Logica Capital commentary for the month ended July 31, 2023.

Summary

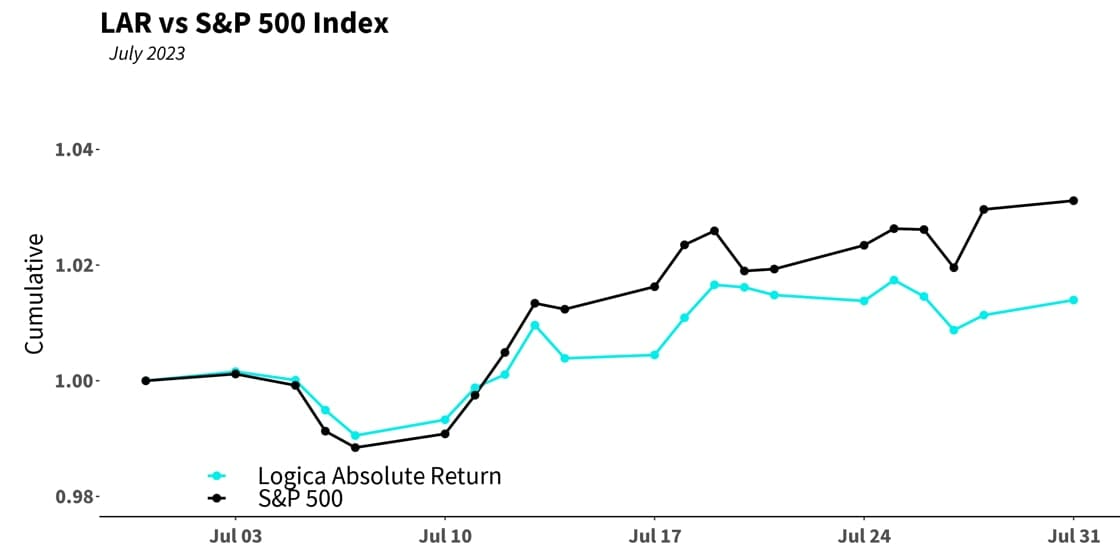

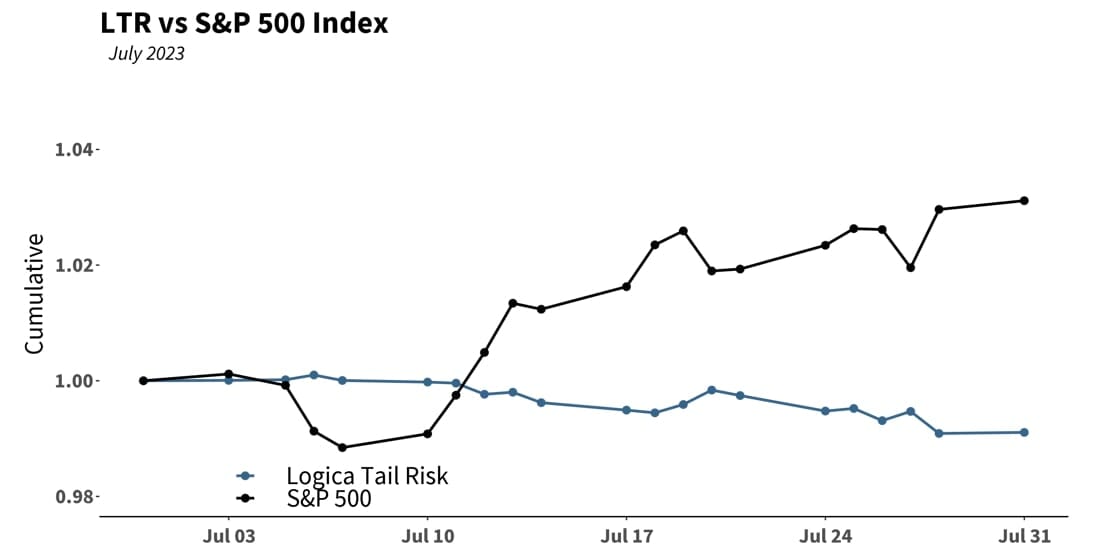

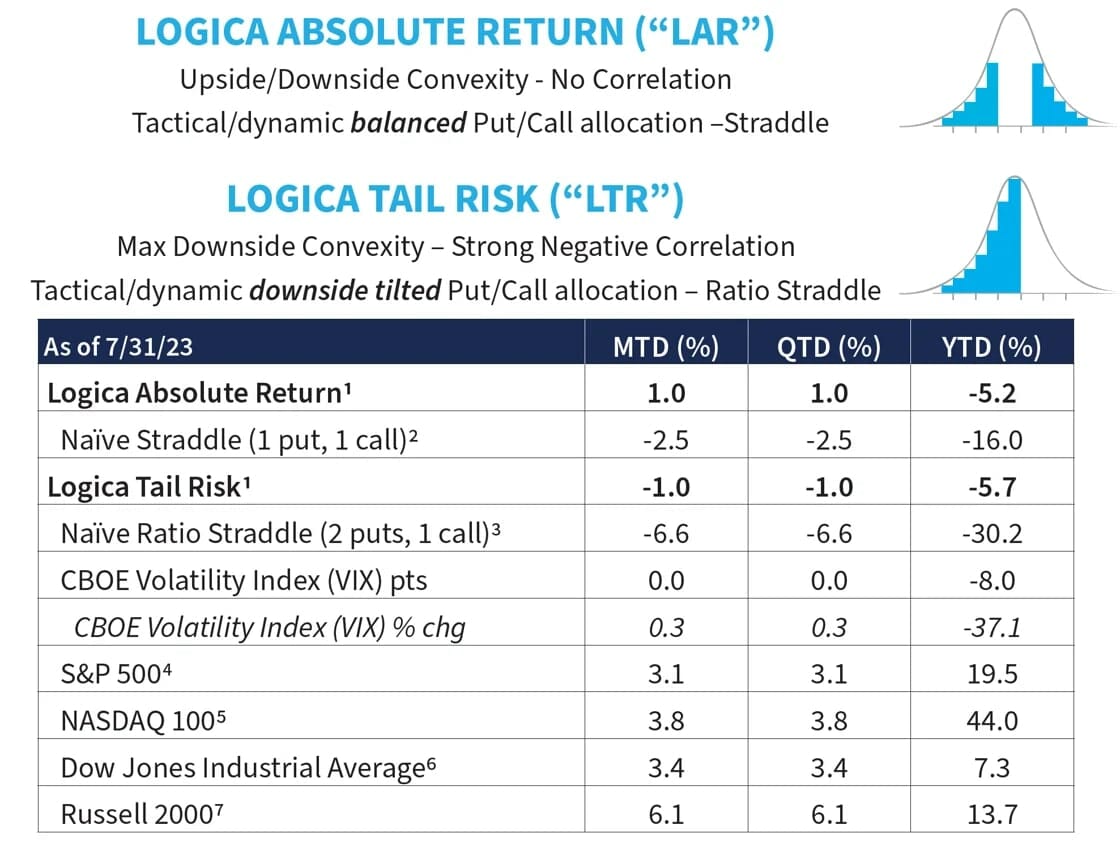

Markets continued their broad rally in July, with all of the 4 major indices gaining more than +3.0%. In fact, all 11 sectors of the S&P 500 gained, led by Energy at +7.8%. Implied Volatility/VIX also provided a favorable environment for long volatility strategies, providing no headwind to speak of – essentially flat on the month.

1) Returns are net of fees and represent the returns of Logica Absolute Return Fund, LP and Logica Tail Risk Fund, LP, respectively. Past performance is not indicative of future results.

2) Naïve Straddle Return: a 1.5 month out, S&P 500 at-the-money put and call bought on the final trading day of prior month and sold on the final trading day of current month. This return on premium is divided by a factor of 6 to be comparable to Logica’s typical AUM-to-premium ratio. For illustration purposes only.

3) Naïve Ratio Straddle Return: a 1.5 month out, S&P 500 at-the-money put and at-the-money call (divided by 2) bought on the final trading day of prior month and sold on the final trading day of current month. This return on premium is divided by a factor of 6 to be comparable to Logica’s typical AUM-to-premium ratio. For illustration purposes only.

4) S&P 500. The index measures the performance of the large-cap segment of the U.S. market. Considered to be a proxy of the U.S. equity market, the index is composed of 500+ constituent companies.

5) The Nasdaq-100 is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

6) The Dow Jones Industrial Average is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

7) The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index.

