History is littered with “facts” that turn out to be myths. For instance, you may have heard that Einstein failed math class. Not so.

Q1 2021 hedge fund letters, conferences and more

But wait! There’s more:

- George Washington never had wooden teeth.

- A penny dropped from the Empire State Building won't kill anyone (too flat to gain required momentum).

- Napoleon at 5’5,” was about average in his day, not short.

“Truth” is elusive, because once crowd-think gets going, it’s hard to stop.

I’m telling you this because there are market bears out there and I am not sure they are working with the truth.

This is inherently good, because without bears, bulls couldn’t make money. And when everyone’s a bull, then it’s probably time to be a bear. But most of the time, bears just add a (grumpy) price resistance that bulls have to fight against.

There’s generally no shortage of fearmongering in the stock market.

The latest scare for stocks is two-fold:

- President Biden will jack up taxes and kill the economy.

- The sky-high P/E ratio on the S&P 500 virtually ensures an imminent meltdown.

I’ll dig into both, and tell you why I prefer to see cute teddy bears, not rabid snarling claws-out Grizzlies.

What About Higher Taxes?

No one is dying to pay higher taxes, certainly not me. But let’s assume the unlikely worst: Biden’s tax proposal passes without obstacle. The first instinct is to think it’s cataclysmic for stocks. But would it be?

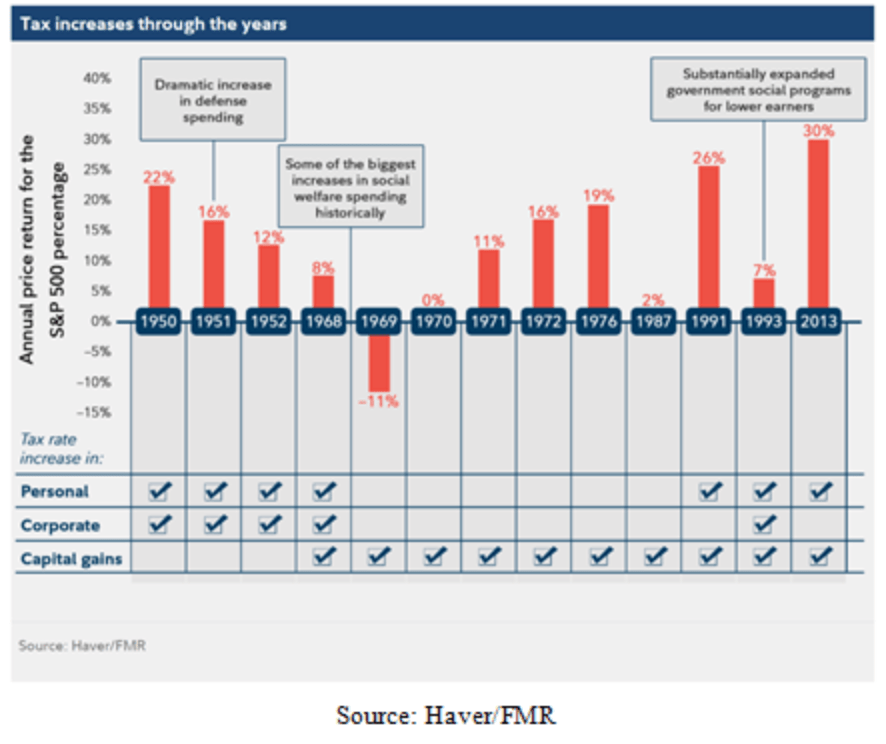

Looking back since the 1950s, tax hikes may not actually pose significant hurdles to investors after all.

When we hear of higher taxes, we think sinking stocks, but that’s like a short Napoleon. The fact is that for 70+ years, stocks have shown better-than-average returns when tax increases hit. Naturally, other economic factors helped influence market action, but stocks generally went up when taxes rose.

There are several types of taxes – like corporate, personal, and capital gains taxes. Seldom do all three go up at once. All three went up in 1968 and 1993 and both personal and capital gains taxes went up in 2013.

In 2018, markets cheered as the Trump team slashed top corporate taxes to 21%, and top personal taxes to 37%. If Congress does nothing, these top rates will end in 2026 and would return to top rates of:

- 35% for corporate taxes

- 39.6% for personal taxes

Biden is essentially proposing these changes take effect sooner. They are really aimed at those who earn more than $400,000 a year. This mainly affects the wealthy, but if you’re an investor living in a high-cost city like New York, there’s a fair chance it would affect you. For instance, if you live in Manhattan, your top rate could go to 58%, that is, a 39.6 personal rate + 3.8 health care + 3.8 NYC tax + 11 state = 58%.

