Carl Icahn-backed Xerox hiked its takeover offer for HP by $2 to $24 per share, stepping up its hostile campaign for a merger. The bidder said it intends to launch a tender offer on or around March 2 that values HP at about $35 billion, including debt. The offer, comprised of $18.40 in cash and 0.149 Xerox shares for each HP share, represents a 41% premium to HP’s unaffected 30-day volume-weighted average trading price, Xerox noted.

Q4 2019 hedge fund letters, conferences and more

The latest attempt came after a lower $33.5 billion proposal was criticized by HP as "significantly" undervaluing its business. Xerox also disclosed that it met with several of HP’s top shareholders, which pointed to the need for the "enhanced returns, improved growth prospects, and best-in-class human capital" that a merger between the two firms would bring, according to Xerox.

Xerox also previously nominated 11 directors to stand for election at HP’s upcoming annual meeting, a move depicted as "self-serving" by the target. HP has also criticized Icahn’s support of a combination, arguing the activist, a significant shareholder in both companies, stands to win big on the proposed tie-up, much more than his fellow HP shareholders.

The company said that it will wait until its February 24 earnings release to respond to the planned offer, noting that it "wants its shareholders to have full information on the company’s earnings and the value inherent in the company before responding to Xerox." Analysts have projected that HP will report a profit of around $14.6 billion for the fiscal first quarter, down from the $14.7 billion in January 2019.

What We'll Be Watching For This Week

- Will Krupa Global Investments make any public demands at NMC Health?

- How will Occidental Petroleum respond to Carl Icahn’s calls for answers about its Anadarko acquisition?

- Will Glass Lewis weigh in on Yoshiaki Murakami’s board campaign at Leopalace21 after Institutional Shareholder Services backed the activist?

Kerrisdale Short Match

Kerrisdale Capital disclosed a short position in Match Group and its controlling shareholder IAC/InterActiveCorp (IAC), alleging the two companies will emerge bruised from pending investigations as well as the expected regulatory tightening regarding dating apps and sites.

In a report published last week, Kerrisdale said the ongoing trial filed by the U.S. Federal Trade Commission (FTC) over alleged trickery of customers by Match and the pending criminal investigation by the U.S. Department of Justice (DOJ) represent an elevated risk for investors, one that is poised to "significant[ly]" affect the share price of the two firms.

Last September, the FTC sued Match, accusing it of protecting its paid users from "romance scammers" while deliberately exposing non-paying users in an effort to force them to buy online dating subscriptions, Kerrisdale said.

In addition, a previous investigation by the DOJ has intensified of late, with Match being served with a grand jury subpoena around the same time as the FTC’s legal proceeding. A week before the DOJ’s move, Match Vice-Chairman Sam Yagan resigned, followed by CEO Mandy Ginsberg, who announced her departure in late January. The fact that the two were the only members of Match’s board who worked at Match.com during the periods when the fraud allegedly took place raises some serious questions, in Kerrisdale’s opinion, and "strongly" suggests that the criminal case "has teeth."

According to Kerrisdale, these problems "will likely result in a lasting impact to Match’s business model," slowing subscriber growth and squeezing margins. This comes as Match is battling with a "dramatic" deceleration of its subscriber base in the firm’s main asset, Tinder’s operations in North America.

To arrange an online demonstration of Activist Insight Shorts, email [email protected] or view our product brochure to find out more.

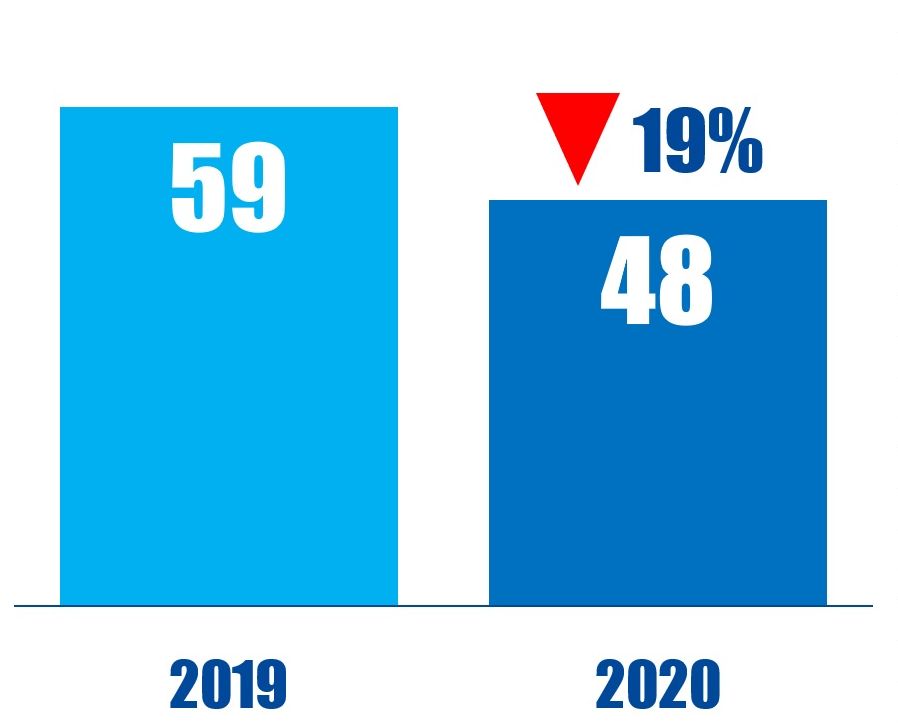

Chart Of The Week

The number of U.S.-based companies publicly subjected to activist demands between January 01 and February 14 in respective years.