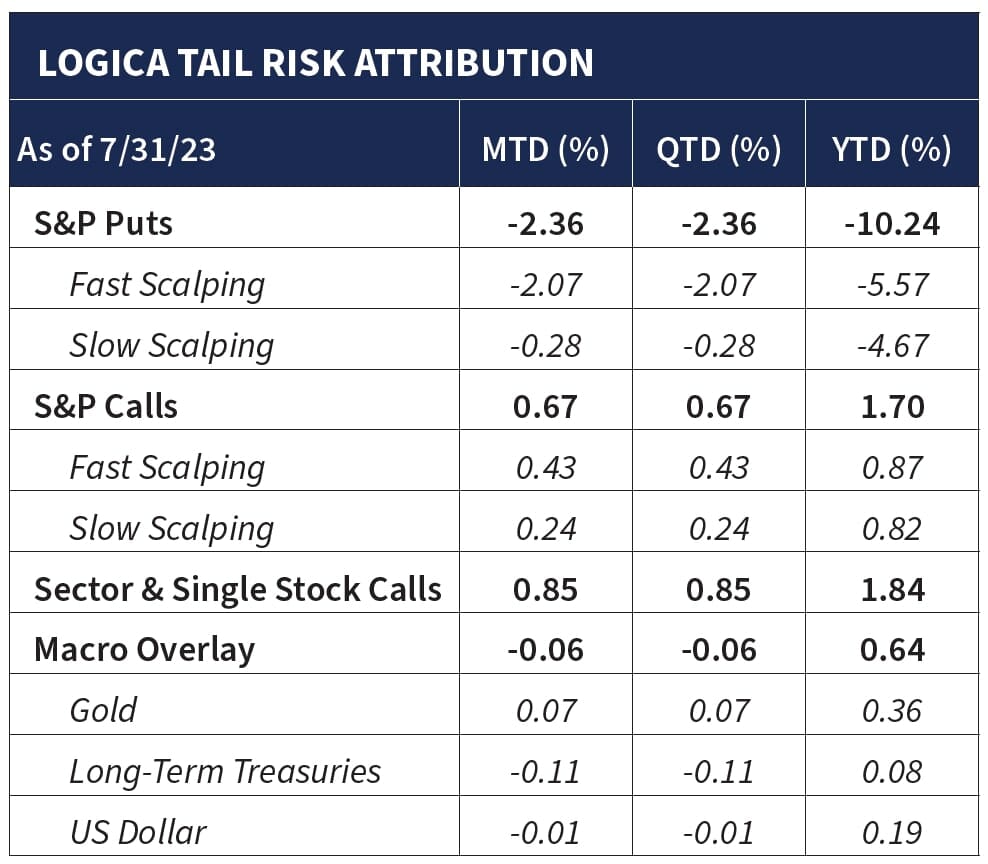

The Portfolio: Looking Inside – Commentary & Portfolio Return Attribution

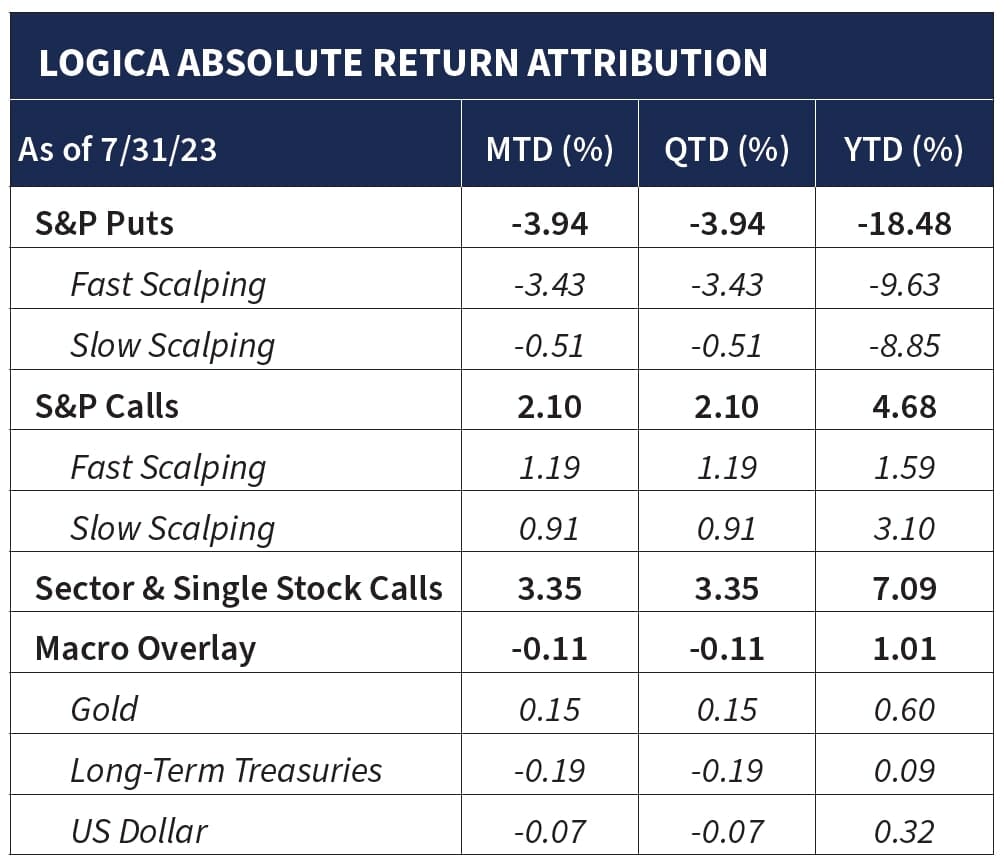

8) For illustration purposes only. Attribution returns are composed of daily returns, gross of fees

“We must take care always to keep ourselves, by suitable establishments, in a respectable defensive posture.”

– George Washington

Given the broad rally continuing in July, and lack of any volatility headwind, our modules experienced ideal “healthy market” conditions. Sector & Single Stock Calls, which employ a diversified exposure, gained nicely on the month, slightly outpacing the S&P 500. We are happy to see the return of some alpha for our stock selection process, as we had been lagging earlier this year as a result of the thinner rally concentrated in the technology sector that we were not overly exposed to. But given the healthier broadening out of the market, our outpacing is a nice demonstration of our ability to capture excess return on the upside “all else being equal.”

On this point, some might argue that concentration is almost necessary in order to outperform a benchmark, as the more diverse one’s portfolio, the more the portfolio acts like the index, and the harder it is for selection alpha to rear its head. But in being broadly diversified, and still generating some excess return, we believe we offer something far more important; our alpha comes from nuanced differentials in weightings and exposures while maintaining total portfolio balance. And maintaining overall balance is essential to our core objective of maximizing down-capture during market stress, where any material imbalance introduces basis risk to that defensive posture.

The Volatility Market: Looking Outside

“The future has already arrived. It’s just not evenly distributed yet.”

