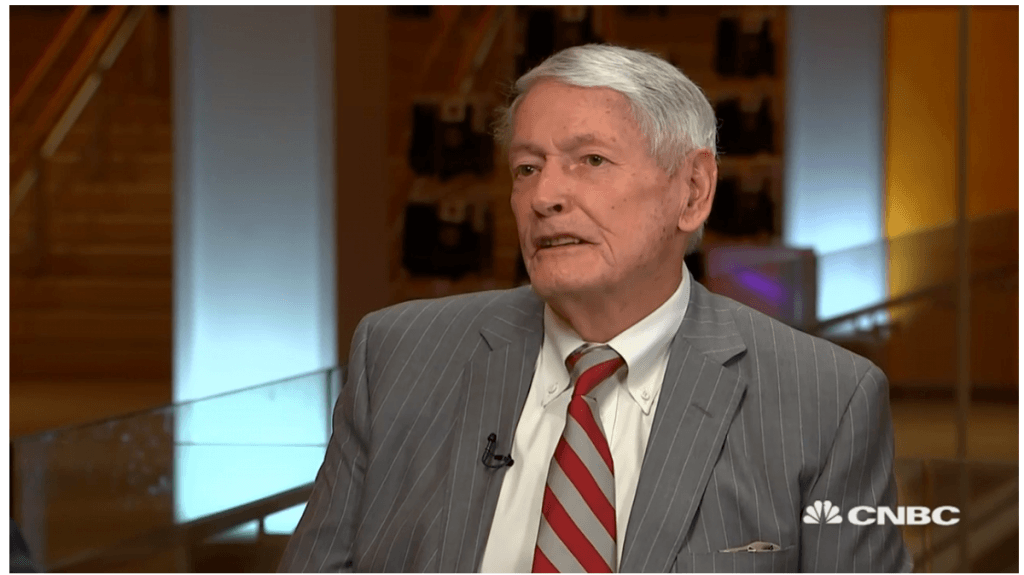

CNBC Exclusive: CNBC Transcripts: CNBC’s David Faber’s Interviews from Liberty Media Investor Day Today With John Carl Malone

WHEN: Today, Thursday, November 21, 2019

WHERE: Across CNBC’s Business Day programming live from Liberty Media Investor Day

The following is the unofficial transcript of CNBC EXCLUSIVE interviews from Liberty Media Investor Day across CNBC’s Business Day programming today, Thursday, November 21st. CNBC’s David Faber sat down exclusively with Liberty Media Chairman John Carl Malone (excerpts), Liberty Media President & CEO Greg Maffei, Sirius XM CEO Jim Meyer, and Charter Chairman & CEO Tom Rutledge. Videos from the interviews are linked to below.

Q3 2019 hedge fund letters, conferences and more

All references must be sourced to CNBC.

Watch CNBC’s full exclusive interview with Liberty Media chairman John Carl Malone

DAVID FABER: Yeah, you know, it’s the annual time for me to sit down with John Carl Malone. We tape our interview. We just finished it, actually, guys. Where we talk about all things, of course, in terms of the landscape. And this morning, as you might imagine, of course, dealing with what we talk so often about: the streaming services.

A year ago, we were talking about what Disney + might actually look like. Now, we have a better sense for that. And for HBO Max. So much of the competition going on. We focused on that. But I’ll tell you, man, I encourage everybody when we get it online to watch the entire interview.

Because Mr. Malone went all over the map in terms of, not just the landscape, but so many different companies, whether it’s Charter or Discovery or Expedia, or Lionsgate or Uber, or Softbank. We talked about them all. But we did talk a lot, as you might expect, about AT&T given its HBO Max entrance into the streaming services and how important that conceivably that will be for the company. Malone has some reservations.

JOHN CARL MALONE: HBO is the king of the hill, spending about $2 billion a year on content. Domestic, primarily domestic, a little bit of international, not much. You know, that was the biggest budget, you know, and had been the biggest budget in pay TV for years. All of a sudden, bang, right? So, the way I look at I, in the U.S., if you wanted HBO, you already have HBO.

