A commentary by Lucille Jones, Deals Intelligence Analyst, Refinitiv, on the IPO boom.

Q1 2021 hedge fund letters, conferences and more

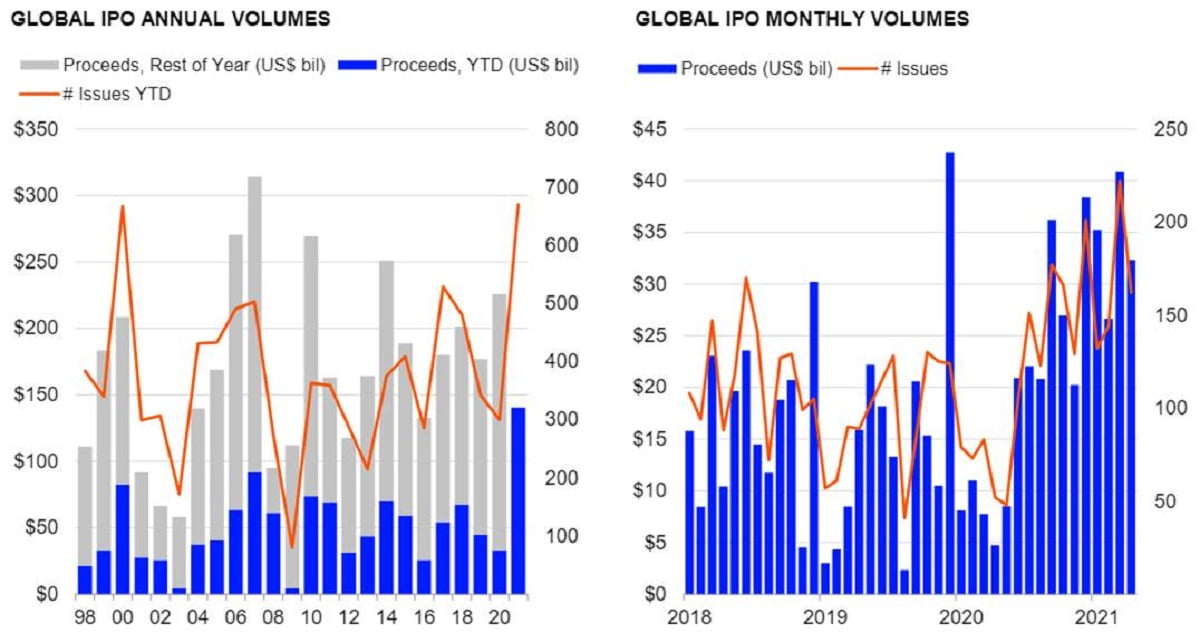

IPO Boom – 2021 Global Activity YTD

- 670 IPOs recorded globally YTD

- More than double the number recorded during the same period in 2020

- Highest YTD tally in more than two decades

- Together these stock exchange debuts have raised a record US$140.3 billion

- More than 4x the proceeds raised during the same period last year

- Smashed the previous all-time record of US$91.8 billion, set in 2007, by 53%

Leading Sector

- Almost 1-in-5 IPOs YTD have been in the technology sector with these new listings accounting for 27% of total proceeds

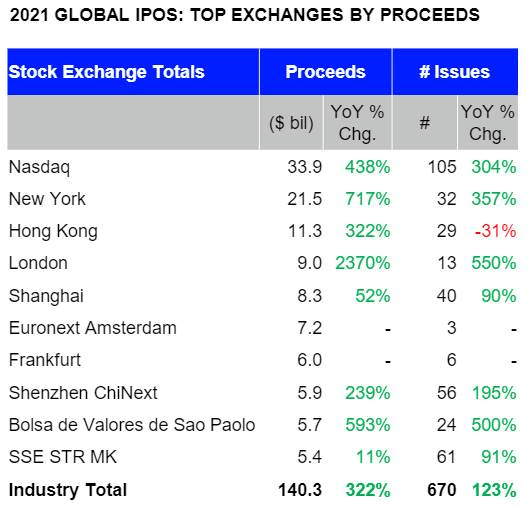

Leading Exchanges by Proceeds

- Listings on US exchanges account for 40% of total global proceeds raised YTD

- European exchanges, 21% and Asian exchanges, 25%

Most Popular Venue

- Nasdaq is the most popular venue for IPOs by both proceeds and by number of deals

- Record: $33.9 billion has been raised on Nasdaq YTD

- More than 5x the proceeds raised YoY

- Highest YTD total since our records began in 1970

- Record: $33.9 billion has been raised on Nasdaq YTD

- 300% Increase YoY: 105 new listings have been recorded YTD

- Last exceeded 21 years ago during the dot-com boom

Most Popular Location

- New York is the next most popular venue for IPOs YTD

- 13-Year High by Proceeds: $21.5 billion has been raised from 32 new listings so far during 2021

- Highest number of listings at this time of year since 2017

- 13-Year High by Proceeds: $21.5 billion has been raised from 32 new listings so far during 2021

- Hong Kong follows with 29 IPOs raising US$11.3 billion

- While the number of flotations declined 31% YoY to a 4-year low, the dollar value quadrupled to the highest YTD total of all-time

- London Thirteen flotations on London’s Main Market have raised a combined US$9.0 billion YTD

- Just one less than the number recorded during the whole of 2020

- Already exceeding FY 2020 proceeds by 59%

- More has been raised in London than any other YTD period since 2007

- A further 9 companies floated on London AIM raising US$763 million, more than 3x the value recorded at this time last year

These figures do not include listings of special purpose acquisition companies, which have raised an additional US$97.6 billion globally so far during 2021.

All analysis based on underwritten initial public offerings that meet Refinitiv’s global standard inclusion criteria. Excludes IPOs issued by SPACs, closed end funds, or trusts.

Follow us on Twitter @Dealintel | Visit Deals Intelligence for more information keeping you up-to-the-minute on market intelligence through a variety of research reports, weekly investment banking scorecards, deals snapshots and our industry-leading quarterly reviews, highlighting trends in M&A and capital markets.