– Francois Rabelais

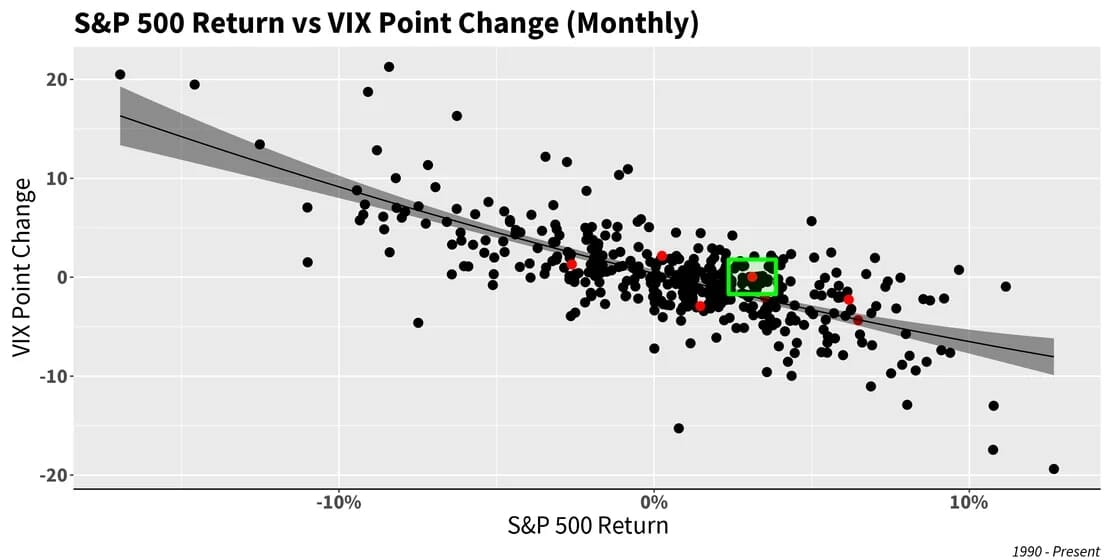

As mentioned above, July was a favorable month with respect to the relationship of Implied Volatility (“IV”) and S&P 500 movement. Looking to the scatterplot below, we note a slightly better than expected relationship vs. historical, and these points are without consideration of the starting level of VIX/IV coming into the month, which was already quite low, indicating an “even better” behavior than all else being equal (more on the impact of the “starting level of IV” below).

This improved outcome, vs. the multi-year period leading up to it, is very much in line with what we have been hypothesizing, as repeatedly expressed in several monthly letters over recent months. The point we have been shouting from the rooftop – and increasingly louder as IV continued to drop — is how much less downside room IV had to go, having arrived at below historical averages and closer to its long-term lows. As such, it is of course quite satisfying for us to see the “future” display the outcome we had hypothesized.

Moreover, given our strong conviction of both the relative “cheapness” of IV vs. recent years, alongside the improving behavior of IV to S&P movement across various ways we analyze the relationship, we have been slowly increasing our total long volatility exposure. As we have also mentioned over the last many months in our letters, our models have led us to accumulate a larger volatility exposure in a methodical and ordered way.

And July was a perfect example of our thesis having played out, as essentially there was zero-to-no cost of holding that excess volatility even though the underlying index gained +3.1%. This is both unusual and wonderful. Of course, we still bear the unavoidable cost of Theta, the relentless time decay of holding optionality, albeit Theta is simply the cost of doing business.

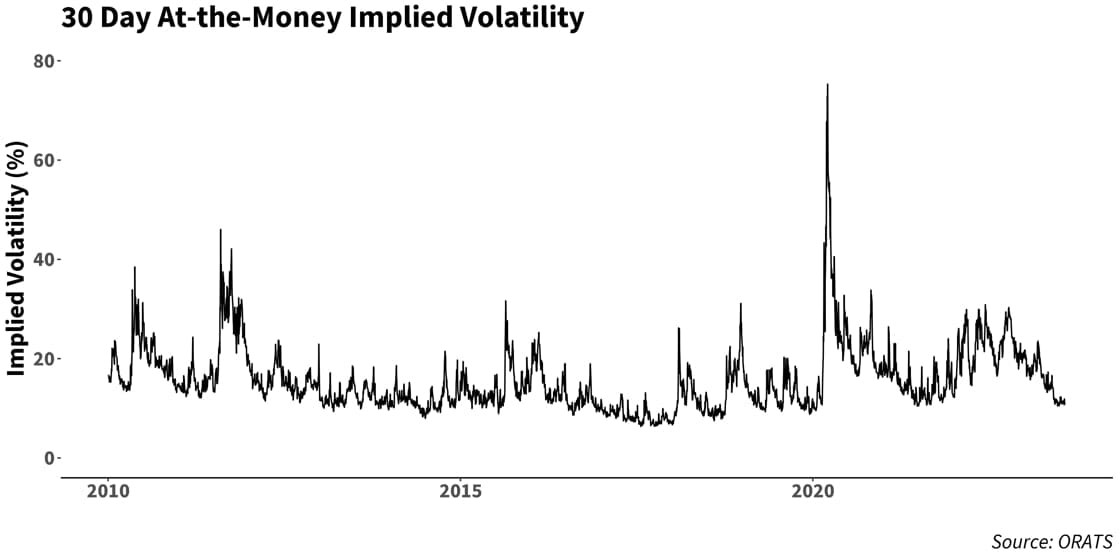

Observed in a different way, we can see the attractiveness of IV in the below chart of ATM pricing since 2010. Our proximity to long term lows becomes clearly visible. Of course, new lows are always possible (we are no stranger to fat tail events!), but in probabilistic terms, by the end of July, the hope/expectation is that most of the “vol crush pain” is over.

“History never looks like history when you are living through it.”

– John W. Gardner

In fact, in thinking back on the “pain”, one can observe the far right of the chart below to clearly see how elevated IV was last year, hanging out in the 20-30 range throughout most of 2022 was an unusual event. One could suggest that the bear market in equities over the course of 2022 is consistent with higher IV, and yes, that is a fair case.