Right? So, I don’t see that they gain a lot of new customers. They might transition some existing ones, so that they don’t have the wholesale discount. Right? But in exchange for that, they have maybe a little more churn and a little more overhead. But, I don’t see the growth of – for HBO in going this route. And, in fact, you could see attrition.

DAVID FABER: Why?

JOHN CARL MALONE: And they certainly don’t have the budget to defend and protect their content supply long-term. And they don’t own the rights to international distribution. And it will take them years to develop, you know, and hold on to enough content so they can be a real player internationally. So, I have problems seeing the scale. I really have trouble seeing HBO being able to get to scale to be at the top of the chart in terms of direct consumer subscribers.

DAVID FABER: Guys, so much more from Malone on so many different things. But that’s certainly some of his key takeaways when it comes to what was an introduction just a couple weeks ago. I was in L.A. of course interviewing John Stankey, when they rolled out HBO Max, or told us what it will be. It won’t roll out until the Spring of next year. AT&T shares, by the way, as you both know, down sharply the last couple of days on that downgrade from Craig Moffett a couple days ago, questioning the ability of both the DirecTV and Warner Media assets to perform well and be able to sort of keep things steady while they also are relying on AT&T on significant growth and wireless to meet their overall target of one or so percent revenue growth. So, a lot more to share with you as this day goes on from Malone.

…

CARL QUINTANILLA: David, let’s get back to some Malone sound.

DAVID FABER: Alright, yeah, let’s do it. Carl, of course, it’s our annual sit down with John Carl Malone here at the Liberty Media Investor Day, where they go through so many different companies. Don’t forget, they own a significant stake in Charter. Malone, himself, owns a significant stake in Discovery. Formula 1, the old QVC, LiveNation, TripAdvisor.

So many different names connected to this company. And we talked about a lot of them during the course of our hour or so talk with Mr. Malone. But we also talked about the changing landscape of the media business. Of course, it’s a business, by the way, that he helped to create. Right?

The distribution model that we all know so well when he controlled TCI, the largest cable company in the country. Took significant stakes in the content company, the programmers and set up that distribution model that has made so many people very wealthy. It’s going away. And the question is, what is going to replace it? And who are the winners going to be? I asked Mr. Malone for his thoughts.

JOHN CARL MALONE: I think, if you are asking me, who is going to be around and strong five years from now, I would say, for sure, Disney and Netflix. Okay. Disney because they have terrific content and tons of it and a great brand globally.

So, i think their challenge is to get people’s credit cards. They have no large direct consumer relationship. So they’re going to have to piggyback on the backs of people who do. Like Verizon or--so, that’s going to be an area by area, group by group, in order to get that direct consumer relationship in scale. Netflix, you know, is so far in the lead.

They have such a big base and revenue stream that they’ll be around. They may not be as profitable as they would have been if there was no big competition driving up the cost of content and dividing, to some degree, the available revenue stream. I think Apple is going to surprise everybody with the numbers they achieve in a short period of time.

DAVID FABER: You do. Why do you think that?

JOHN CARL MALONE: Well, I think even though they’re thin on content.

DAVID FABER: Really thin.

JOHN CARL MALONE: Their distribution strategy of, essentially anybody who buys anything from Apple gets a free trial for a year. And, of course, Apple already has their credit card. So, when you start with 460 million credit cards or 460 million consumer relationships.

DAVID FABER: 1.4 billion devices or something.

JOHN CARL MALONE: And you give them something for free. And they get to use it for a year and then they put it on your bill. That’s a very interesting way to get large numbers fast. And, of course, it’s chicken and egg. As they get large numbers, then they can gauge what people like, what people don’t like. They can go out and acquire or build more content. So, their approach is content light, wonderful, mass distribution strategy.

Disney content heavy. Right. Needing some way to get consumers to take an action that gives them a relationship. So, those are the two entrants going at each other. I’m concerned that HBO will continue to be a decent service in the U.S., but I don’t see that they have the revenue stream potentially to match what Netflix can spend. Obviously, Amazon with Prime has an entirely different monetization approach.