Yuck!

Let’s just say these taxes go into effect. Historically, stocks reacted opposite to how you might expect. Since 1950, taxes were increased 13 times. During that time, the S&P 500 posted above average returns according to research done by Fidelity sector strategist Denise Chisholm. She pointed out that the year before and during a tax increase, stocks rose 12 of 13 times (all but 1969), and they went up 100% of the time corporate or personal income taxes were raised (but not capital gains taxes).

Graphs are for illustrative and discussion purposes only. Please read important

disclosures at the end of this commentary.

This also extended down to individual sectors. She said the S&P Discretionary sector counterintuitively did better during tax increase periods. Her research also showed that bonds also did the opposite of what was expected. Instead of attracting capital, bonds actually floundered during the same periods.

Here’s the likely reality: In “Negotiation 101,” President Biden needs to come to the table with more than he expects. In the words of Louis Navellier: “Democrats need to win the mid-term elections. They can’t do that if Biden wrecks the economy. He needs to push a lot and walk away with some compromise.”

Essentially, this is all optics. The truth is, it is entirely unclear if Biden’s tax talk will ever make it to law.

What About Today’s Super-High P/E Ratios?

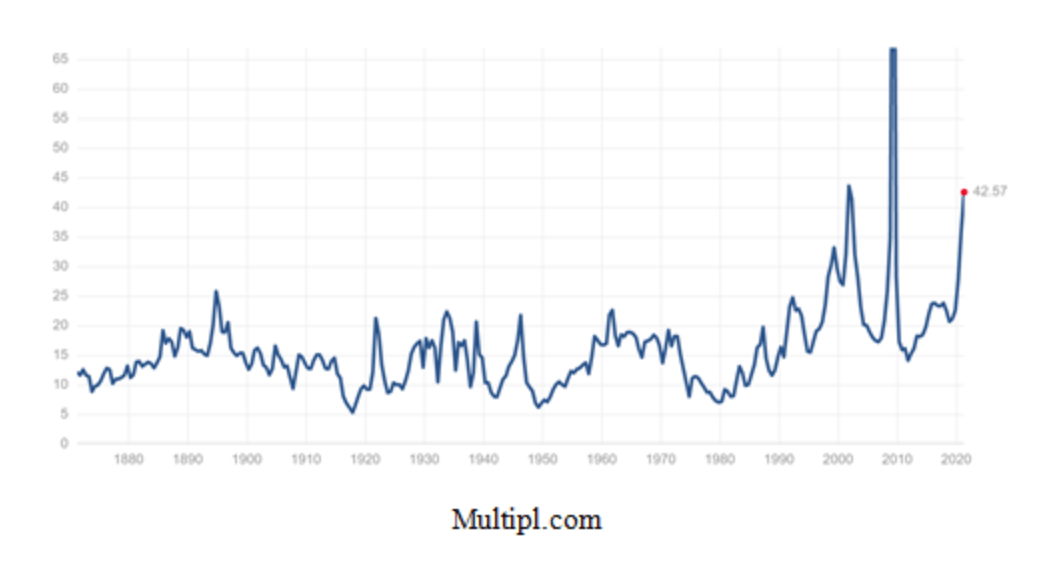

Yes, P/Es are really high. Today’s trailing S&P 500 P/E ratio is 42.57, highest since 2008.

Graphs are for illustrative and discussion purposes only. Please read important

disclosures at the end of this commentary.

That’s worrisome. But here’s the deal: Earnings are rising – fast. With price divided by earnings, a larger denominator means a shrinking P/E. Earnings are rising to meet price, not prices falling to meet earnings.