But the inconsistency was the range, wherein IV repeatedly sought the 30 level, and then spent weeks retracing back to the low 20’s, only to do that same up/down shakeout multiple times more. The indecisiveness, to say the least, was more of the difficulty. In any event, we seem to be through that struggle at this point, and to a great degree, in a far preferred IV environment:

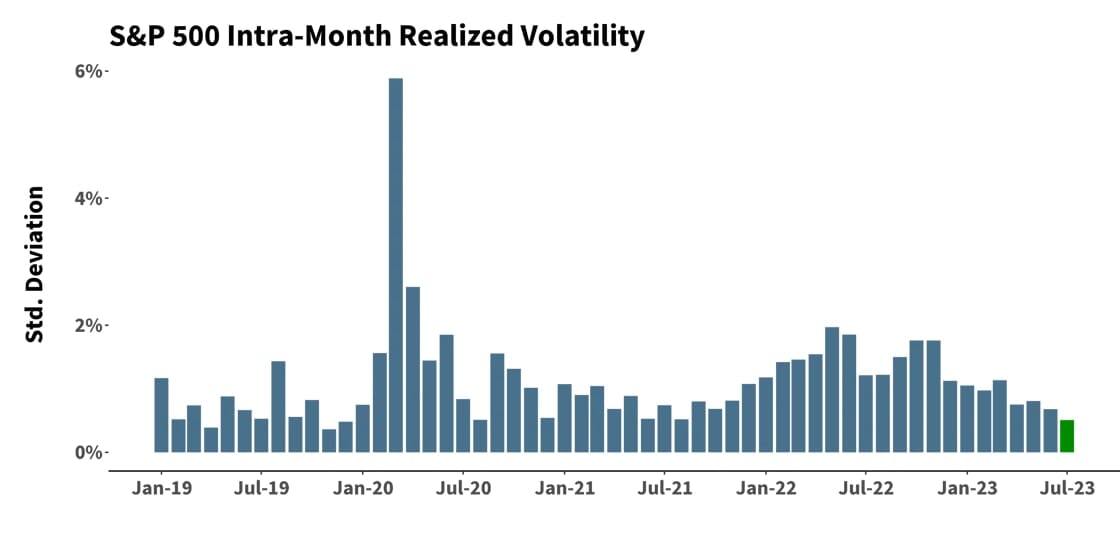

Separately, Realized Vol (“RV”) also ticked down a notch in July; interestingly, to the 4th lowest value since our chart began in 2019. And more profoundly, this level also represents a bottom 20th percentile observation since 1928.

“It costs a lot of money to look this cheap.”