You could expect Jeff to step on the accelerator or the brake in terms of how much content he is willing to buy and give away to support Prime. And, you know, I think it’s not his primary business. I mean, it’s not. So, you know the free shipping is very powerful, a lot of glue, content that’s unique is kind of a marketing tool for that. And I think --

DAVID FABER: They are spending an awful lot of money on content right now.

JOHN CARL MALONE: Well, as a percentage of the value of Prime. You know.

DAVID FABER: Right.

JOHN CARL MALONE: But actually if you believe that they don’t need to sustain it indefinitely.

DAVID FABER: No. I mean, I know there is factions within the company who say this could all go to the bottomline—would we really lose any Prime customers?

JOHN CARL MALONE: I think Amazon evolves to be a bundler of other people’s services, with less of their own and more of other people’s. So, you know, i think ultimately everybody, all of the tech guys, would really like to be the platform and let everybody waste their money on content. Right? Because, the real pay day is the relationship with the customer and the information about the customer and being a gateway. And that’s where I think ultimately the tech companies want to go.

DAVID FABER: You know, a year ago, you were talking to me, at the time, about Apple and your expectation, that they would – because it was before we had seen anything really -- that they would come to play. They started with I don’t know, 13, 14 shows. I mean, it’s virtually nothing. But do you think that they’re going to continue to ramp up spending to your point that as they watch in terms of how many relationships they actually get? Are they committed to this, do you think?

JOHN CARL MALONE: Well, I think it’s they have optionality with this. Right? I mean, they’re going to get out there six, eight months down the road, they’re going to look at how many people have signed up or potentially signed up. They’ll do the arithmetic backwards and decide, you know, how much they can afford to spend on content.

And if it look likes go for them, like that they can include video in some kind of a bundle that includes music and all their other games and, you know, I think they want to be a bundler and a platform. Right? And video could be an important component to that and this gives them a relatively inexpensive look at whether or not adding a video component adds value to the bundle that they can offer and glue and pricing power and if it does, then they can step on the accelerator.

DAVID FABER: A lot more from Malone throughout the morning, guys. Of course, that’s just one part of this. We talked a lot about so many other aspects of not, just media business but a lot of things as well. Carl.

…

DAVID FABER: Hey, Carl. Yeah, of course, as we do every year here, we sat down with John Carl Malone earlier today. We tape an interview, it typically goes at least an hour, we try to cover so many different things and make that available to everybody at CNBC.com.

As you might imagine, of course, we spent a lot of time talking about the changing landscape of the way programming is distributed, the way it’s produced and what that means for the existing players and for the newer entrants that we have seen over the number of last years.

One name we came to as well and something that you, Carl and Jim and I have talked about a lot is ViacomCBS. The deal will close in the not too distant future, putting these two companies back together. Jim has often commented on how cheap it is and how he regrets owning it in his charitable trust.

We did talk to Malone about that as well. And I asked him he whether or not thinks that company given it is certainly still dependent on linear cable networks for much of its livelihood and potentially as an arm supplier of content to so many of the streaming services, whether Malone thinks it’s well positioned right now.

JOHN CARL MALONE: I think it’s cheap at the moment. What they don’t have is global presence. While they make a lot of their own content and own a lot of their own content, a lot of it is bought, and the real locomotive in that whole collection in CBS. And CBS is totally dependent, in my opinion, on sports rights.

And the guys who own sports rights know that. So, I’m not sure about long-term profitability or whether or not CBS has enough market power to carry all of those channels. Right? And so, my guess is at least at the affiliate level, what Shari is going to face is fights over prices on affiliate fees.

DAVID FABER: As they face ever increasing rates from the NFL or the NCAA.

JOHN CARL MALONE: Yeah. And so, kind of the threat that you won’t get CBS and the New York Giants game, you know, if you don’t agree to carry 12 channels and pay for them, at some point that rubber band breaks, right?

I think, in my own opinion, now, Shari is going to be mad at me for saying this, but I think Viacom underinvested in the content on their channels for a number of years while they were spending their money buying back stock at high prices. And I think that was kind of a tactical mistake. In fact, I think -- I think Sumner made a mistake when he split the two companies.

Because they really always belonged together. And had it evolved together, there would have been more juice invested in those niche categories that really are sticky. Now, you know, you’ve got to say, how important is MTV to a distributor?

