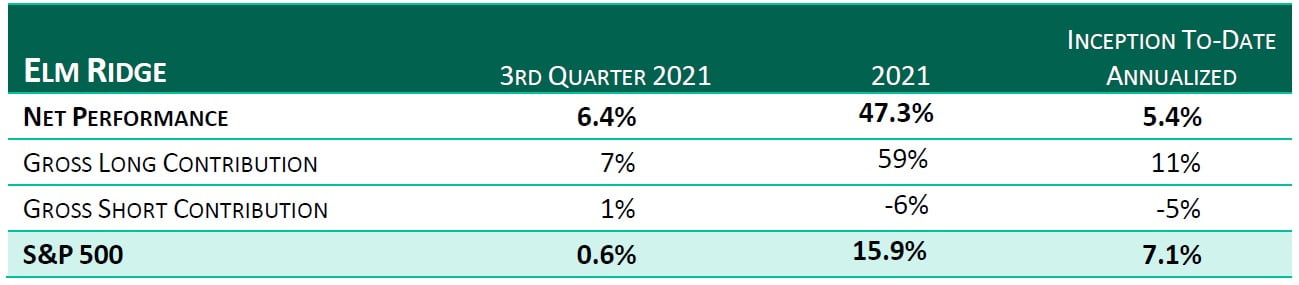

Elm Ridge commentary for the third quarter ended September 2021, titled, “Santayana Was A Schmendrick.”

Q3 2021 hedge fund letters, conferences and more

Graham and Dodd investors are people who place a very high value on having the last laugh. In exchange for the privilege they have missed out on a lot of laughs in between.” - Michael Lewis

How many times must we bail from a wave

And almost get swallowed by the sea?

And why does it look that I tilt at windmills

Do my quests approach reality?

Are we just a bunch of old Troglodytes

Can we think, or just depend on memory?

The answer, my friend, while I piss into the wind

The answer is blowin’ in the wind

– Not Bob Dylan, “Blowin’ in the Wind”

There I was during a break from riding in the woods, turning away from the wind and then wondering why I don’t do the same thing at work. Next thing you know, my friend gets rewarded with 15 minutes of peace and quiet while I butcher Bobby D in my head. Maybe it’s time for a sing-along, as the analytical (didactical?) case we thought we laid out in last quarter’s letter seems to have fallen on deaf ears. Evidently after some follow-up conversations with our investors, I’ve learned that while they have no doubts that the housing market is in a bubble, they believe that the similar performance of their almost look-alike investment portfolios are built on a much stronger edifice.

Surviving The No News Period

We’ve had enough rain and reassurance. And so we’re glad the past quarter is done. We survived the annual “no news” period, where companies and professional investors take their vacations, and the spinmasters can readily sell any story that catches the public’s ear. We noted in our last missive that the summer would provide little evidence to challenge the prevailing narrative that any incipient inflation is just temporary; low rates and high growth multiples could continue feeding the market beast. And, after giving up more than a third off our yearly performance from early-June through the end of August, we basically recovered it all the past month, as recent data seemed to poke a few holes in that story.

Cooling Inflation

Indeed, the August CPI was first thought to show “cooling inflation,” as used auto prices and airfares finally turned the corner (slowed their growth). Never mind that its largest component, the lagging “owners’ equivalent rent” measure, came in at just 2.6%, while just one week later we learned that US single-family rents reached a 15-year record of 8.5%. And don’t worry about soaring wages. The fact that company after company spoke of labor shortages during their second quarter conference calls the last couple of months must be irrelevant. It will all settle down. Just a few days ago, FedEx Corporation (NYSE:FDX) (with an August Fiscal quarter end) noted that despite wage hikes of 16% for Ground package handlers and more than 25% for their major Express ones, they still can’t fill necessary vacancies (all this before they try to bring on 90,000 workers for the holidays). But that must be a company-specific issue.

Everyone seems to have stuck to their guns, as we expect to see confirmed in the coming 13Fs, when the mavens will report their holdings. They continue to believe that the outcasts should trade at their old multiples, while those of the new CBGBs (Certified Bonified Good Businesses) should edge ever upward. The CBGBs shaping aluminum into cans should trade at 18x cash flow (EBITDA) while the cost- and carbon-advantaged (with most of its electric power sourced from hydro) aluminum producer, Alcoa Corp (NYSE:AA), should trade at only 1/3 that multiple. After all, the CBGB supporters argue that as can demand grows: “in a materials space rife with significant macro uncertainty (debates about “peak,” China and issues with spiking input costs), we think this investment thesis provides relatively high insulation from such factors.”