– Dolly Parton

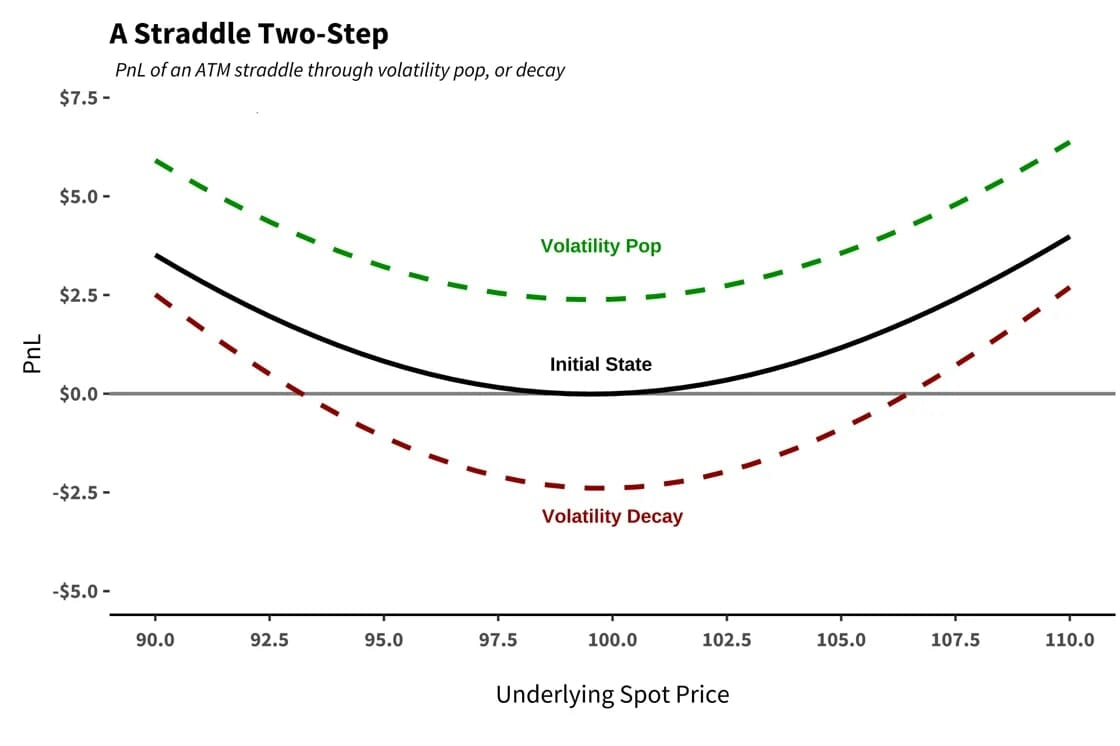

Referring back to the starting level of IV, and how much that impacts payoff, if we look back at a few charts we shared years ago, we illustrate the effect of a volatility pop (as well as the other side of the coin — volatility crush) in order to show how much the odds are in one’s favor given an improved starting point. That is, when the red “decay” line is far less probable, we can see how much smoother sailing things are starting from the black line… and moving to the green line. Simply, there is less area below 0, or if you will, less downside pressure to fight for an option holder to make their way upwards (into positive PnL territory):

*The below chart shows the straddle PnL given a rise in volatility, and/or volatility decline, given approximately 8.5 points of IV movement (independent of Delta, the underlying’s directional movement).

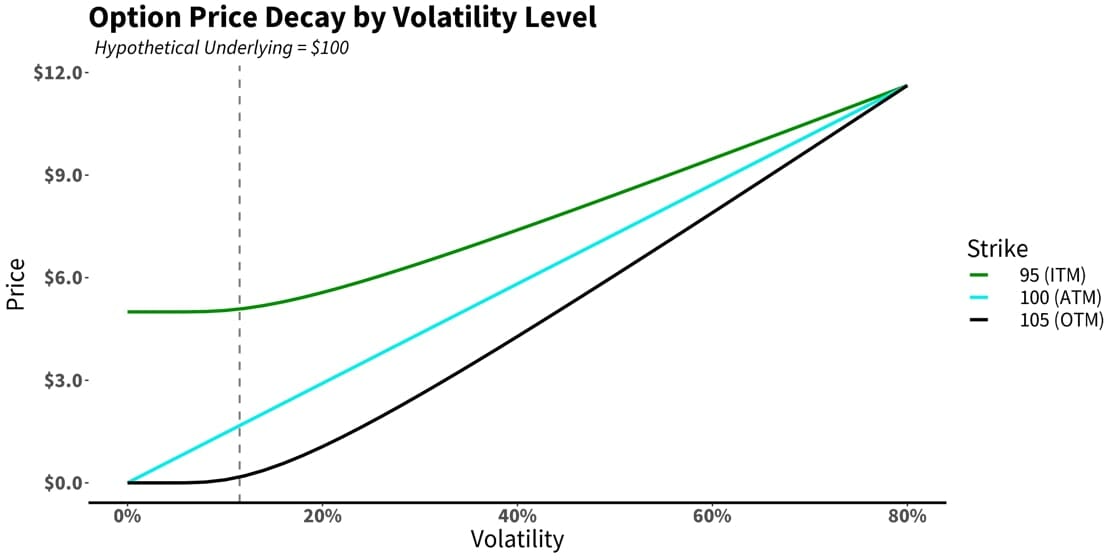

Along the same lines, we can look at the below chart, and specifically to the vertical dashed grey line, and see that at current levels of IV, there is little room left to the left side. Moreoever, since an ATM option has no intrinsic value, it is 100% premium, and can be said to be composed entirely of “volatility” (commonly called “extrinsic value”) – and thus, when we say “volatility is cheap” we are simply saying “option prices have little downside left,” much in the same way one would say a value stock at a very low valuation might be cheap.

Finally, taking a closer look at the daily movement of our strategies for the month of July, we note that each did as expected, and in line with their intended relationship, and anti-relationship, with the broader market.