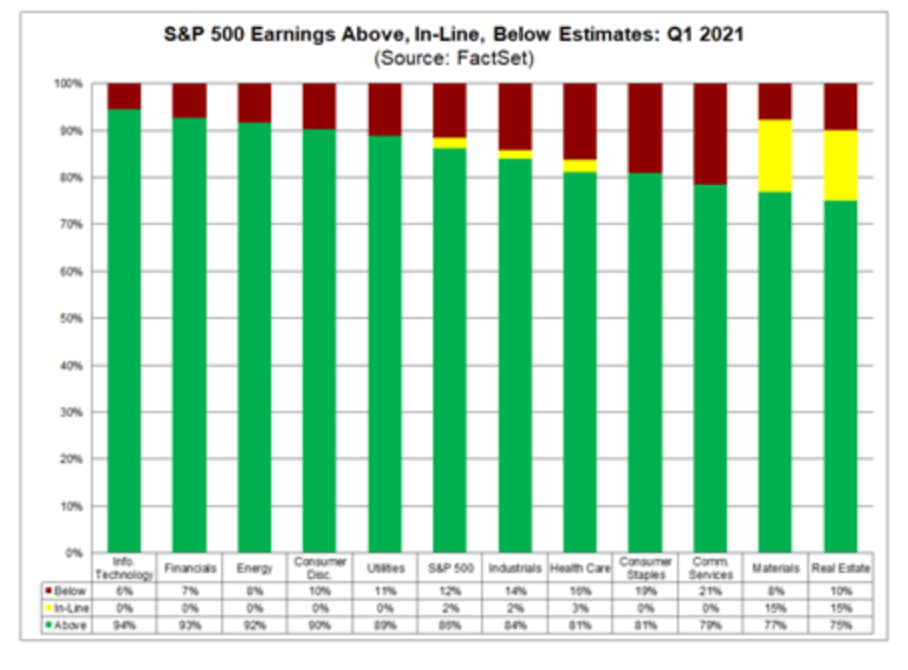

According to FactSet, 60% of the S&P 500 reported Q1 results so far. Of those, 86% beat EPS estimates. If that trend continues, this will be the highest “beat rate” since FactSet started tracking this figure in 2008. In aggregate, first-quarter earnings are coming in at a huge 22.8% above original estimates.

Graphs are for illustrative and discussion purposes only. Please read important

disclosures at the end of this commentary.