How important is Nickelodeon to a distributor? You know, when I see them essentially licensing SpongeBob, their best program, to other people, I worry about, you know, the sustainability of the model. And the fact that they are U.S. only. So, they don’t get a lot of support internationally to help them pay for their content. So, you know, yes, historically they are very cheap.

DAVID FABER: Cheap, but cheap for a reason, Carl. Now, he had a very different take, as you might expect, on Discovery which also is very cheap but which he recently bought. We will share more on his thoughts on that company later in our program. For now, I will send it back to you.

…

DAVID FABER: Welcome back to "Squawk on the Street." I’m David Faber at Liberty Media’s Annual Investor Day. We have a chance here to sit down with the company’s Chairman John Carl Malone.

You heard my interview just now with Liberty’s CEO Greg Maffei in which we were discussing the proliferation of content, the enormous amounts that are being spent by companies such as Netflix, Disney, Amazon and Warner to amass content for their direct to consumer platforms. Maffei says it may have years to go in terms of these inflated prices. I did ask Mr. Malone as well, when he thinks things will start to rationalize.

JOHN CARL MALONE: I think that the number of people trying to do scripted programming on a global basis and buying this content away from each other will thin out as some people make it and some don’t. At some point some of the players are going to look at the numbers and they’re going to say, you know, we no longer have belief that if we -- that hail mary passes are going to keep working. Reed, you know, who has been brilliant –

DAVID FABER: Reed Hastings.

JOHN CARL MALONE: Yeah, he has been throwing hail mary passes since he started, right, and it’s worked for him. And now he has a budget that’s huge, bigger than anybody else’s. Over time he will have to -- he will have to turn the dials to modulate that spend to where he has a really good business that doesn’t churn out on him. People will start experimenting with bundling with other services to reduce churn to make it more sticky.

Distributors will start bundling on behalf of some of these people if, in fact, that reduces churn and makes the composite more desirable, more sticky. And so, it will evolve the same way that the cable business did and the big bundle is created, right? And as those new packages are created, the guys who have uniqueness will start extracting more and more share, the prices will go up and we will see this play again.

DAVID FABER: Exactly. Well, I mean, I’m not -- for our viewers, of course, to understand, you are not just talking about this idly, you obviously own a significant stake in Charter. So, you see it from the distribution side. Significant stake in Discovery. So, you see is from the content side.

JOHN CARL MALONE: Internationally we see it.

DAVID FABER: And internationally with Liberty Global as well.

JOHN CARL MALONE: Yeah.

DAVID FABER: When you think of cord cutting right now--

JOHN CARL MALONE: Right.

DAVID FABER: You know, everybody is like, ‘Oh, my god, it’s just going to continue at this rate.’ We’ve watched the losses at Direct and at Dish in particular.

JOHN CARL MALONE: Right.

DAVID FABER: Does it start to level off at some point?

JOHN CARL MALONE: Yes, I think it does. It doesn’t stop -- the erosion doesn’t stop completely. But it will make a transition to where, in my opinion, these distributors will start becoming where you go for a bundle of other services. So, you may not buy the big bundle but you might end up buying a service from HBO or Netflix. Netflix already is distributed by most cable operators, right, as an incremental service. Certainly, Prime is talking to the distributors about a similar relationship.

My guess is Disney will eventually, you know, be willing to provide some split in order to be in a bundle, if that reduces churn or helps distribution. You know, Discovery will be in that situation over time. So, you know, this will be a transition.

It won’t be a black and white thing. Right at the moment, because the video margins for the U.S. cable distributors are thin and getting thinner as more and more retrans pressure and sports pricing pressure comes in, it’s been sort of discovered that actually margins improve as you lose video customers and you become less capital intensive. And so, if you shrink the video base and don’t try and innovate the video platform, right, your margins go up.

DAVID FABER: Right.

JOHN CARL MALONE: Your cap ex goes down, your leverage free cash flow goes up and your stock takes off.

DAVID FABER: What about these companies -- I mean, does Discovery have enough scale. Does CBSViacom have enough scale? Do we need to see one more round of sort of consolidation among content providers?

