Activist shareholder Land & Buildings criticized a proposed split by Apartment Investment and Management Company (Aimco), saying the company’s Tuesday press release “laid bare” that shareholders will incur a tax of as much as $8 per share.

Q2 2020 hedge fund letters, conferences and more

Amico Overvaluing Its Assets

Aimco wants to keep its development business and assets worth about $1.3 billion, and fold a portfolio of 26,599 apartments worth around $10.4 billion into a real estate investment trust. Land & Buildings says that the two resulting entities are unlikely to trade anywhere near the underlying value of the company’s assets, which Aimco itself put at $59 per share.

It also took particular issue with the scheme’s tax implications, saying that it is essentially a taxable spin-off of 90% of Aimco's enterprise value, which the activist believes "creates unnecessary friction costs and could destroy substantial shareholder value." In an apparent answer to Land & Buildings’ concerns, Aimco said the transaction would entail stock and cash distributions expected to be treated as a taxable dividend, which the activist does not agree with. The stock has lost a third of its value so far this year.

What We'll Be Watching For This Week

- How will Calfrac’s vote on a recapitalization go today after both ISS and Glass Lewis recommended shareholders vote against it?

- Will New Mountain Vantage Advisers gain board seats at Virtusa’s shareholder meeting today?

- How will the Securities and Exchange Commission’s recent vote in favor of changes to rules regarding shareholder proposals affect U.S. companies?

Activist Shorts Update

The Friendly Bear predicted a 65% downside for automotive software company Cerence. In a Tuesday report, the short seller argued that "investors who thought that it was a cutting-edge company were in for a rude awakening."

The Friendly Bear suggested the company’s pre-spin parent company, Nuance, did not pursue a strategic exit which strongly suggested that logical buyers could not find Cerence attractive at price levels of $15 per share, versus price levels of $55 per share at the time of the report. The Friendly Bear concluded that the company would follow in the path of Telenav, a car navigation stock that saw its stock collapse in the face of identical competitive pressures.

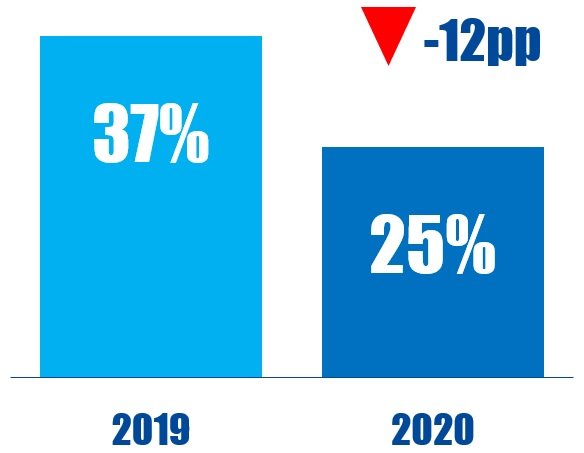

Chart Of The Week

The percentage (as of September 25 2020) of Europe-based companies publicly subjected to activist demands that were U.K. based, compared to the same period last year.