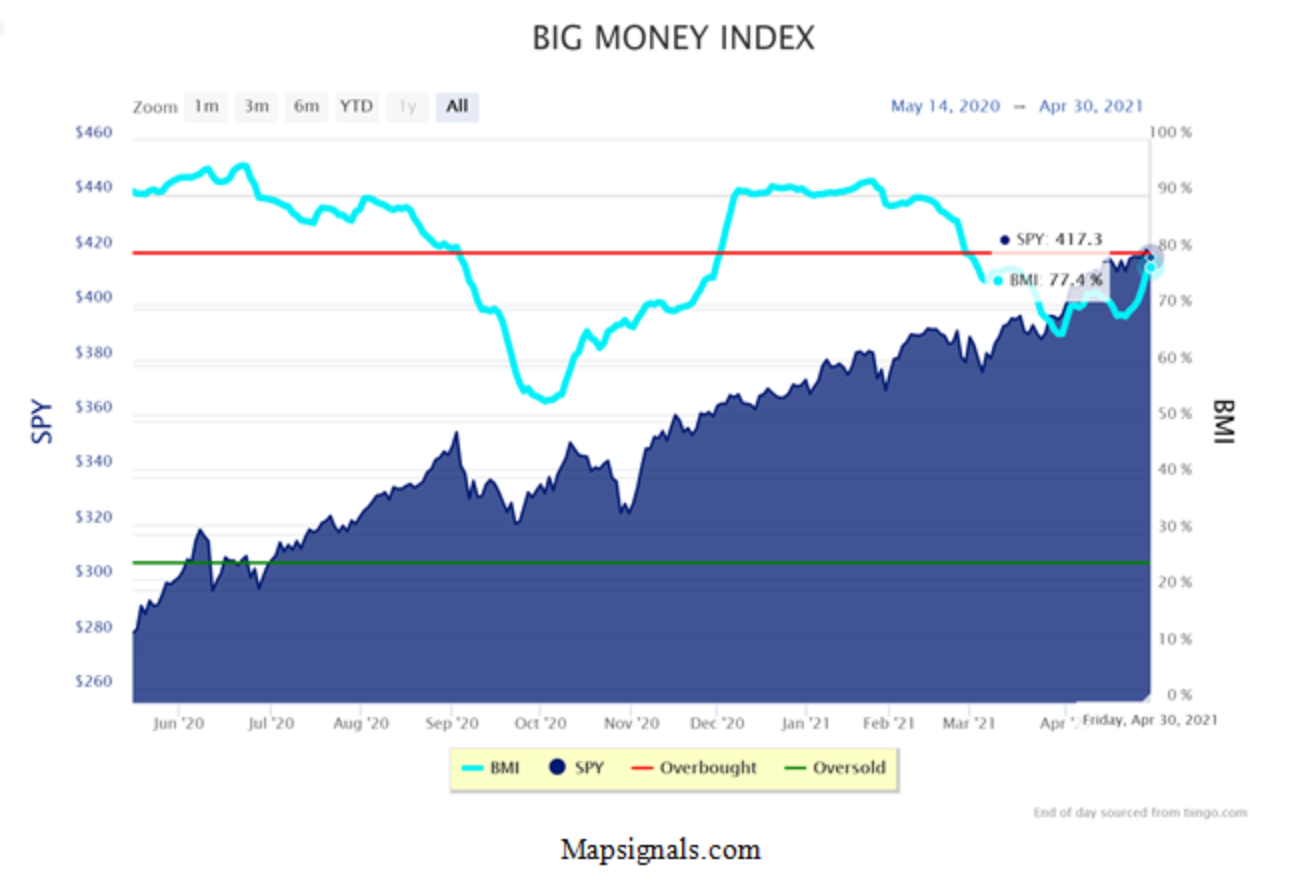

What does the Big Money Index (BMI) say? Despite a choppy market last week, Big Money data is on the rise. The Big Money Index just ripped up to 77.4% which means institutional money is flowing into equities:

Graphs are for illustrative and discussion purposes only. Please read important

disclosures at the end of this commentary.

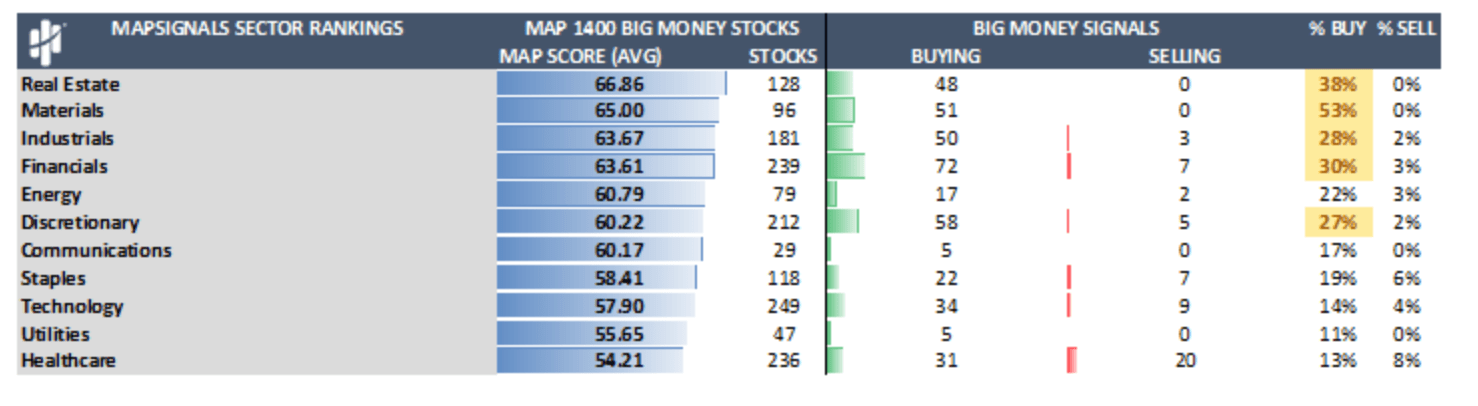

Buying last week was focused on Real Estate, Materials, Industrials, Financials, and Discretionary:

Graphs are for illustrative and discussion purposes only. Please read important

disclosures at the end of this commentary.

These factors are not bearish:

- A rising BMI.

- Buying in infrastructure and reopen sectors.

- Virtually no selling to speak of.

Therefore, before we get carried away by talk of rising taxes taking us off a cliff, it pays to know the facts. Most of us don’t want to pay more taxes, but most of us don’t know that, historically, it’s not a big deal. And the hard truth is, if the wealthy get taxed, they are the ones who know best how to minimize the effect. Loopholes and tax strategies are rarely employed by the middle and lower classes. That’s because good accounting is expensive. There’s the rub: Taxes aimed at levelling the playing field usually don’t.

Rich socialite Leona Helmsley famously said, “We don’t pay taxes. The little people pay taxes,” but she was way wrong. The richest 1% pay more than the poorest 90% in income taxes, but history also shows that the rich actually pay more taxes when rates are lower, and they think their taxes are “affordable.”

That’s just another example of what Mark Twain said: ” What gets us in to trouble is not what we don’t know: It’s what we know for sure just aint’t so.”