McIntyre Partnerships commentary for the third quarter ended September 2021, discussing their new position in Madison Square Garden Entertainment Corp (NYSE:MSGE).

Q3 2021 hedge fund letters, conferences and more

Dear Partners,

McIntyre Partnerships' Performance and Positioning Review – Q3 2021

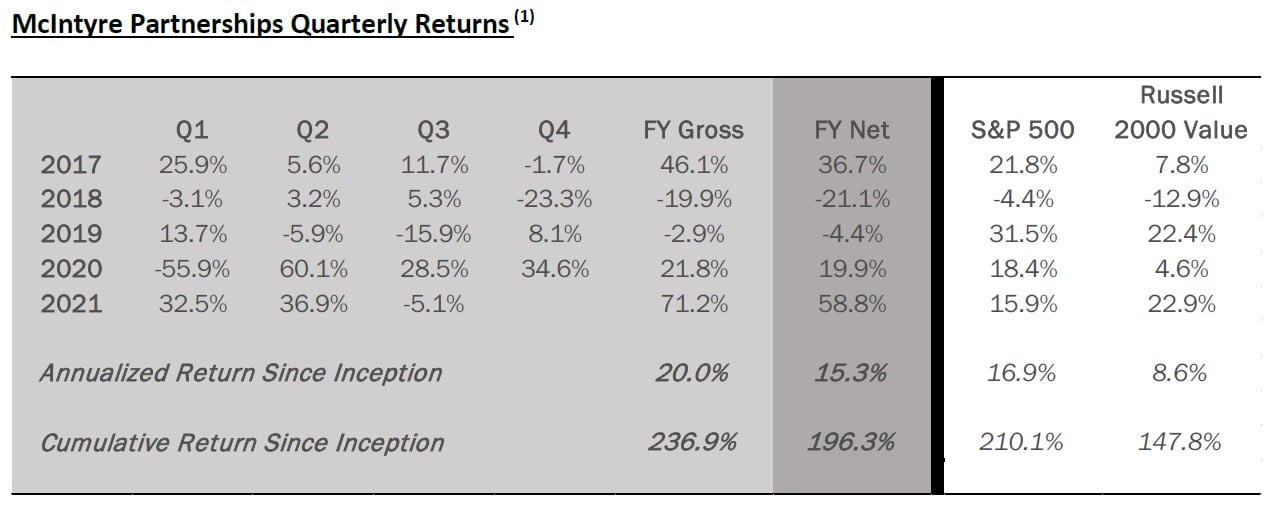

Through Q3 2021, McIntyre Partnerships returned approx. 71% gross and 59% net. This compares to S&P 500 and Russell 2000 Value returns including dividends of 16% and 23%, respectively. Our investment in Garrett Motion Inc (NASDAQ:GTX/NASDAQ:GTXAP) is a “big bet” investment, which, given our concentration, makes market comparisons less useful at present.

Despite some modest movements in positions, Q3 was a relatively uneventful period. Our concentration in GTX and its pullback during the quarter drove most of our decline, but our performance largely mirrored the macro undercurrents during the quarter, with small cap and value stocks flat to down after a strong H1 performance. Auto suppliers broadly fell as semiconductor supply issues caused a significant retrenchment in global auto production. Entering Q3, most market observers expected Q2 to mark a trough with Q3 production forecast up 10% sequentially. Instead, auto production fell 10% sequentially and consensus now expects 2021 auto production to be flat year-over-year. Despite the supply issues, auto demand remains strong, as evidenced by sharply rising used car prices and record low dealer inventories, and I believe auto production issues are delayed rather than lost sales. Beyond auto, supply chain issues in the paint and coatings space drove a selloff in TiO2 producers. However, like auto, paint and coatings demand remains strong. I believe global TiO2 inventories are depleted and Chemours Co (NYSE:CC) will be able to push price while maintaining volumes for at least the next year.

In the YTD winners’ column, GTX/GTXAP and CC both contributed over 1000bps of performance, with our GTX gain the larger of the two. MCS, TPHS, and CAAP contributed 500-1000bps, while LPX, NTP, Permanent Bank, and our “Cruise Options” portfolio contributed 100-500bps each. In the losers’ column, our GSE bet (FNMA, FMCC) lost ~100bps.

Portfolio Review - Exposures And Concentration

At quarter end, our exposures are 113% long, 7% short, and 106% net. Our five largest positions are GTX/GTXAP, CC, MSGE, Corporacion America Airports SA (NYSE:CAAP), and Permanent tsb Group Holdings PLC (LON:IL0A), and account for roughly 93% of assets.

Portfolio Review - New Positions

Madison Square Garden Entertainment (MSGE) – Potential Co-Invest Opportunity

During the quarter, the fund initiated a position in MSGE, which is a holding company controlled by the Dolan family with investments in live entertainment and sports media. The “trader talk” pitch for MSGE is that the stock has extremely solid downside asset protection, anchored by MSGE’s unlevered ownership of the iconic Madison Square Garden arena, and has two significant “call option” type upside investments, the MSG Sphere in Las Vegas and a turnaround of the MSG Networks, which drive multi-bagger upside potential. To the downside, I believe the MSG arena is worth at least $55 per share, or roughly $2.0B. In the remote event that literally all MSGE’s numerous other businesses are worthless, the unlevered nature of our MSG arena investment provides strong downside support. To the upside, the Las Vegas Sphere is a $1.8B stadium development that could redefine the live concert experience and I believe the emergence of online sports betting and direct-to-consumer local sports media strategies could reinvigorate the MSG Networks. If the company successfully executes, I value shares over $300. At a current price of ~$70, I believe MSGE is an exceptional risk reward.

I am currently in the process of marketing a co-investment opportunity. Investors interested in viewing our MSGE deck are welcome to reach out.

As always, please feel free to contact me with any questions.

Sincerely,

Chris McIntyre

McIntyre Partnerships