Of course, Citigroup Inc (NYSE:C) and AerCap Holdings N.V. (NYSE:AER) should trade at less than the tangible value of their net assets. And with steel prices having soared 3x from pre-pandemic levels, we need to steer clear of ArcelorMittal SA (NYSE:MT), who might be able to give us back its entire stock price over the next year (making anything else gravy), since it can’t keep doing that forever. Finally, turning to oil, we’ll let Chevron Corporation (NYSE:CVX)’s CEO echo our contention:

Interference With Market Signals

“There are things that are interfering with market signals right now that we haven’t seen before…” Chief Executive Officer Mike Wirth said Wednesday in an interview at Bloomberg News… Even though oil and gas prices have surged this year, … major producers have been reluctant to invest their cash in new projects, a shift in behavior from previous upswings… Already, Europe is facing its worst natural gas crunch in decades, with prices rising to record levels even before winter when demand is typically at its strongest.

One reason executives are wary to plow investment dollars into new supply is shareholders haven’t shown they’re in their corner. They want cash returned to them immediately rather than seeing it re-invested in new developments. “There are two signals I’m looking for and I’m only seeing one of them” right now, he said. “We could afford to invest more. The equity market is not sending a signal that says they think we ought to be doing that.… Looking out for a few years if the global economy continues to grow and recover post Covid, is there sufficient reinvestment in the energy that runs the world today?” Wirth said. “Or are we turning so quickly to the energy that runs tomorrow that we created an issue…?”

“Don’t Worry, About a Thing”

I am old and curmudgeonly

Obsessed and deranged

I’ve ranted for years

But very little has changed

Am I a tool of a shibboleth?

And Graham and Dodd too?

For I am destined to spout

And irritate you

I may be vile and pernicious

And my case does not sway

My facts seem fictitious

With the stuff that I say

I’m the worst you can get

Have you guessed me yet?

I’m the slime, throwing shade,

On your retirement bet

– Mostly Frank Zappa, “I’m the Slime”

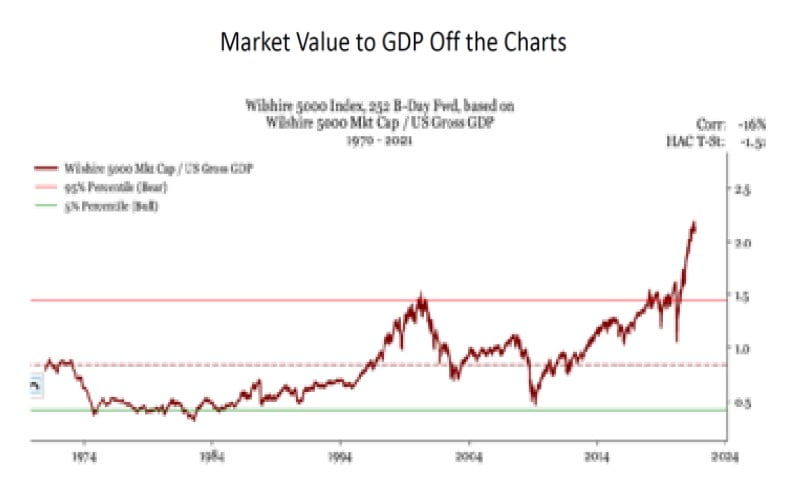

“Don’t worry, about [that slime]. ‘Cause every little thing, gonna be all right.” Bob Marley wouldn’t have given two $#!%s that the US market value to GDP is now 50% higher than during internet bubble (see chart above). Amazon, Apple, Microsoft and Google, should each be worth more than Germany. We should be listening to crypto tips from erstwhile internet expert Ryan Jacob who evidently “navigated the dot-com bust”11 by only losing a mere 95% during that period. And you should pay heed to new guru Cathie Woods, who says she’ll sell Tesla when it reaches $3,000 – when the company would be selling for a measly $3 trillion or two Germanies. (Risk could slot it in between Irkutsk and Kamchatcka). She sure seems mighty confident with her assertion that we have cyclical deflation: citing lumber having tumbled from its $1,700 peak to $500; and copper from $4.90 to $4.20 – even though both are settling substantially above their pre-pandemic averages. After all, as she argues: it is “hard to fight us given our research on [artificial intelligence training costs and creative destruction].” And I can’t help but recall once more the wisdom of an investing legend: “anyone who thinks they’re that @#$%ing smart, is @#$%ing stupid.”

Both our longs and shorts now sell at PE multiples we saw back in 2000. But don’t you worry. You have most of your money in real companies, like the four horsemen above, (along with heavily correlated PE and Commercial Real estate). These aren’t GameStop, AMC or a digital picture of a rock. But neither were Microsoft, Intel, Cisco and Lucent, back when these tech leaders peaked in the 3rd quarter 2000, after the internet collapse. An equal weighted investment in them would only have cost you more than 70% over the next couple of years. And it would have taken you more than 15 years to get back to even. So what? Santayana was a schmendrick. Sing with me.

Santayana was a schmendrick

Was a good friend of mine

I never understood a single word he said

‘Cept his forget-the-past-repeat-the-past line

And it’s always been a mighty fine line

There’ll be joy in value world

A dormant wind will swirl

Joy to those issues with the low PE

Joy to you and me

– Lifting Three Dog Night, “Joy to the World”