JOHN CARL MALONE: Well, I mean, if you go back a couple years, you know, Discovery is the one I’m most familiar with.

DAVID FABER: Of course.

JOHN CARL MALONE: 32 years, I think, now. But we saw in Scripps, for instance, a consolidation opportunity that would give us scale, increase optionality, brands that we understood, talent in the organization, opportunity for synergies of consolidation. Didn’t solve the direct consumer issue, but gave us a lot more firepower. So, that’s worked out really well and now Discovery has got an investment grade balance sheet, deleveraged quickly. Generating give or take $3 billion a year in leverage-free after-tax cash. Right? So, they have a lot of juice with which to solve their issues.

They own all their content worldwide in all platforms. And they’re pretty much the only global company right at the moment whose products are in front of audiences on a global basis. So, they’ve got a lot of the pieces, right. They need to make the transition from linear to interactive, IP, direct-to-consumer.

DAVID FABER: Which is wat we were talking about in terms of --

JOHN CARL MALONE: Correct. That’s correct.

DAVID FABER: The hybrid approach.

JOHN CARL MALONE: They need that hybrid approach. And they’re reaching out in a lot of different ways. They brought in some extremely highly talented people from -- ex-Amazon guys to help them with this direct consumer opportunity. And I personally am willing to bet that they are going to make this transition.

DAVID FABER: You bet a little more earlier this week.

JOHN CARL MALONE: I did.

DAVID FABER: Well, actually, it was a pretty big purchase for you, 2.6 million shares.

JOHN CARL MALONE: 75 million bucks. I wrote the check. Yeah.

DAVID FABER: Why did you do it now?

JOHN CARL MALONE: I believe -- I believe that they will solve these issues and that they are dramatically undervalued right now. When I put my screen up and I look at companies based upon market cap versus leverage-free cash flow, they were the cheapest thing on the screen. And I said, wait a minute, you know, they’re growing in a world where everybody else is shrinking. They’re -- they own all their content. And they’re generating a ton of cash. They’re an investment-grade balance sheet. Why are they cheap?

DAVID FABER: What is the multiple on -- it’s really low, right?

JOHN CARL MALONE: Probably 5.5 times cash. So, that’s giving them like 16, 17 percent cash return. Right. After tax. That’s pretty darn cheap for a good company. So, I said, yeah, I think I will buy some more. I started buying it when the Scripps deal was -- got a thumbs down from the market, so I bought some in the teens. Then I bought some more in the very low 20s. And now I’m buying some – I think I paid $28.03 for the shares that I bought. So, I’ve increased my exposure to Discovery. And I did it because I believe I’m going to make money.

DAVID FABER: Lionsgate.

JOHN CARL MALONE: Right.

DAVID FABER: Why did you sell it?

JOHN CARL MALONE: I sold it because I -- I didn’t see them execute a strategy of using their library and content capabilities to drive Starz. I really thought the opportunity was to take Starz, use Lionsgate’s creative skills to drive Starz globally, aggressively, and they got -- in my opinion, they got hung up on selling our content to somebody else versus putting in our own distribution. My concept originally when I went into it was that they were going to drive their own distribution.

I also thought that if they were successful in that they would make themselves much more valuable to other people. Okay. And I think that they didn’t do that. And I became discouraged with their ability to do that. Now, they seem to be gaining some traction now outside the U.S. In distribution, and they’ve gained some traction in the U.S. with Amazon as a marketer for Starz. It was just, you know -- it was the question you started with.

DAVID FABER: Right.

JOHN CARL MALONE: You know, who is going to win in the streaming game? And I didn’t see a path for that company to be a winner in that space. If they didn’t merge with somebody else –

DAVID FABER: They were close to -- I mean, CBS before the Viacom deal was pretty close.

JOHN CARL MALONE: And may be still. May be still Showtime and Starz should get together because there’s enormous synergy in that combination and that would provide scale.

DAVID FABER: Right.

JOHN CARL MALONE: But this is a scale game and you’ve got to be global to get scale.

DAVID FABER: You know where he’s coming from. He’s always talked about it. Global scale. So important to this business model. Back to you, guys.