There are many different ways in which we can measure the severity of a market correction. The absolute peak-to-trough decline is one way. Duration of the drawdown is another. But we can also measure corrections by taking note of the performance of individual stocks, in what is akin to looking under the hood. After most big equity market drawdowns (10% or more), what we typically find when we pop the hood is a shambles of beaten up individual stocks. It’s a symptom of investors selling their most vulnerable holdings when things get hairy, and it’s also a symptom of the type of selling exhaustion that causes markets to stop declining. Luckily, we can measure the degree to which individual names have been beaten up by calculating things like the average stock’s decline from a recent high (chart 1), the percent of stocks making new lows in price (chart 2), the percent of stocks in a bear market (chart 3), and the percent of stocks with positive performance over a given look back period (chart 4).

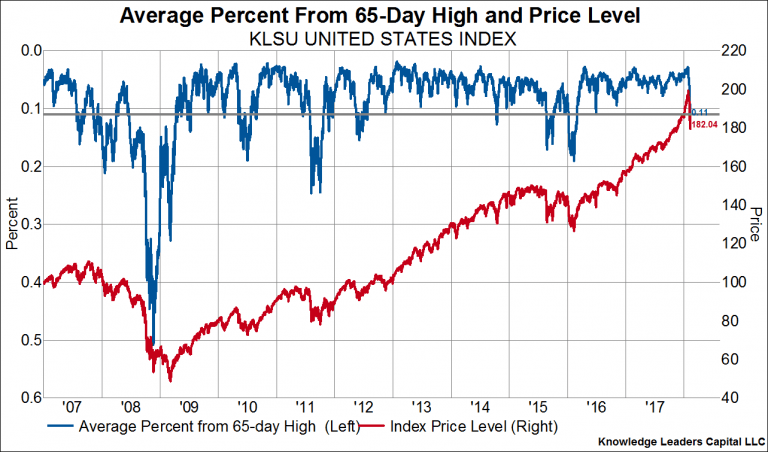

What we find interesting about this market correction (so far) is the lack of individual names that have taken it on the chin. When examining the charts below it’s helpful to note all the previous substantial market drawdowns in the S&P 500 since the late 1990s (excluding the bear markets): Summer 2007 (8%), Spring 2010 (16%), Fall 2011 (18%), Spring 2012 (9%), Fall 2015-Winter 2016 (12%). In each chart, the price of our United States Index is plotted on the right axis (red line) as the indicator is plotted on the left axis (blue line).

As we can see in chart 1, the average stock’s decline from its 65-day high was just 11% as of Friday the 9th. All previous significant market declines have been accompanied by this indicator pushing closer to the 15-20% level.

The percent of stocks making new 65-day lows stands at only 18%, a pedestrian number when looking back at market history. All the previous market declines mentioned saw this indicator breach 30%.

The percent of stocks in a bear market is also rather tame, at only 5%. Previous selloffs drew this indicator above 20% before they were over.

Finally, most stocks (54%) are still trading at a higher level that they were just 65 days ago. During past corrections, only 5-25% of stocks had posted 65-day price increases.