg. You know, as you pointed out, while it was a challenging year and 2021 for all of us, I'm really proud of what we accomplished at Merck. And really, we had such a strong year in terms of growth as you pointed out, 24% growth in the quarter, 17% growth in sales for the full year. So really the business delivered and if you look at it, it really continues to be the strength of what we see in oncology portfolios. We continue to deepen the portfolio, moving into earlier lines of therapy and continuing to expand the indications and the reach of Keytruda which is just a phenomenal drug, a foundational treatment for cancer and making a difference in so many people's lives. And then continued strength in our vaccines’ business led by Gardasil. Our animal health business continues to deliver as well. So across the board, all of our our growth drivers are delivering and we really made a lot of advancements in our pipeline as well. So, all in all, I feel very good about how we're coming out of 2021 with great momentum as we go into 2022.

TIRRELL: And looking at a few of those major drugs, it looks like Keytruda even though it grew a lot during the quarter might have been slightly light of analyst expectations is that what you're seeing too and what drove that? Beyond that, Gardasil looks like quite a beat in terms of analysts’ expectations coming in about $100 million ahead of what they might have been looking for so what was driving Gardasil’s growth?

DAVIS: Yeah, so if you look at Keytruda, basically what you're seeing is overall Keytruda grew very strongly. It grew 18% as we look at it for the full year 16% in the quarter, but what we saw really as you look at the mix between US and international, most of the miss you’re referring to relative to what was expectation was coming out of the international business, and that really was more due to timing than anything. We've seen the fundamentals, we had some advanced purchases that were accelerated into the third quarter that affected us as well as the fact that we had a pretty big impact from, from foreign exchange. So if you adjust out to those items and look at the underlying trend, the business actually continued to accelerate and grow so it's, it's really doing well and then Gardasil is just really a phenomenal story. People recognize more and more across the globe this is a vaccine cancer, or a cancer vaccine, I'm sorry, and as you look at what it can do, that is fueling the growth everywhere but in particular, we've seen just phenomenal growth in China where it's now the number one drug in that market.

TIRRELL: And Molnupiravir still seeing within the range of given $5 to $7 billion for the year but narrowing it now to $5 to $6 billion. How are expectations of that drug kind of shaking out as you start to deliver it more around the globe?

DAVIS: Yeah, so as you look at it, we're actually in line with the original guidance we gave them. We gave the guidance of 5 to 7 billion that was cumulative over what really ended up being a portion of it coming in the fourth quarter, which is about 950 million, and then the incremental 5 to 6 as you look at ‘22, so we're actually, we're in line with what we expected it to be. And this is really based on the strength of what we're seeing with the number of strategic purchase agreements we have in place. We now have agreements with over 30 countries. We delivered product now to over 25 countries. We're on track if you look at by by the end of 2021, we delivered 1.4 million courses in really just the last couple of weeks of December after we got emergency use authorization in the United States. And importantly, we're on track to meet our full commitment to the US of 3.1 million courses here in the next few days and really on pace for about 4 million courses delivered globally as we speak. So all in all, it's off to a strong start. We're gonna have to see how the pandemic evolves, what happens with Omicron. We've shown that Molnupiravir works against Omicron, which is important against that variant, and obviously we'll have to see how this plays out and what is the initial uptick but right now we feel we're off to a good start. We just have to see how the year plays out.

TIRRELL: And will you be tracking how Molnupiravir does in terms of the real world outcomes data? You showed of course, 30% reduction in risk of hospitalization and death, but 90% reduction in the risk of death in your trials, will you be able to provide data showing what this can actually do when given in the real world?

DAVIS: Yeah, and I just want to emphasize the last point you just made because I think this is so important. If you look today, despite the fact that we are starting to at least in the United States, you know, the wave of Omicron is moving its its path through, we still are facing over 2,000 deaths due to a COVID-19 a day and the fact that Molnupiravir does reduce the risk of death by 90%, we could have a meaningful impact in helping patients so I think that's very important. But as you talk about real-world evidence, you know, we are continuing to look at how the drug is performing. There's actually an important study going on in the UK that's being led not by us but by the government in the UK, the panoramic study, that will give important information and then we are continuing to track what happens as we start to roll the drug out around the world. So over time, we do expect we will have more real-world data that should help to really inform how this drug is doing.

TIRRELL: Also want to ask you about your animal health business. You mentioned it as a driver. This has been a question for Merck for a long time. Do you plan to keep the animal health business? It's really been in vogue for pharma companies to separate these businesses.

DAVIS: Yeah well, I appreciate that. You know, we think the animal health business is an important part of Merck. It's a strategic growth driver for us. You know, the business grew 8% in the quarter, grew 16% for the year in 2021. We're set up to continue with strong growth as we look into 2022. We've invested heavily in this business and capacity expansion in business development, and in driving their pipeline much as we drive the human health pipeline, both working synergistically together. So, you know, I continue to believe this as an important part of Merck. It's something we continuously ask ourselves, you always have to look soberly and objectively at your portfolio. But as I look at it today, I continue to think this is an important business for Merck.

TIRRELL: And how are you looking at M&A? Of course, you've done a large deal recently, but biotech valuations have really been bad for that sector recently. Does that make targets more attractive to you and what areas are you looking at?

DAVIS: Yeah, well for us, you know, obviously, we always focus on what we can drive and how we can accelerate our internal pipeline. But then we recognize we need to augment that to business development. So that is an important part of our strategy. We are going to continue to pursue that. And as you point out the deal we did for the acquisition of Acceleron in 2021, that brought in sotatercept, which is going to be we believe a multi-billion dollar drug once approved, is an important example of the types of deals we're looking to do, science driven, where we see as a strategic fit that we can bring real value to so we're going to continue to pursue deals like that, deals like Pandion, a deal we did in ‘21 in the earlier stage in immunology with, with its IL-2 mutein which is really important, as you think about a lot of autoimmune diseases. So those are examples of the types of things we're going to look for, you know, the valuations are changing, but I think it's too early to really tell. The market needs to figure out is this a permanent reset, or is this a temporary move. And obviously, there still is a lot of capital available in the biotech space. I think it is probably going to be a little bit less going forward. IPOs seem to be slowing a little bit and we'll have to see how the, how cash moving into the into the space moves as we look at people investing in ‘22. So, we're going to see how this plays out. I do think there could be some opportunities, but it's going to take some time to see how it actually evolves.

TIRRELL: Alright, makes sense. Rob Davis, thanks so much for being with us this morning.

DAVIS: Well, thank you very much for having me. We're excited about where we're headed in ‘22 and beyond. Thanks.